Back

Vedanshu Singh

Newbie • 5m

The glow of growth just slammed into the wall of regulation ⚖️ "Gameskraft crosses ₹4,000 Cr but PAT sinks 25%." 📉 In FY25, Gameskraft raked in ₹3,896 Cr—up 12% 📈. But let’s be real: ₹2,072 Cr blown on ads 💸 (a 58% jump) is less “smart scaling” and more “set fire to cash.” Net profit fell to ₹706 Cr 🪫, partly thanks to a ₹231 Cr CFO fraud fiasco 🚨. Margins? Strong on paper (ROCE 45.7% ⚡, EBITDA 24.9%)—but paper doesn’t survive a policy bonfire. Because August 2025 arrived. One ban. One Act. And suddenly RummyCulture, Pocket52, and “Add Cash” vanished 📴. Overnight, the cash cow turned into a paper tiger. One lyrical truth: it’s easy to brag about topline growth when your entire model depends on a format regulators can erase overnight 🌊. 1️⃣ 99% of revenue tied to real-money play—no Plan B in sight. 2️⃣ Chose compliance over fight—safe, but surrendering control. 3️⃣ Reinvention or irrelevance—casual gaming, ads, or die trying 🚀. The roast? Gameskraft scaled brilliantly, but without reinvention, that ₹4,000 Cr run looks like a high-score nobody can play again 🎮🔥.

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 1m

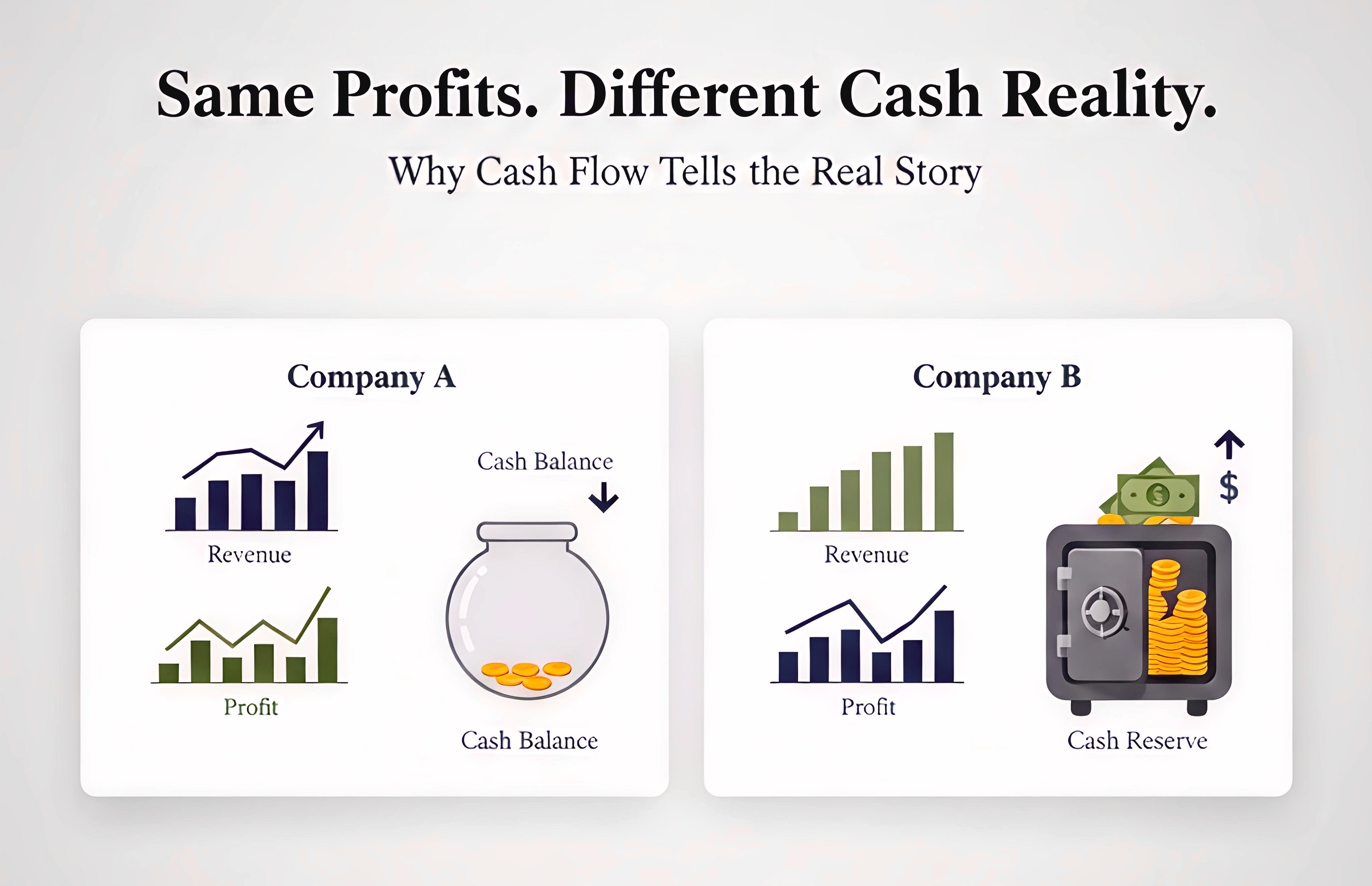

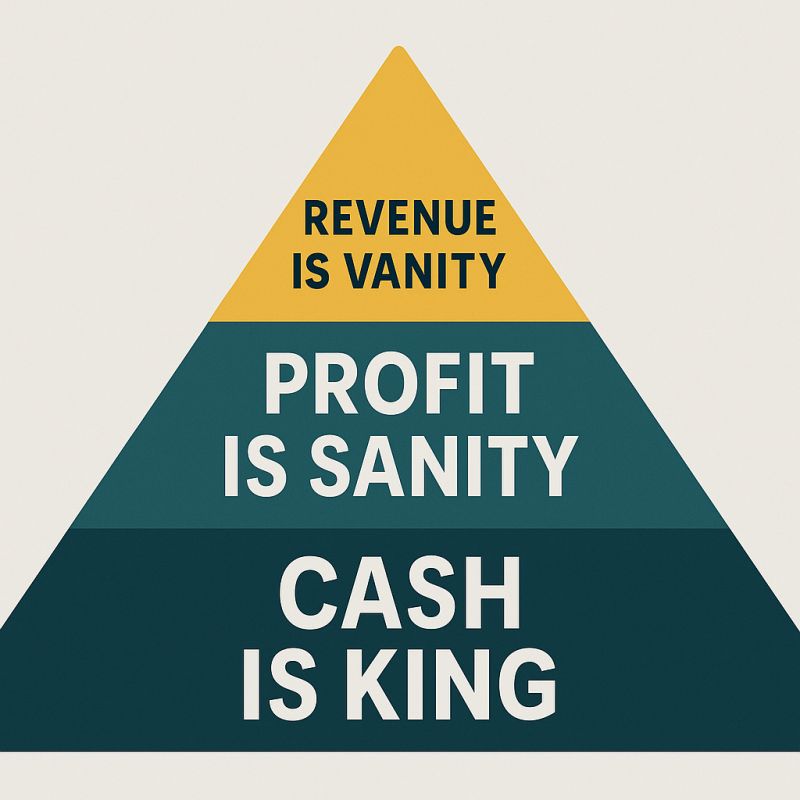

Two companies can report the same profit. Yet one constantly struggles with cash, while the other quietly builds a buffer. This used to confuse me until I started paying attention to how cash actually moves. Some businesses collect money quickly an

See More

Karnivesh

Simplifying finance.... • 1m

A finance leader once said something that changed how I look at businesses. “We were profitable on paper, but cash was always tight.” That’s when the cash conversion cycle started making sense to me. A company may sell today, wait weeks or months

See MoreKarnivesh

Simplifying finance.... • 1m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See MoreNandishwar

Founder @StudyFlames... • 1y

💥 Biggest Acquisitions of 2024! 🏢💰 2024 saw some groundbreaking acquisitions that reshaped the business landscape. Here's the ultimate highlight reel: 1️⃣ Zomato x Paytm’s Ticketing Business: A mega deal worth ₹2,048 Cr! 🍴🎟️ 2️⃣ Device42 x Fr

See More

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

Did the Sharks Miss a Big Opportunity with BoreCharger? 🤔 A Profitable Deeptech Startup Walks Into Shark Tank… And Gets Lowballed?! 🤯 Yesterday’s Shark Tank India S4E46 featured BoreCharger, a company with a patented robotic system to replenish d

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)