Back

mg

mysterious guy • 8m

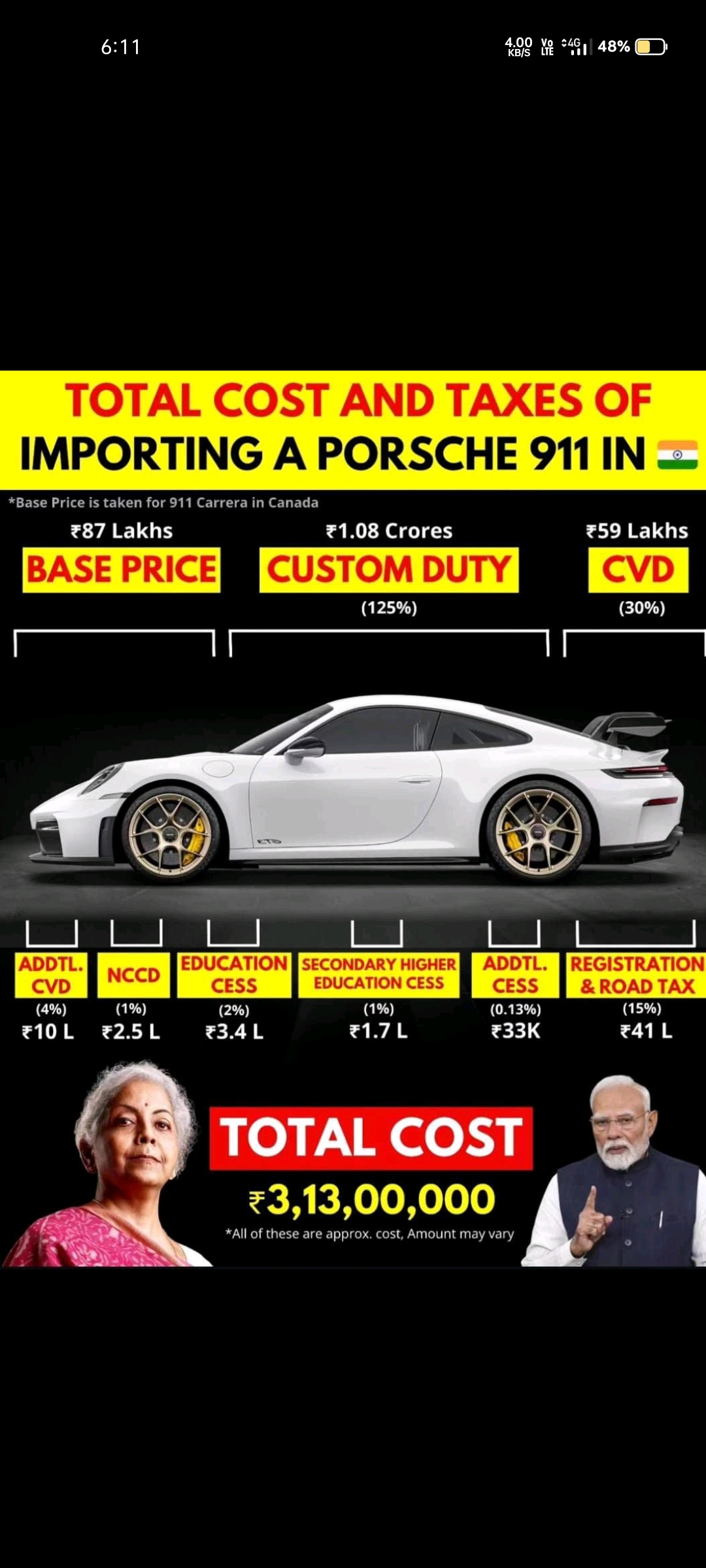

liable to 31% CESS tax....

More like this

Recommendations from Medial

CA Kakul Gupta

Chartered Accountant... • 11m

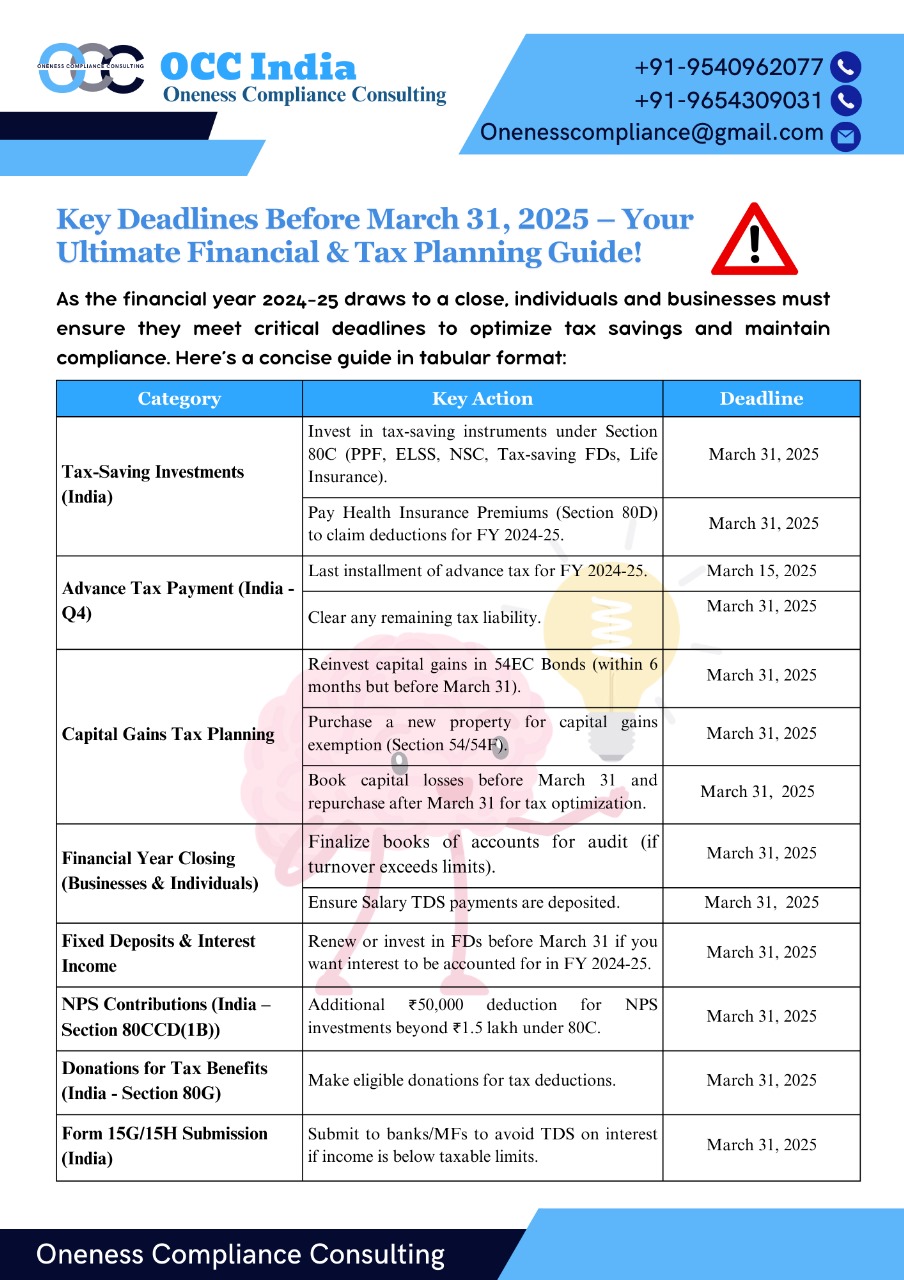

Summary of action points Before March 31, 2025 ✔ Review tax-saving investments. ✔ Pay pending taxes/advance tax. ✔ Submit investment proofs to employer (if salaried). ✔ Plan capital gains/losses for tax efficiency. ✔ Update financial records for the

See More

Sameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreShubham Patel

•

E-Cell, IIT Bombay • 1y

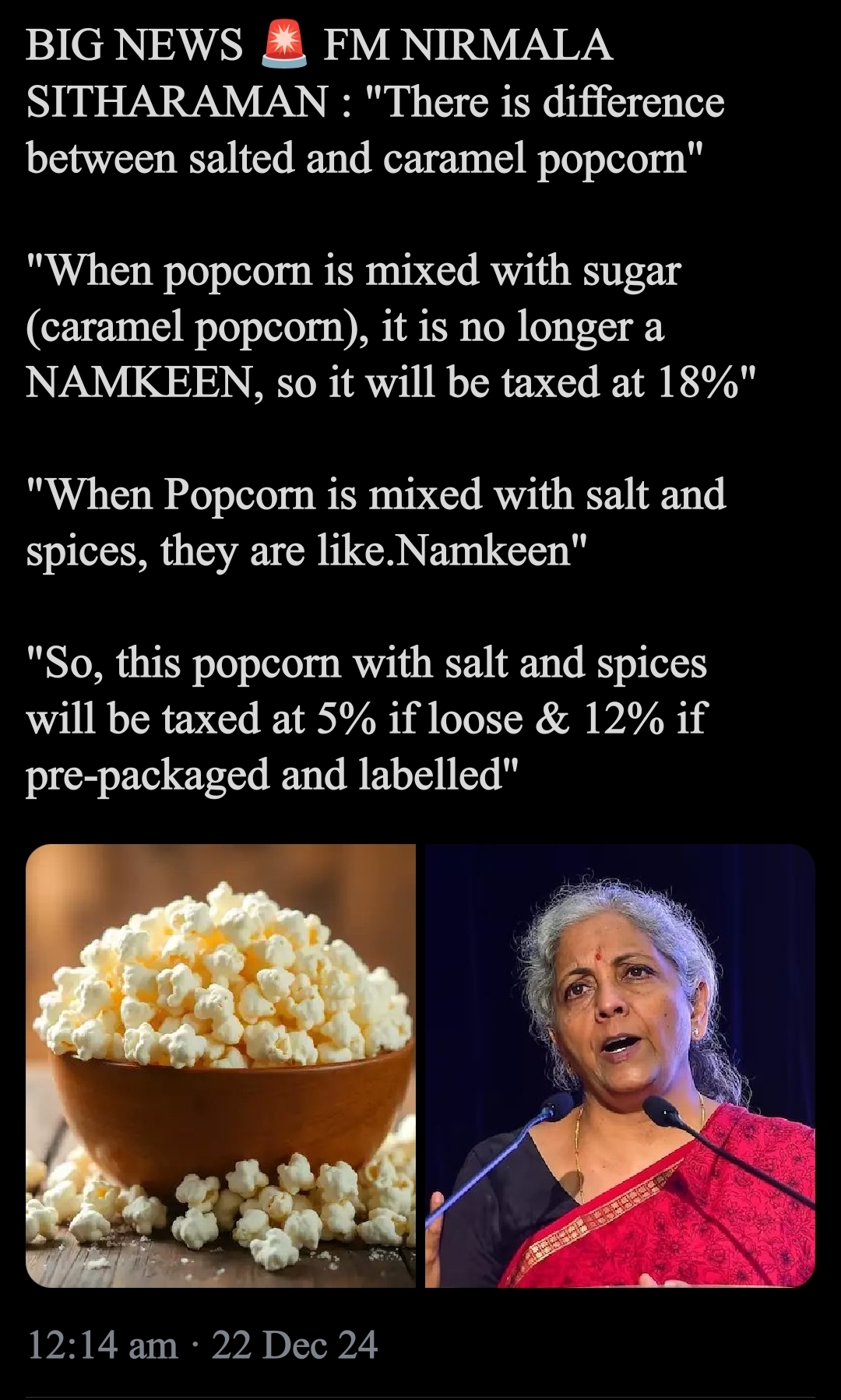

Mehnat ki kamai par moti rakam maangte hue pakadi gyi 😅( Caught demanding huge amount for hard earned money) Tax -Treatment of popcorn 🍿 The Goods and Services Tax (GST) Council, chaired by the finance minister and including state representative

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 10m

30+ Strategies How Billionaires Avoid Taxes. 🚀 1. Double Irish with a Dutch Sandwich 2. Tax Haven Residency 3. Offshore Shell Companies 4. Trust Funds 5. Carried Interest Loophole 6. Capital Gains Tax Rate 7. Intellectual Property Rights Shifts 8.

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)