Back

Aditya Arora

•

Faad Network • 4m

Left Deutsche Bank after 16 years to build a 9,000 CR company. 1. Starting in global fixed income structuring, Bhupinder Singh worked hard and became the head of investment banking and securities for Deutsche Bank's Asia Pacific region by 2013. He was now managing 21,000 CR of revenue and 2000 clients across 15 countries. But something worried him. 👇🏻 2. On one side were the large traditional banks and public lenders, and on the other were the fragmented fintech players. He aimed to establish a financial institution that provided global banking services utilising modern technology. He was thinking about how to approach it. 🤔 3. And the answer came in four words - Non-Banking Financial Company (NBFC). After 16 years, he left his top job to establish a tech-driven NBFC that caters to the millions of underserved middle-class households. In January 2016, InCred Financial Services was born. 🚀 4. Bhupinder spent the 12 months closely studying the market, consumer patterns, risk and regulatory affairs. He decided to target the consumer loans and MSME credit market with a low collateral requirement, a strong team, and even stronger technology. ✅ 5. As it expanded into education and personal loans, too, it raised 300 CR led by Paragon Partners in 2018. And then it grew like a rocket. By 2019, it crossed 1000 CR in revenue, 500 team members and served 6000 customers with a loan book of 1000 CR. 📈 6. It raised 600 CR, led by Dutch development finance institution FMO. It built proprietary credit algorithms that went beyond credit bureau and analysed education background, employment history, and even psychometric indicators. But Bhpinder knew something was missing. 🤔 7. He had to take a full-stack approach to service clients across the spectrum. So, he built InCred on three pillars: InCred Finance (core NBFC lender), InCred Capital (wealth management, investment banking, and equity broking), and InCred Money (retail investment). And magic happened. 🪄 8. By 2022, InCred had scaled to assets under management (AUM) worth 4000 CR at a revenue of 488 CR. It counted Amazon, Swiggy, Godrej, and Indiabulls among its clients. The moment came on July 26, 2022, as InCred Finance merged with KKR India to create a financial giant from India. 🇮🇳 9. InCred had proved everyone right as it grew by 50% to scale to an AUM of 7500 CR at a revenue of 877.5 CR from interest income and commissions. By December 2023, it had raised 500 CR led by Manipal's Ranjan Pai and became India's second unicorn of 2023. 🦄 10. Today, InCred clocks an AUM of 9039 CR at a at revenue of 1293.1 CR and profit of 316.3 CR. Its first pillar - InCred Finance achieves a net profit of 374 CR alone. 💪 ➡️However, the best part is that Bhupinder Singh supports the higher education of 140 students from low-income families and provides free healthcare to 700 patients. 🙏

Replies (1)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 4m

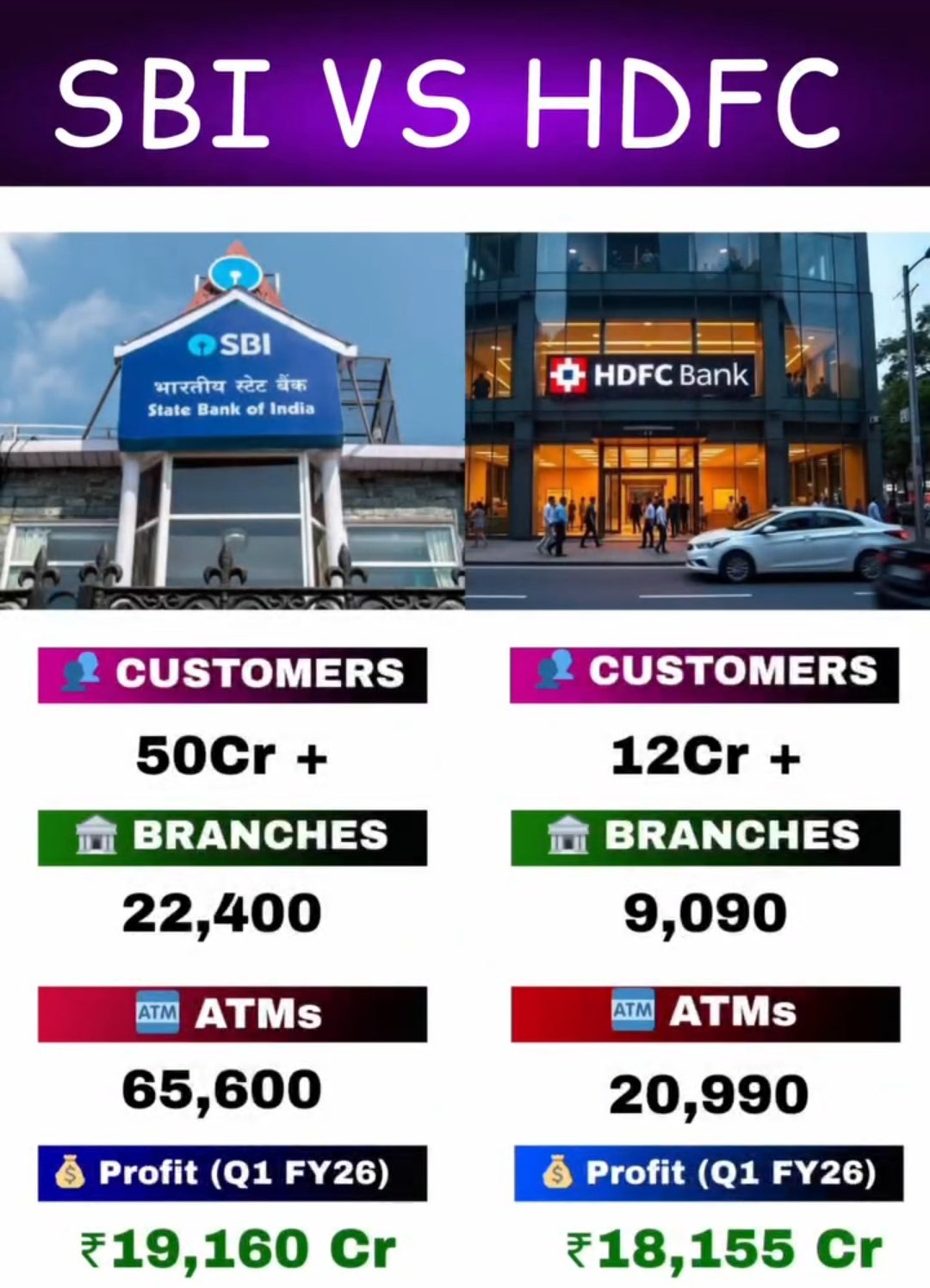

SBI vs HDFC Bank – The Battle of India’s Banking Giants! 🇮🇳 SBI: 50 Cr+ customers | 22,400 branches | ₹19,160 Cr profit 🏦 HDFC Bank: 12 Cr+ customers | 9,090 branches | ₹18,155 Cr profit 👉 Who’s the real king of Indian banking? Comment your o

See More

Mayank Kumar

Strategy & Product @... • 1y

Companies that don't catch many eyeballs or seem flashy are often the ones making money. Avanse Financial Services Ltd. filed its DRHP last week for a 23,500 Cr IPO. It is an education-focused NBFC that provides hyper-personalized education financin

See MoreSwapna Retail Private Limited

Hai Ek Rishta Dil Se... • 1y

Executive Summary Our Fintech solution aims to revolutionize the banking experience by providing a comprehensive range of retail and business banking services under one roof. By offering a single office for all banking needs, we enhance customer conv

See Moregray man

I'm just a normal gu... • 9m

Airtel Payments Bank’s consolidated net profit jumped 82.6% to INR 63 Cr in the financial year ended March 31, 2025 (FY25) from INR 34.5 Cr in the previous fiscal year, driven by strong adoption of digital banking solutions. In Q4 FY25, its profit i

See More

Anonymous

Hey I am on Medial • 1y

Aye Finance Secures INR 110 Cr in Debt Ahead of IPO Delhi, India- IPO-bound lending tech startup Aye Finance has successfully secured INR 110 Cr (approximately $12.8 Mn) in debt from a group of investors, including Northern Arc, ASK Financial Holdin

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)