Back

Jeet Shah

Grow with the FLOW • 5m

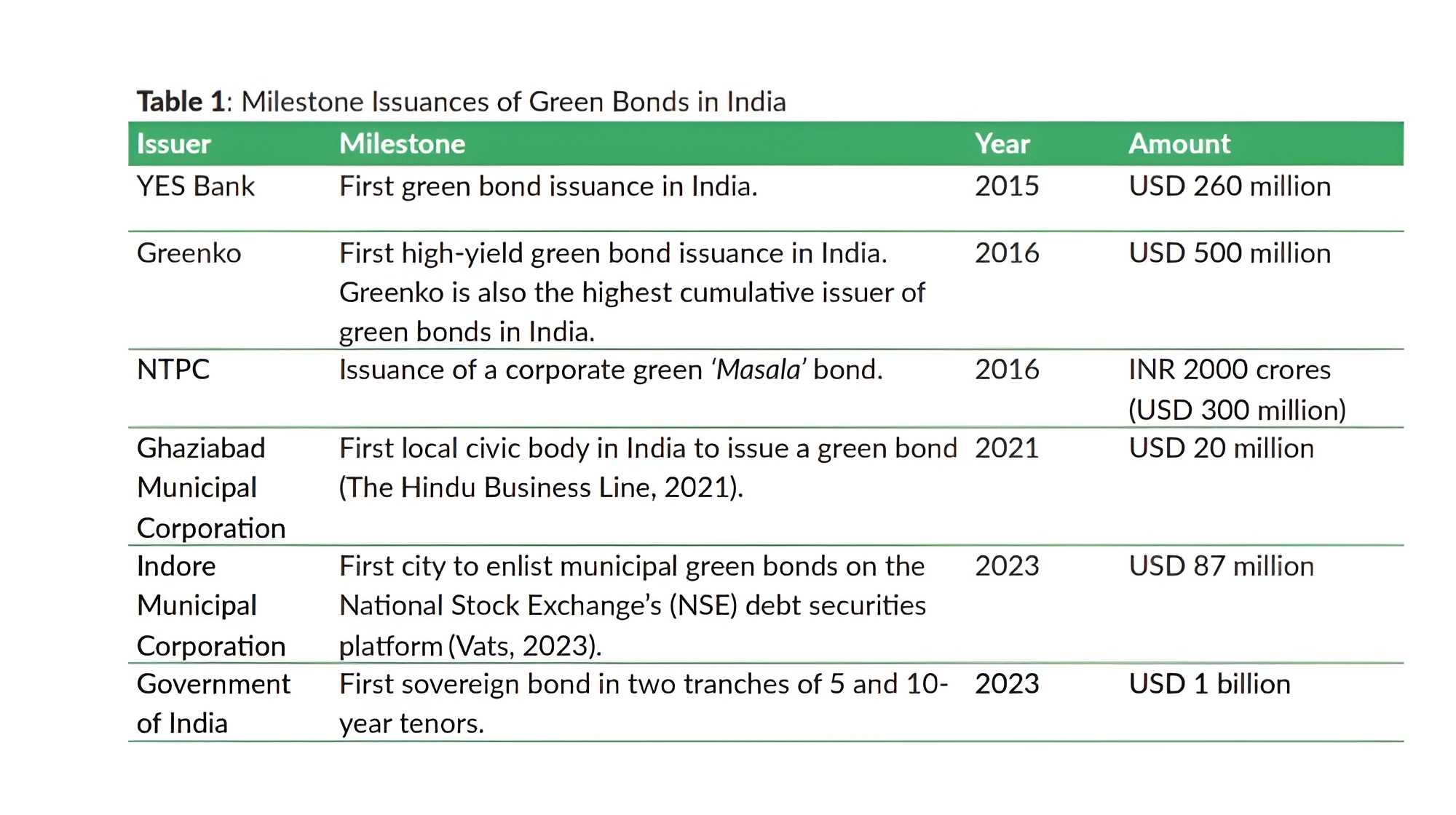

The ₹300 Crore Question How Bajaj Housing Slashed 25% Interest Costs Sep 25: While markets obsess over stocks, Indian CFOs pull off a financing heist. Behind closed doors? RBI cut repo rates by 1% when Smart CFOs rewired their capital. The Mind-blowing math A AAA-rated firm paying 7.5% on 10-year bonds (May 2024) grabbed 6.85% in 2025. On ₹1,000 crore? ₹6.5 crore saved yearly—profit margins boosted, no extra sales. India’s twist? Bond issuances hit ₹10 trillion in 2025. Bajaj Housing Finance, Aditya Capital, and Manipal Hospitals locked 3–10 year bonds 80–120 bps below bank loans The shocker? Banks cut lending rates by just 5 bps. Bonds offered real arbitrage Smart firms ditched bank loans for bond-smart financing The payoff cascade Lower int. - Higher EBITDA → Stronger CF → More reinvestment power. 💡 For fin. pros Are you tracking bond yield curves vs. bank rates, or leaving crores behind? 👉 Is this India’s corporate fin. revolution—or a rate-cycle blip? Drop your take!

Replies (1)

More like this

Recommendations from Medial

Ishita Singh

I will rule the worl... • 1y

Bank of Baroda shares in focus as lender to raise funds via long-term bonds :- Bank of Baroda shares closed 2.07% lower at Rs 250.65 on Wednesday against the previous close of Rs 255.95 on BSE. Total 3.05 lakh shares of Bank of Baroda changed hands

See MoreJaswanth Jegan

Founder-Hexpertify.c... • 1y

“How DHFL Founder steal investors money” Big Fat Corporate Scandal #4 DHFL’s Promoters Scam Dewan Housing Finance Corp LTD was one of India’s largest housing finance companies engaged in providing loans for housing and real estate projects.DHFL had

See More

Ansh Kadam

Founder & CEO at Bui... • 1y

How does RBI earn money ? & why the RBI is more of a banker than a regulator. Last year, the RBI transferred over ₹87,000 Crore to the government, and it's expected to surpass ₹1,00,000 Crore in FY 2025. But how does the RBI generate this enormous

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Unlocking Potential: Innovative Financing for Turnaround Projects Turnarounds aren’t just about survival—they’re launchpads for reinvention. But even the best strategies stall without smart financing. Here’s how innovation is changing the game: 1. R

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)