Back

Bhavesh Kumar

Finance & Accounts p... • 7m

1. Sale of Goods by Seller Seller's Invoice Value (Inclusive of GST @28%) = ₹100 Breakup: Taxable Value = ₹78.12 GST @ 28% = ₹21.88 This is a sale made by the seller, and Amazon collects this ₹100 from the customer on behalf of the seller. 2. Service Charges by Amazon to Seller Amazon deducts its service charges for delivering the goods and providing platform services. Suppose the service charge is ₹15 + 18% GST = ₹2.70 → Total Deduction = ₹17.70 This is an invoice from Amazon to the seller for service provided. Final Settlement: Total Collected from Customer: ₹100 Less: Amazon’s Service Charge (incl. GST): ₹17.70 Net Amount Paid to Seller: ₹82.30 Notes: The seller will pay GST of ₹21.88 to the government (Output Tax). Sellers can claim ITC of ₹2.70 on GST charged by Amazon (Input Tax). more clarification pls connect @9873842103

More like this

Recommendations from Medial

Deepak Kumar

Founder @erizo.in • 7m

koi CA ya accountant ho toh mere ek sawal ka jawab dijiye maan lijiye amazon par kisi seller ka Rs.100 ka saman sale hota hai aur uski item ki MRP bhi 100 hai jisme 28% GST included hai, amazon sirf delivery fee aur platform fee le sakta hai, amazon

See MoreAASHIRWAD DEVELOPER GROUP

The business should ... • 1y

Attention GST taxpayers: November 30, 2024 is last day to claim pending input tax credit by filing GSTR 3B November 30, 2024, is the last date to claim any pending input tax credit (ITC) or amend any errors or omissions in compliance with the Goods

See More

CA Kakul Gupta

Chartered Accountant... • 5m

GST Rate Change – Important Clarification The Govt. has clarified that new GST rates will apply on all deliveries made on/after 22nd September. 👉 Even if you have booked your order, issued invoice, or made advance payment pehle, the new rate will

See MoreDinesh H

Mission to Quit 9 to... • 8m

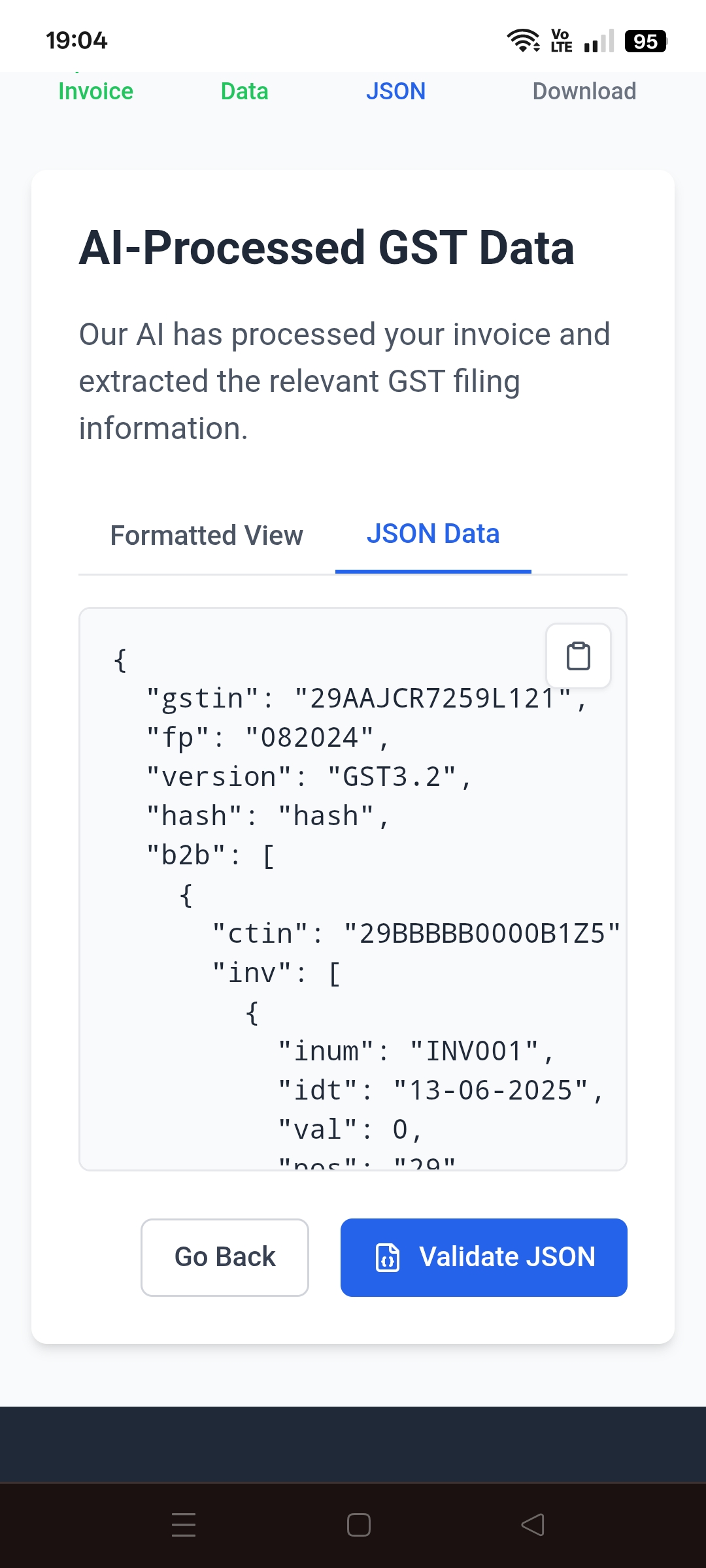

I am looking for some funding to my SaaS startups. so are there any hackathons or some competition to participate and get funds related to Fintech and Gst solution products ? my product is: AI GST Filling Automation helps the gst filling process si

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)