Back

Tushar Aher Patil

Trying to do better • 8m

Day 6 - 📢 Ever heard of a Masala Bond? Here's why it's spicing up global finance! 🌶️📊 No, it’s not a recipe! 😄 A Masala Bond is a rupee-denominated bond issued in international markets by Indian entities. Its purpose is to help companies raise funds from foreign investors without bearing currency risk. 💡 Think of it this way: • Issued outside India • Denominated in Indian Rupees (INR) • Currency risk? Borne by the investor • Regulated by RBI & SEBI • First issued by IFC in 2014 🧭 Why it matters: • Indian companies can access global capital • Keeps debt in INR — no forex pressure • Enhances India’s presence in global bond markets 🌍 Masala Bonds = Global money + Indian flavour! Whether you’re in finance, policy, or just bond-curious — this concept is worth knowing. 📈 Let’s decode more such financial instruments—follow for more bites of finance made simple. #MasalaBond #FinanceSimplified #DebtMarkets #INRBonds #FinancialLiteracy #LinkedInFinance #GlobalInvesting #MasalaNotJustForFood

More like this

Recommendations from Medial

PRATHAM

Experimenting On lea... • 4m

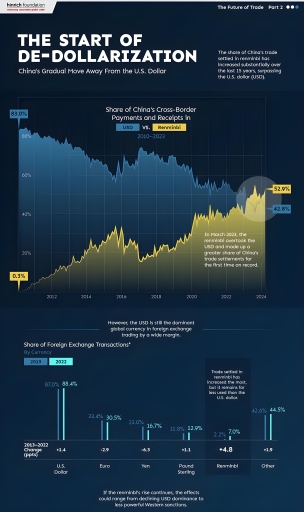

Ethiopia, a BRICS nation, is in earlystage talks with China to convert $5.38 billion of its US dollar-denominated loans into Chinese yuan. This aims to cut foreign exchange costs, boost local currency use in forex markets, and ease repayments simil

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)