Back

Achint Sachdeva

Accelerating 0-1 pla... • 8m

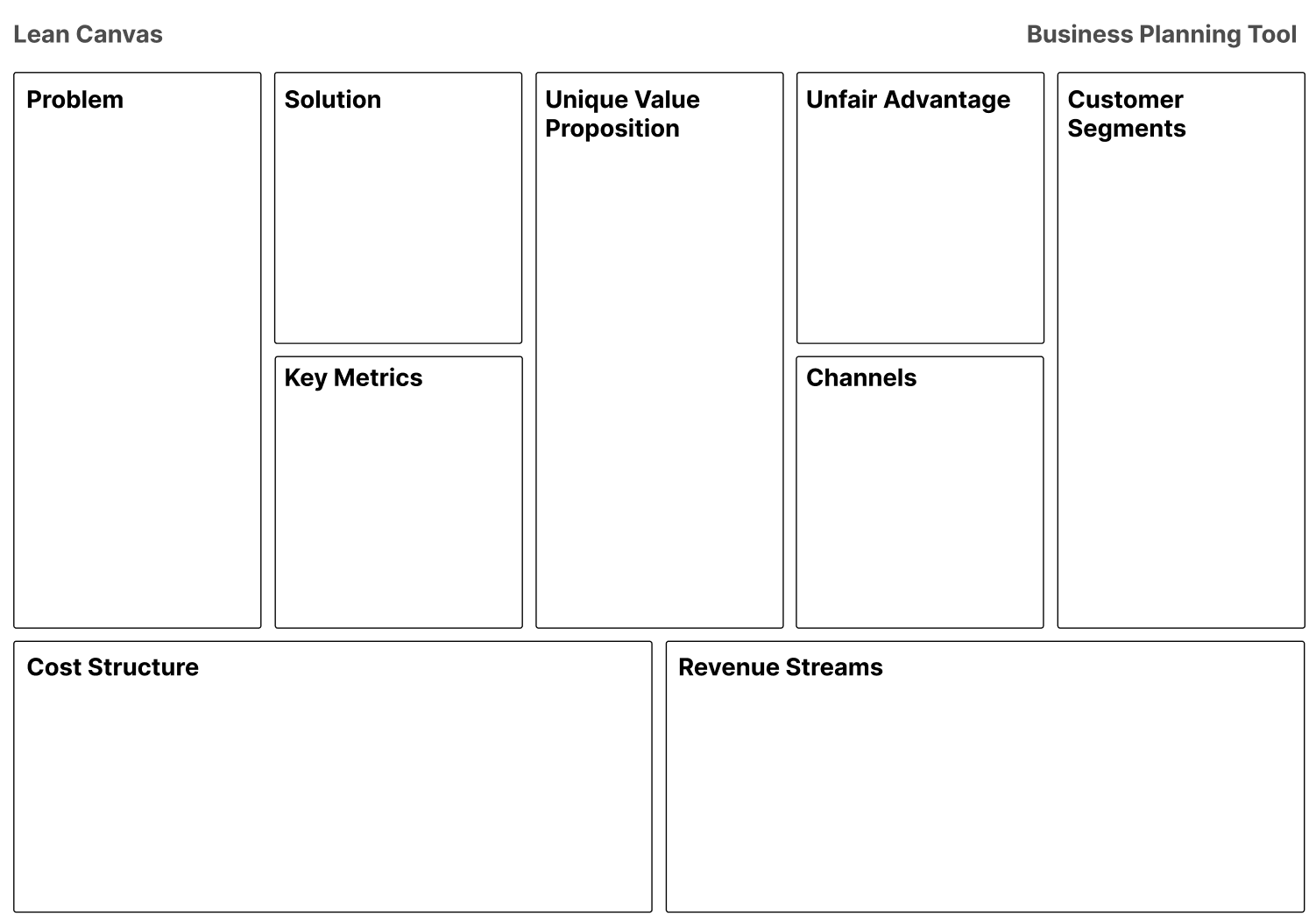

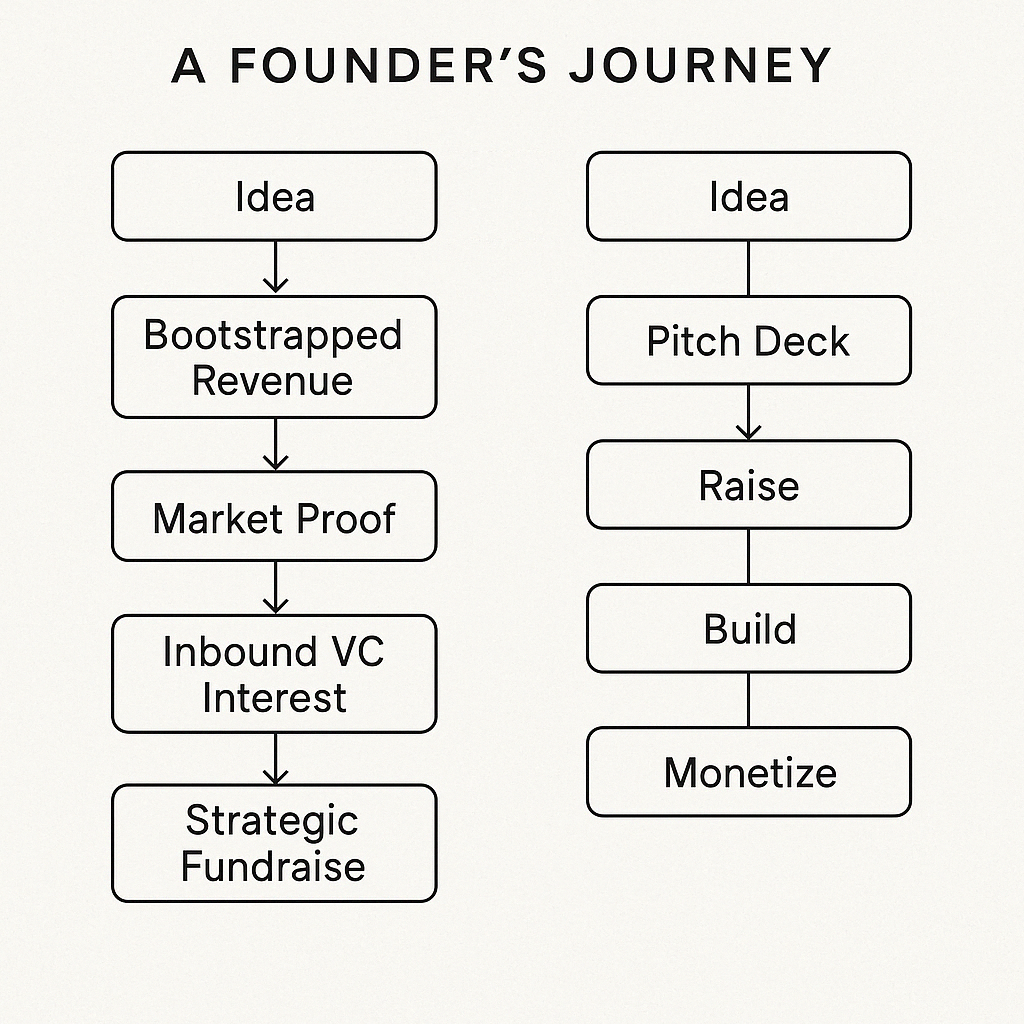

Time to redefine your ‘early stage fundraising' strategy? Stop waiting for the cavalry. The narrative of blaming the early-stage investor ecosystem is a distraction from the real work of building value. We hear the murmurs – "lack of capital," "unresponsive VCs," "tough market." But what if that narrative is precisely what's holding you back? The truth is, capital follows conviction, especially in a market as dynamic as ours. For early-stage founders, the relentless pursuit of venture capital, often for untested concepts, can be a monumental drain on precious time and resources. It diverts focus from the foundational elements: understanding a problem deeply, validating a solution with real users, and proving even the slightest hint of product-market fit. Instead of endless pitch decks for a concept, unleash the power of a lean, frugal prototype. One that solves a genuine pain point for a handful of early adopters, generates tangible feedback, and perhaps even a sliver of revenue. This isn't about bootstrapping forever; it's about building undeniable traction that makes you irresistible to investors when the time is right. Early stage investors aren't looking for polished promises. They're seeking evidence – proof that you can build, iterate, and deliver. That evidence often comes from resourceful, capital-efficient execution, not from extensive fundraising rounds for a mere idea. The best pitch isn't a deck; it's a living, breathing solution. Use the lean startup canvas to simplify your prototype hashtag#LeanStartup #0-1StartupPlaybook hashtag#EarlyStageVentures hashtag#StartupIndia hashtag#Bootstrapping hashtag#FounderMindset

Replies (1)

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreVedant SD

Finance Geek | Conte... • 1y

Day 59: BLR Startup Funding: Beyond the Angel Investors Angel investors are the fairy godmothers of the startup world, but they're not the only funding option in Bengaluru. Here's a look beyond: * Bootstrapping Magic: Self-funding your startup wit

See MoreXinetee

Decentralised , Secu... • 10m

We combine the power of: • Blockchain for transparency & immutability • Advanced cryptography to secure every word • Virtual Machine integration to automate trust with smart contracts • Economic incentives to reward honesty and fuel sustainability T

See More

Vicky

Ask yourself the que... • 10m

What If Bootstrapping Is the New Fundraising? Here’s a contrarian thought: in 2025, bootstrapping isn’t the opposite of VC funding—it’s becoming a new kind of pitch. Startups with solid revenues, loyal customers, and zero external capital are now m

See More

Karan Jot Singh

Jack of all trades, ... • 7m

Introducing Nimbi - A flagship project from Techentia's early build days, still making waves. Built with the mission to unite players globally through crypto rewards, Nimbi turns gameplay into profit via Crypto Dust and NFT wolf collectibles. Robus

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)