Back

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

Did the Sharks Miss a Big Opportunity with BoreCharger? 🤔 A Profitable Deeptech Startup Walks Into Shark Tank… And Gets Lowballed?! 🤯 Yesterday’s Shark Tank India S4E46 featured BoreCharger, a company with a patented robotic system to replenish dried borewells—a massive opportunity in water-scarce regions. They asked for ₹75L for 1.5% equity, backed by solid financials: 📈 Revenue & EBITDA Growth: - FY21: ₹1.02 Cr - FY22: ₹2.78 Cr - FY23: ₹3.22 Cr (8% EBITDA) - FY24: ₹5 Cr+ (15%+ EBITDA) For a hardware deeptech company, this is rare—they’ve been profitable and are scaling efficiently. Yet, only Kunal Bahl showed interest, offering ₹75L for 10% equity—a huge dilution.The founders countered with 2.5% equity, but Kunal didn’t budge, and the deal fell apart. This Rejection is Bizarre 🤨 Sharks regularly fund “me-too” D2C brands burning cash on ads, yet they passed on a tech-driven company with: ✔️ A real tech moat (patented robotic machine) ✔️ Minimal competition in a massive market ✔️ Huge TAM—4 Cr+ borewells in India, with major potential in cities like Delhi, where new borewells are banned, but replenishment is legal ✔️ Proven traction—4,000+ projects completed, including 400 for a government program Yes, they haven’t fully cracked their scaling strategy yet. But isn’t that exactly where the sharks should help? Instead, they undervalued a deeptech company solving a real problem. What’s your take? Did the sharks miss out on a big opportunity, or was their caution justified? ---------------------------- http://www.borecharger.com

Replies (3)

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 9m

Geotech company MapmyIndia posted a consolidated net profit of INR 49 Cr in the fourth quarter of FY25, marking a near 28% jump from INR 38.3 Cr in the year-ago quarter. On a quarter-on-quarter (QoQ) basis, the company’s profit zoomed 52% from INR 32

See More

Aarihant Aaryan

Prev- Founder & CEO ... • 1y

I watched fewer episodes of Shark Tank, most founders optimised for equity, sharks but not cash If someone wants to do a combined deal or wants more equity ask for a little bit more cash-only "cash" increases your runway and chances of succeeding.

Aryan Mankotia

FEAR IS JUST AN ILLU... • 12m

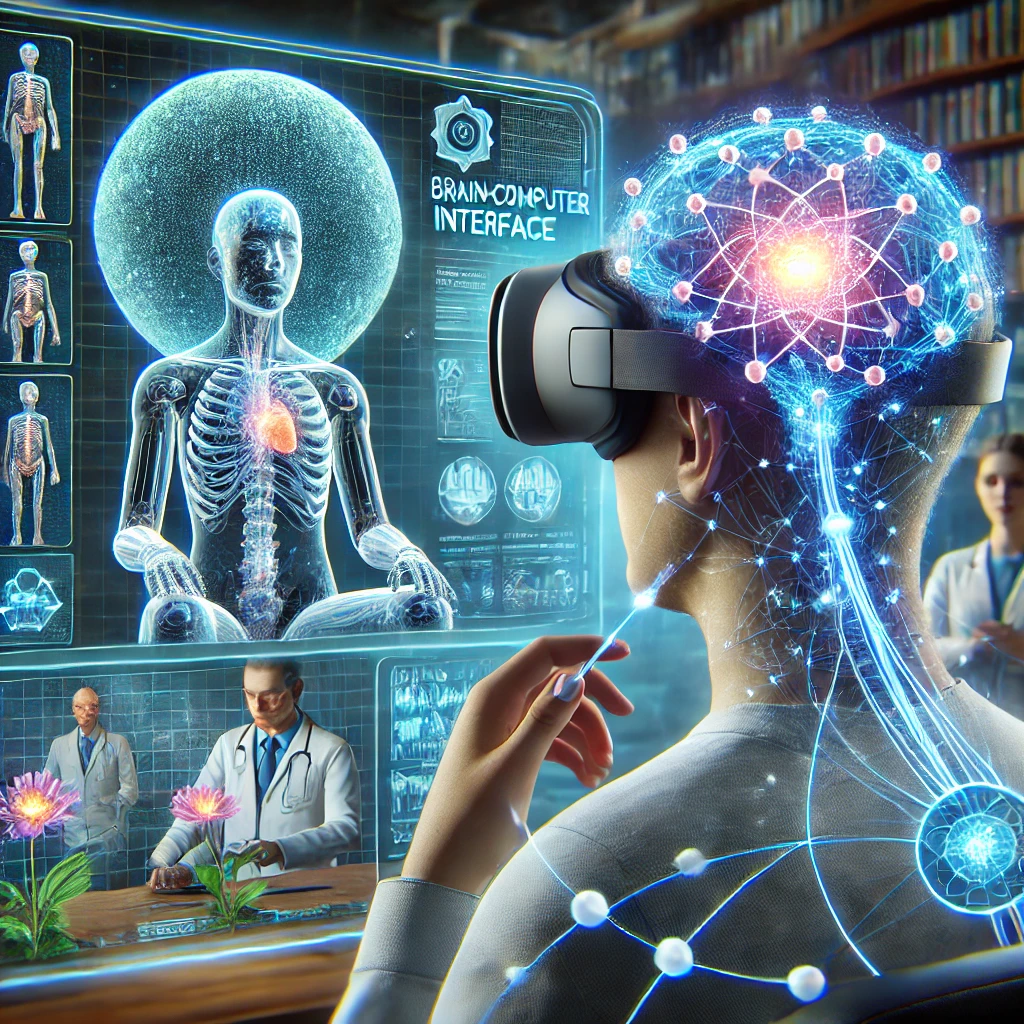

🚀 PixelPeak: The Future of Full-Dive Virtual Reality! 🚀 The era of mind-controlled virtual experiences is here! PixelPeak is redefining VR with advanced BCI-driven immersion, allowing users to interact with a digital world using only their thought

See More

Swapnil gupta

Founder startupsunio... • 8m

📌 Revenue Model of Groww 1. Subscription Charges: For premium services like advanced analytics. 2. Platform Fees: Charged for mutual fund investments. 3. Lending Services: Interest income from instant loans offered to select customers. A. Br

See More

Shreyash Rajgaria

Founder & CEO at BIP... • 8m

💥 From "Bhai, startup register hogaya!" to "Investor ne deck mein kya bola?" A founder’s journey, brutally honest edition 👇 🚀 Incorporation: Startup registered. Still using personal UPI for business. Founder title: CEO / CMO / Office Boy (All-in-

See MoreAbdul Basith

Hey I am on Medial • 1y

I'm Abdul Basith, the founder of Hotdawg, a youth clothing brand that merges contemporary trends and subcultures into standout designs. We've developed a solid foundation: ✔️ Website ready (powered by Shopify) ✔️ Supplier partnerships established ✔️

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)