Back

Indifact News

•

Indifact news • 1d

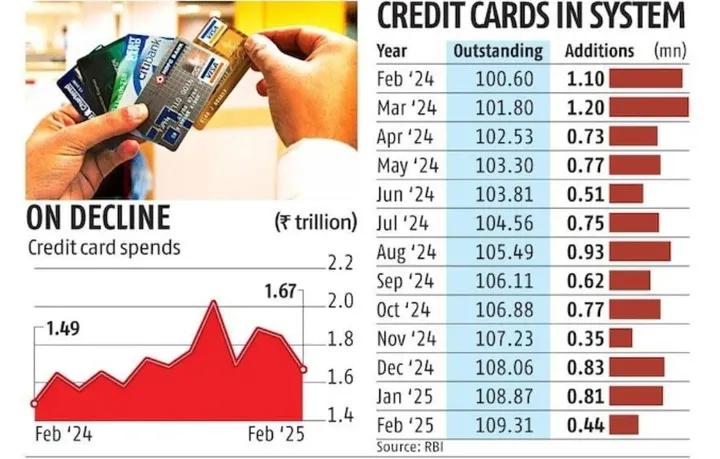

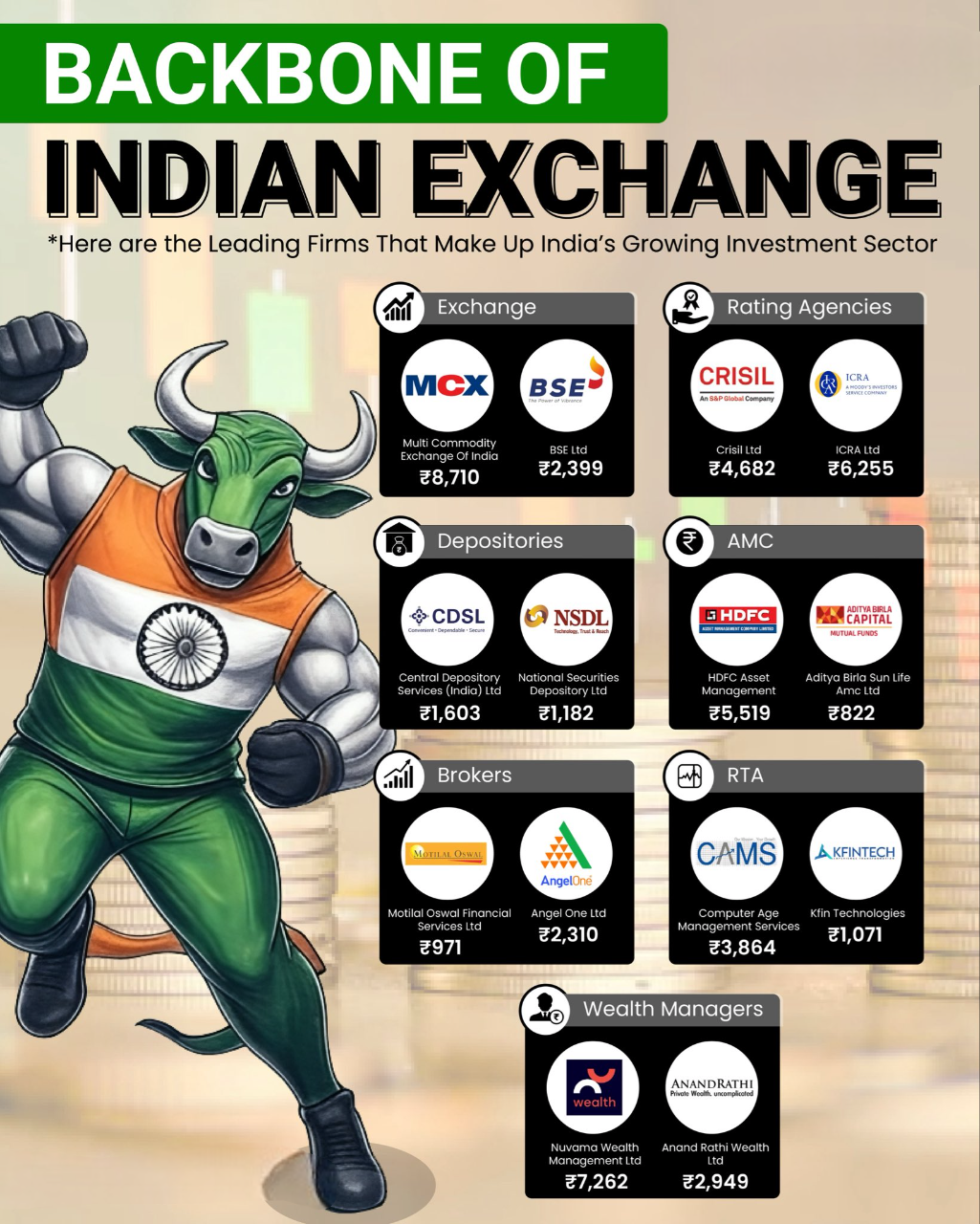

Discover Indian financial sector deals: Inside the $7B Boom Something significant is happening in the corridors of Indian financial sector deals. It’s more than just the usual hum of market activity; it’s a seismic shift, a groundswell of global capital that is reshaping the very foundations of the nation's banking and financial services sector. In the financial year 2025, a golden flood of foreign money, totaling over $7 billion and still counting, has poured into India's banks and Non-Banking Financial Companies (NBFCs). But to see this merely as a capital infusion is to miss the bigger picture. This isn't just about money. This is the sound of a structural reset, the early rumblings of a new era in Indian banking.

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 1y

In the last few years, the returns from the Indian banking sector have not been very impressive. The PE ratio and PB ratio are all below their averages. Currently, the results of HDFC Bank and Kotak Mahindra Bank will decide whether banking stocks or

See MoreRajan Paswan

Building for idea gu... • 1y

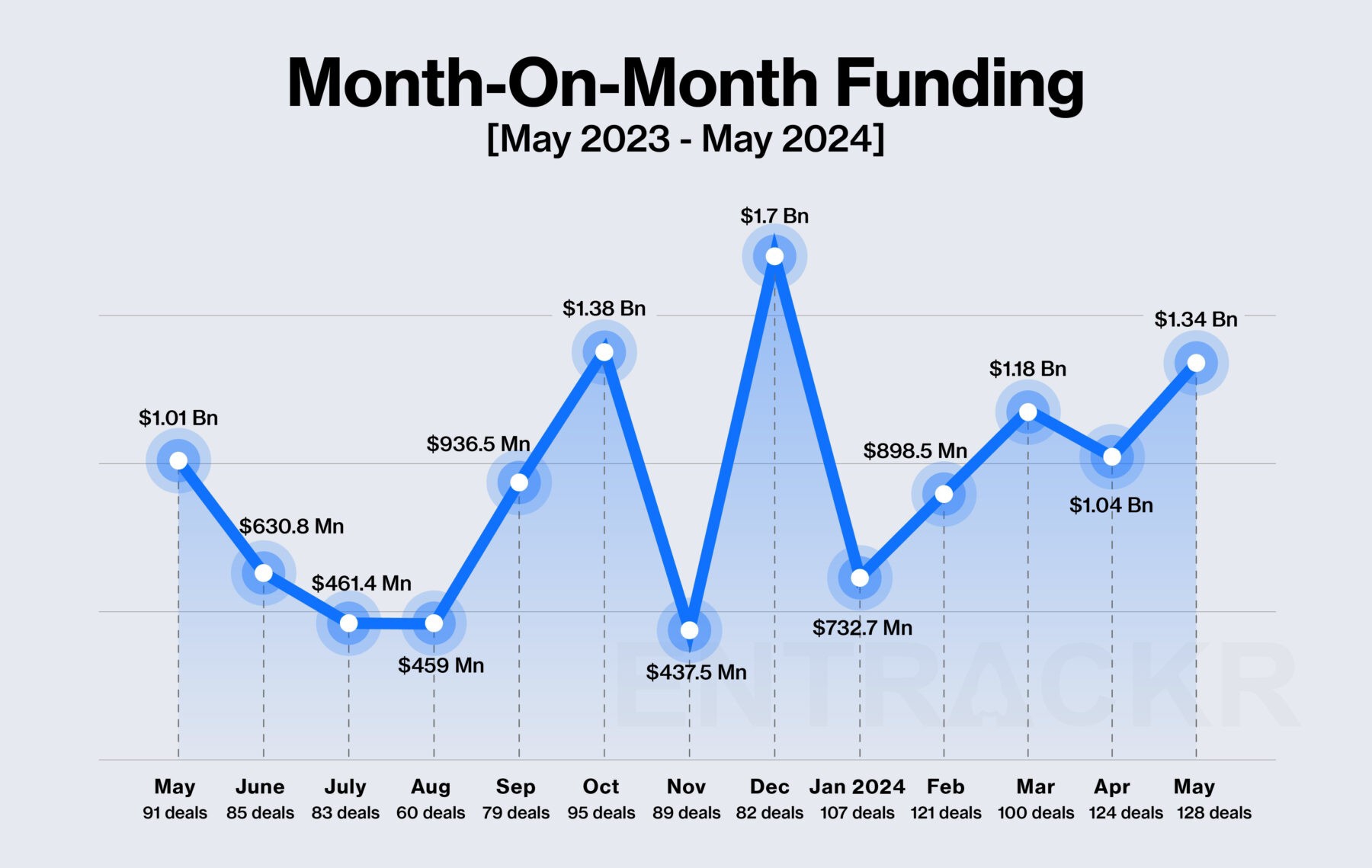

May 2024: A Landmark Month for Indian Startup Funding! In May 2024, the Indian startup ecosystem witnessed a significant surge in funding, raising $1.3 billion, the highest monthly total this year. This growth was driven by several large deals, incl

See More

Download the medial app to read full posts, comements and news.