Back

Ujjwal gupta

Founder @starscolab • 8m

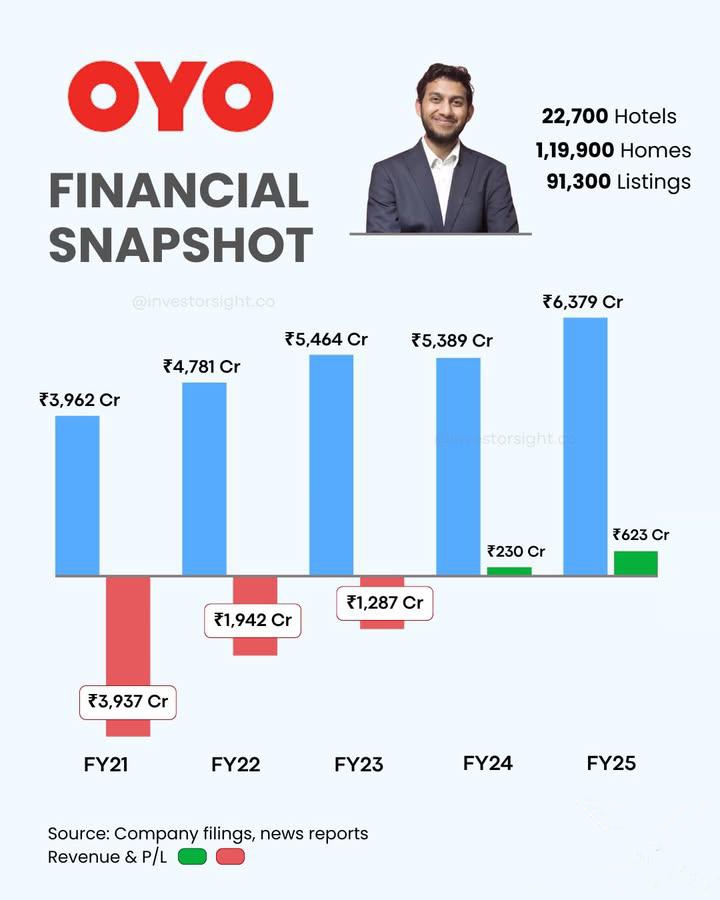

Hard Agree, major of the Indian startups are doing this only. No profits, no sustainable business model. Exit either via another vc round or IPO.

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 8m

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

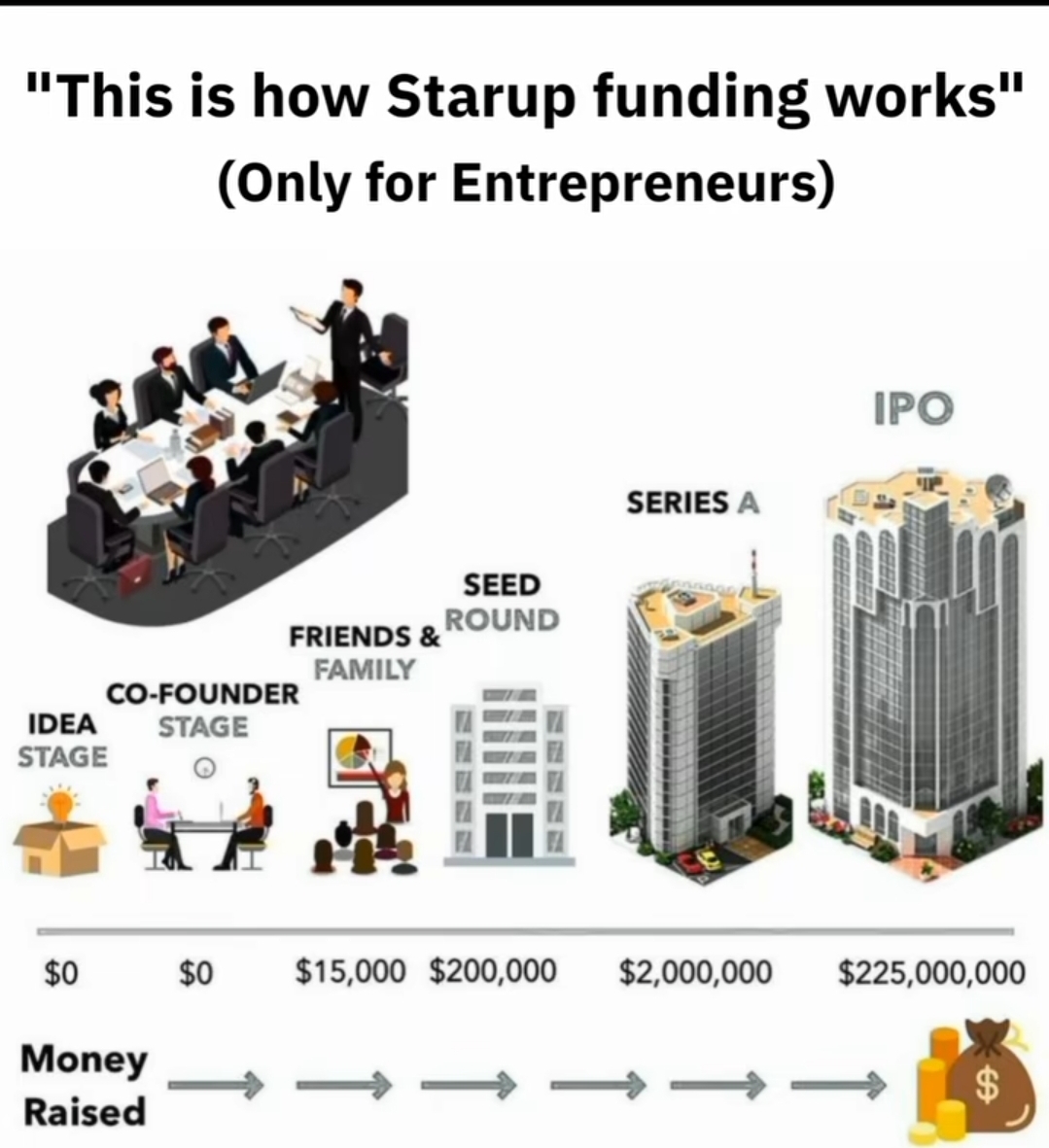

🚀 How Startup Funding Works! 💡 Idea Stage – Just an idea, no funding yet. 🤝 Co-Founder Stage – Team formation, still no money. 👨👩👧👦 Friends & Family – Early believers pitch in ($15K). 🌱 Seed Round – First external funding to grow ($200K).

See More

Account Deleted

Hey I am on Medial • 1y

Let's decode one pattern : • Companies were backed by Softbank such as OYO, OLA Electric and FirstCry are continuously filing for IPO but some IPO's approved or some failed for IPO. • Startups backed by Softbank such as OLA Electric and OYO are ra

See More

SamCtrlPlusAltMan

•

OpenAI • 1y

Sweet short summary: Bain 2024 Indian VC insights. • India's VC scene in 2023 was a rollercoaster. Funding dropped from $25.7 billion to $9.6 billion year-over-year. Despite this, India held onto its spot as the second-biggest VC destination in Asia

See MoreThe Vc Girl

Not a Vc Yet, just O... • 7m

16 VC Terms I’m Learning to Become Sniper . Not a VC (yet), but I’m obsessed with how they think. TAM – Size of the $$ opportunity CAC – Cost to get a user LTV – Money a user brings over time Runway – Months till cash runs out Burn Rate – Monthly

See MoreHarshajit Sarmah

Founder & Editor of ... • 1y

Bitcoin restaking platform SatLayer raises $8M in a pre-seed funding round led by major investors like Hack VC and Franklin Templeton. SatLayer pioneers the restaking of Bitcoin and liquid-staking tokens on the Babylon protocol, enabling users to ea

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)