Back

siddhant dalvi

Advocate • 10m

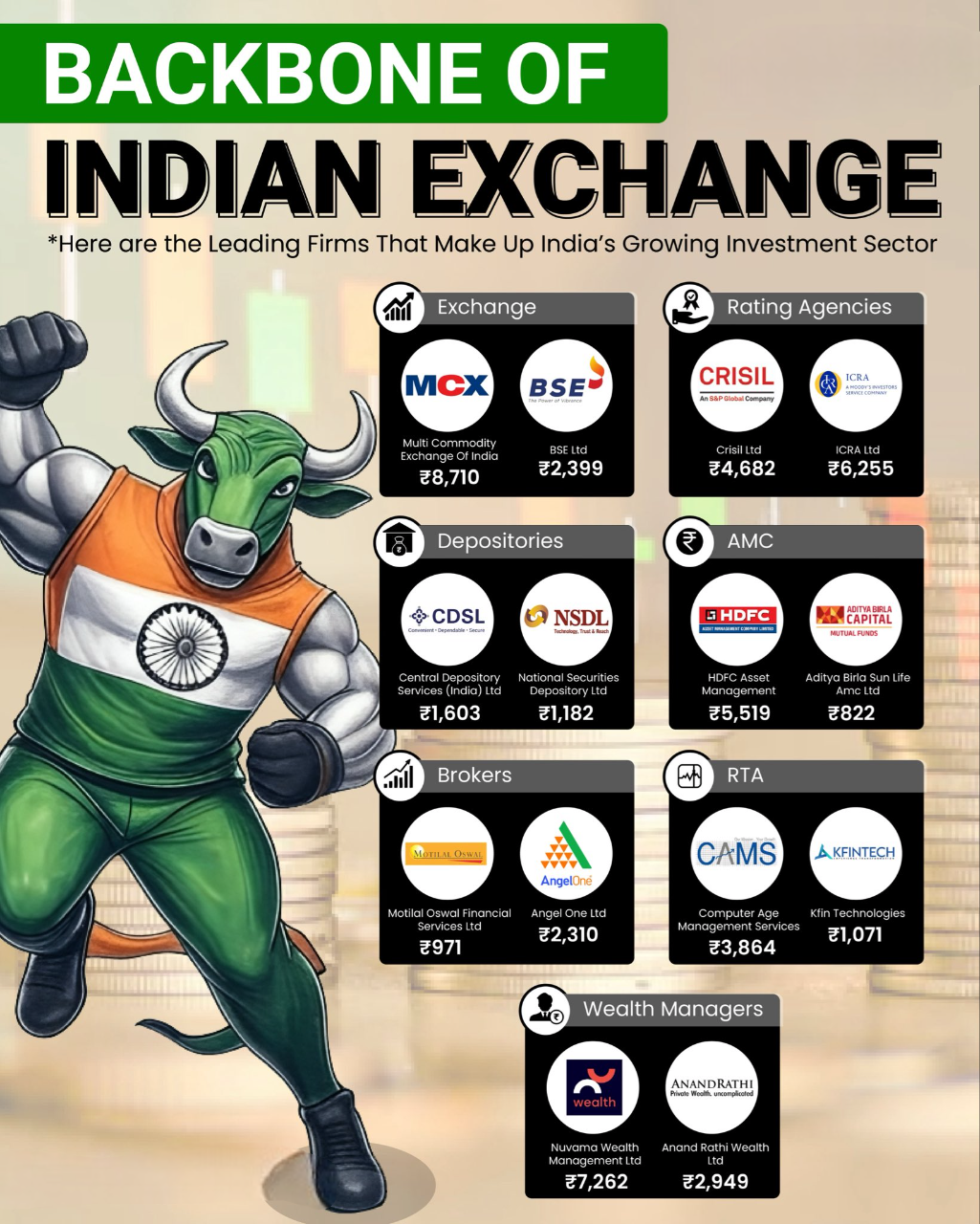

The Pillars of Indian Capital Markets: SEBI, Stock Exchanges, Depositories, and the Regulatory Framework https://siddalviblogs.blogspot.com/2025/05/the-pillars-of-indian-capital-markets.html

More like this

Recommendations from Medial

Yash Barnwal

Gareeb Investor • 1y

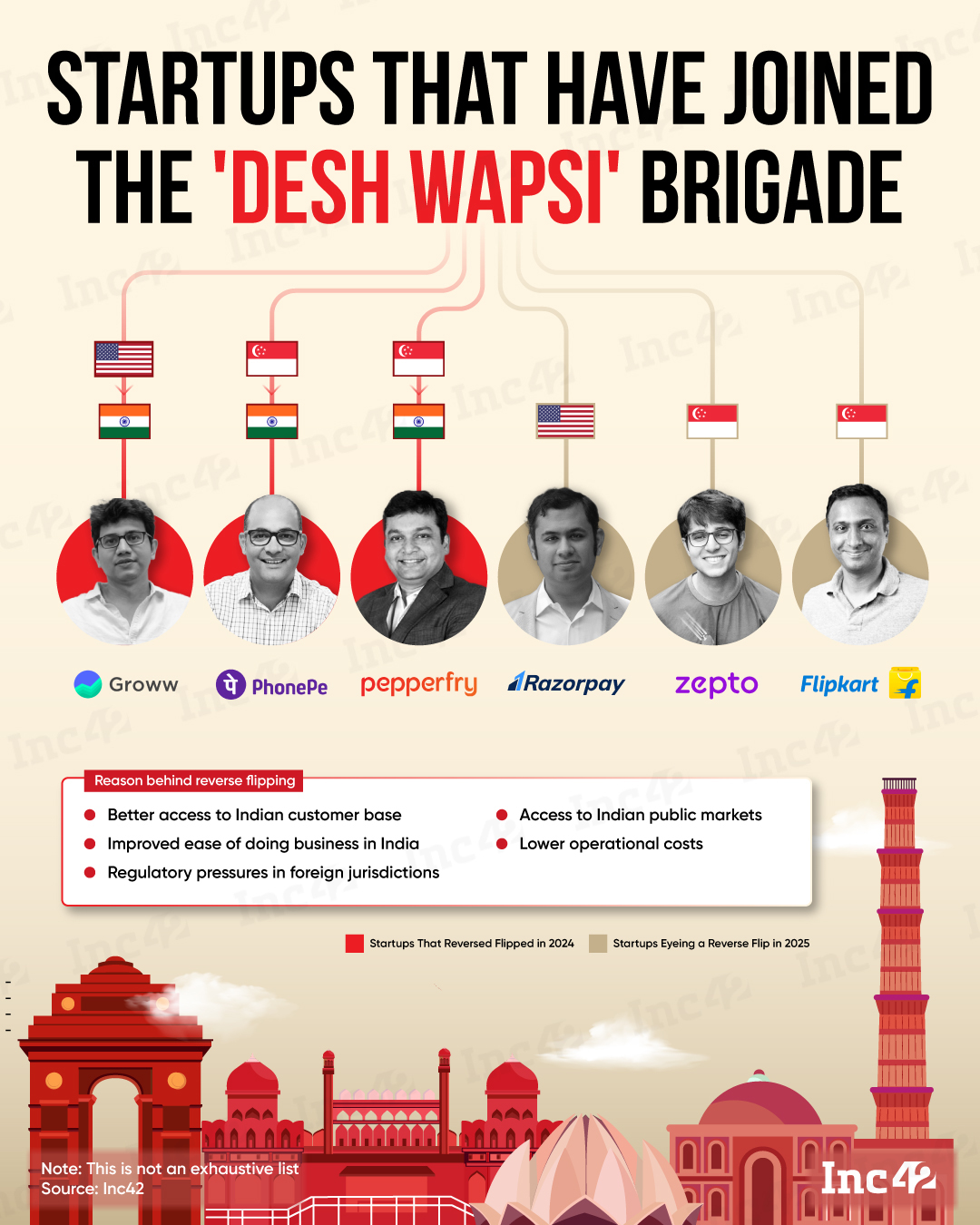

How can Indian startups strategically expand into global markets, leveraging their unique strengths, navigating international competition, and overcoming challenges related to regulatory frameworks, cultural differences, and market dynamics, to achie

See MoreVansh Khandelwal

Full Stack Web Devel... • 2m

Gujarat International Finance Tec-City (GIFT City), India’s first International Financial Services Centre (IFSC) launched in 2009 between Ahmedabad and Gandhinagar, is a multi-service SEZ built for international banking, insurance and capital markets

See MoreTushar Aher Patil

Trying to do better • 8m

Day 6 - 📢 Ever heard of a Masala Bond? Here's why it's spicing up global finance! 🌶️📊 No, it’s not a recipe! 😄 A Masala Bond is a rupee-denominated bond issued in international markets by Indian entities. Its purpose is to help companies raise fu

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

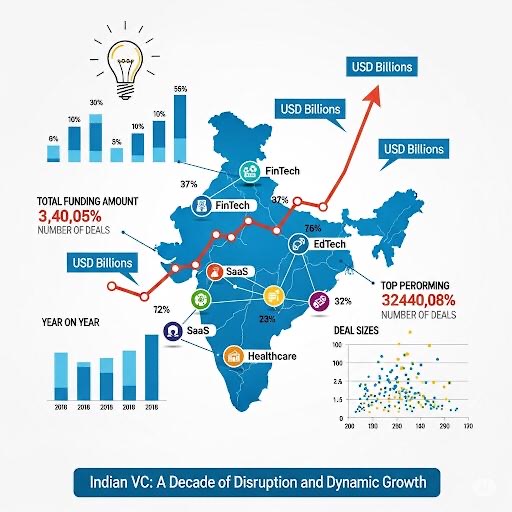

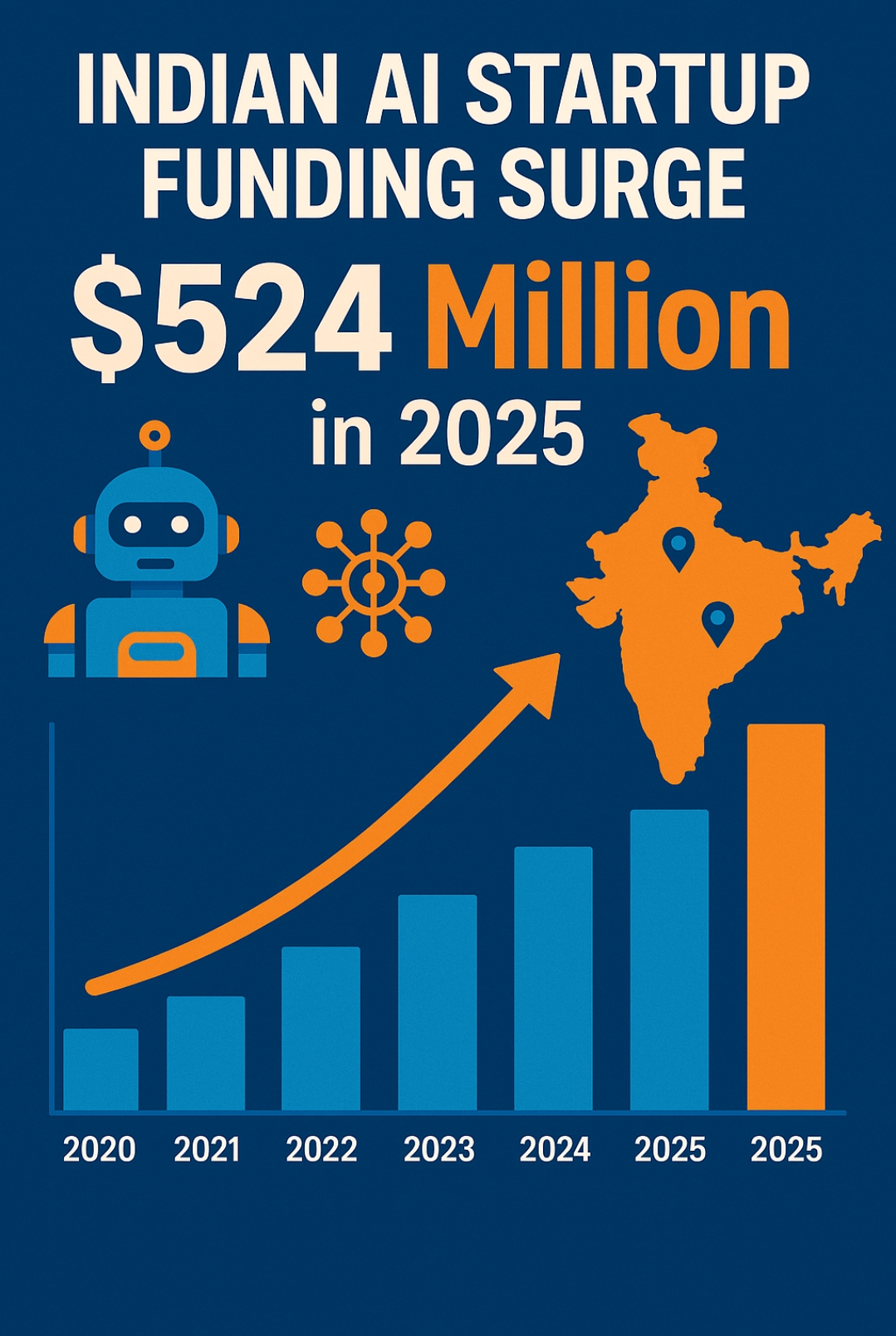

📈 Indian VC rebounds! PE-VC investments +9% to ~$43B in 2024, led by VC/growth at ~$14B (+40%) across 1270 deals (+45%). Consumer tech & SaaS lead. Public markets a key growth driver. VCs now prioritize AI with strong IP & early capital efficiency.

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)