Back

Swapna Retail Private Limited

Hai Ek Rishta Dil Se... • 1y

Executive Summary Our Fintech solution aims to revolutionize the banking experience by providing a comprehensive range of retail and business banking services under one roof. By offering a single office for all banking needs, we enhance customer convenience, streamline banking processes, and foster long-term relationships. Introduction The banking landscape is evolving rapidly, driven by technological advancements and changing customer expectations. Traditional banking models often require customers to visit multiple branches or access various online platforms to manage their financial needs. Our Fintech solution addresses this gap by integrating retail and business banking services into a single, user-friendly platform.

Replies (3)

More like this

Recommendations from Medial

jaspreet Singh

Time equals to money... • 3m

Fintech Industry – Detailed Overview 1. Introduction to Fintech Fintech (Financial Technology) refers to innovative technologies that improve, automate, or transform financial services. It blends finance + technology to create faster, smarter, and

See More

Kabir Kataria

President - SyncMate... • 11m

Fintech: Transforming the Future of Finance The fintech industry is booming, revolutionizing how we manage money. From digital wallets and UPI payments to AI-driven lending and blockchain, fintech is making financial services faster, smarter, and mo

See More

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Fintech in Bangalore: Trends and Opportunities * Trends: Mobile payments, digital lending, insurtech, blockchain, wealth management, regulatory sandbox. * Opportunities: Financial inclusion, increased access to credit, personalized fina

See MoreThakur Ambuj Singh

Entrepreneur & Creat... • 11m

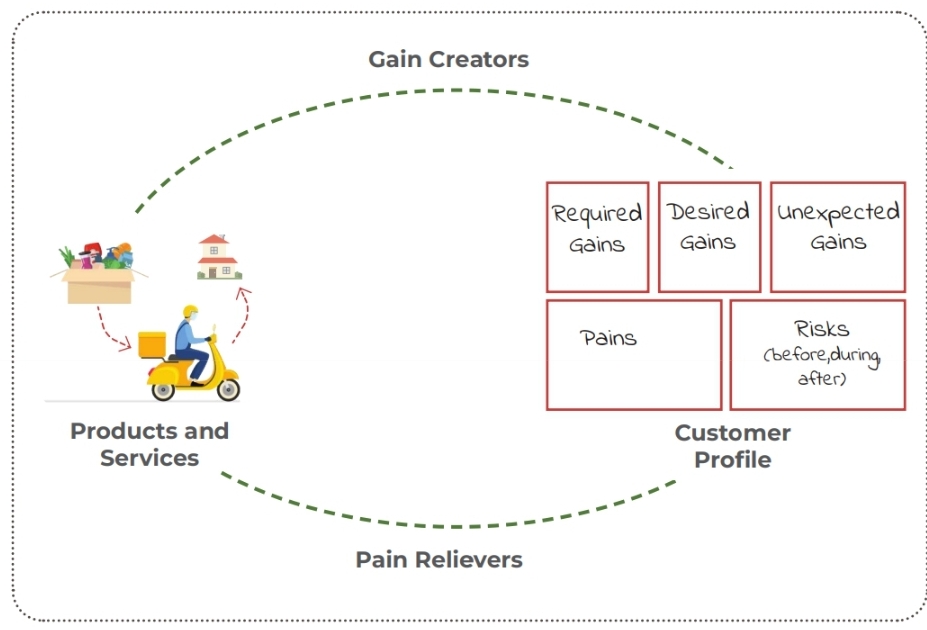

🔍 Value Proposition Canvas Explained This framework aligns a business’s offerings with customer needs: 👤 Customer Profile: Identifies ✅ gains (benefits), ⚠️ pains (challenges) and ⚡ risks 📦 Value Proposition: Defines 🛍️ products/services, 💊 p

See More

Parvej Rijwan

Founder Of Codebaaj.... • 13d

🇮🇳 Top 3 Companies in India (By Market Capitalization – 2026) Latest available data (January–February 2026) ke hisaab se India ki sabse badi companies market cap ke basis par yeh hain: --- 1️⃣ Reliance Industries Market Cap: ₹21.637 Trillion

See More

Unique Financial And Investment Solution

Your Financial Partn... • 8m

*Unique Financial & Investment Solution: A Trusted Partner for Your Financial Future* Unique Financial & Investment Solution is a leading financial services company that has been empowering individuals and businesses to achieve their financial goals

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)