Back

Rohan Saha

Founder - Burn Inves... • 9m

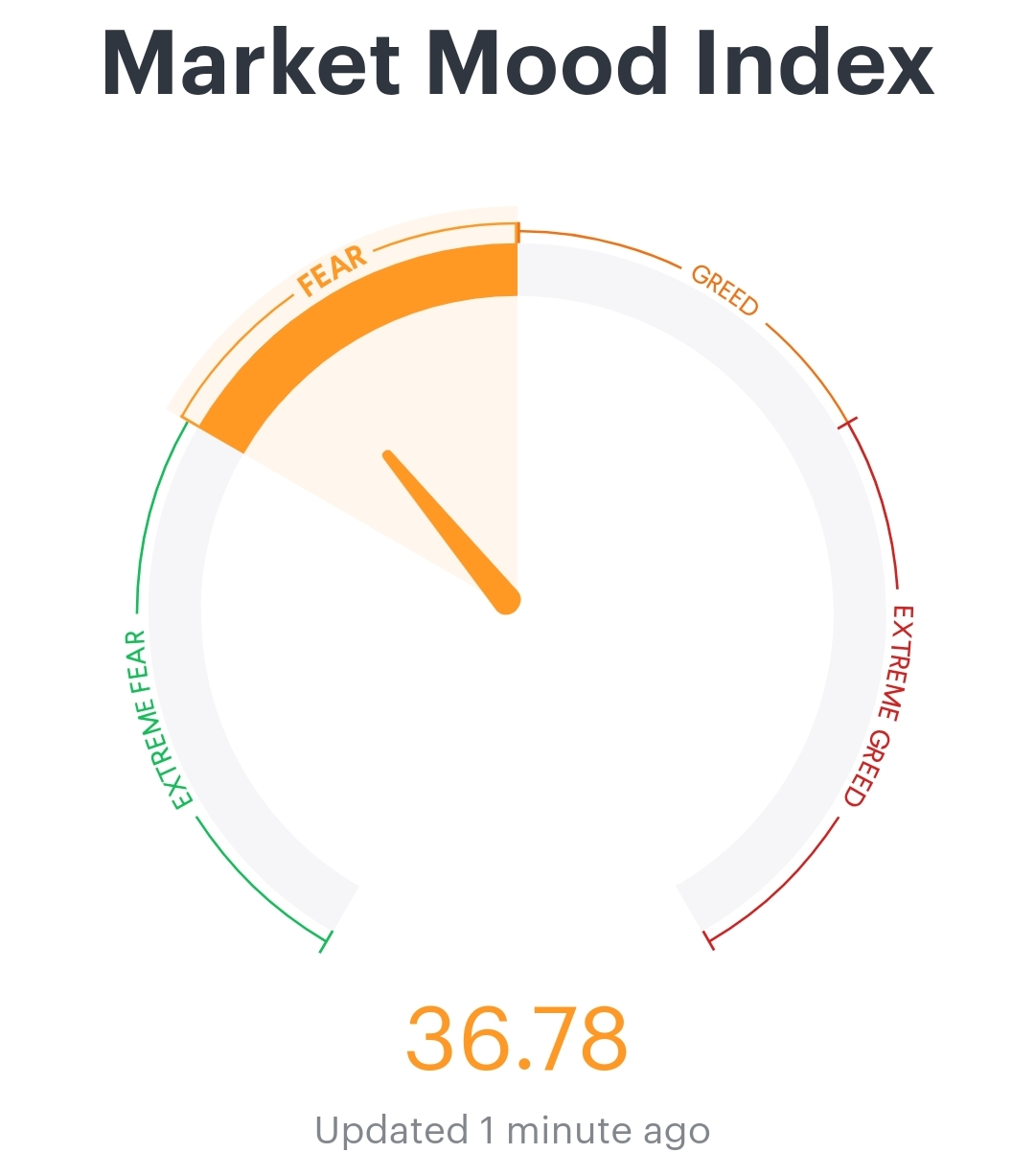

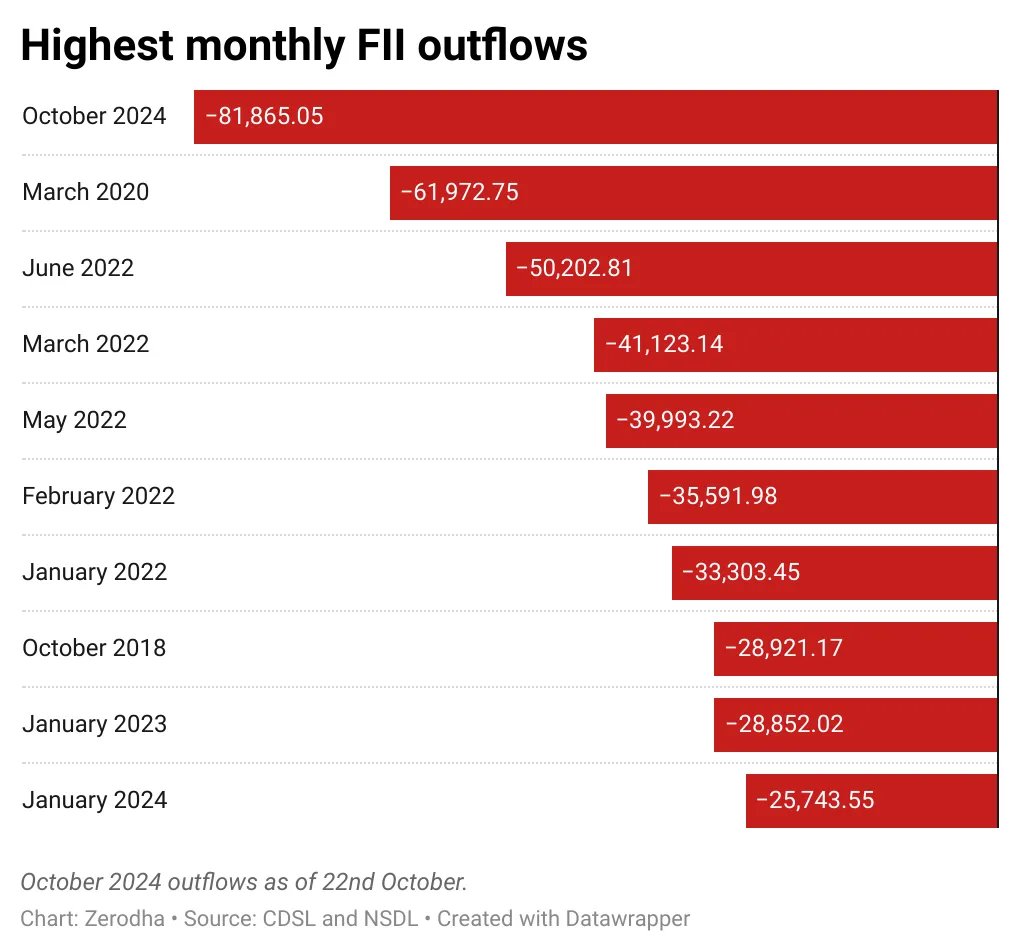

If US bond yields increase further, the market could correct a bit more for now. FIIs will withdraw more money then. avi fir se DII and RETAILERS ki bari hai

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 9m

It's only May 11, and within less than half a month, FIIs have already invested ₹14,167 crore in the Indian market. This amount also includes the net selling from the last trading day. Now, the key thing to watch is whether these numbers remain the s

See MoreRohan Saha

Founder - Burn Inves... • 6m

The market seems to be facing strong selling pressure going into next week Interestingly it is mostly retail investors who are selling possibly even more aggressively than FIIs based on the latest FII and DII data the market usually does not drop thi

See More

Rohan Saha

Founder - Burn Inves... • 8m

Even after the rate cut, bond values haven't dropped much in the secondary market. Government bonds have adjusted a bit, but not significantly. The upcoming primary issues will be worth watching a few NCD IPOs are expected in the coming days. Let’s s

See Morefinancialnews

Founder And CEO Of F... • 1y

"Midcap and Smallcap Stocks Correct, but Valuations Stay Elevated: Chirag Setalvad" Midcap and Smallcap Valuations Ease, but Froth Remains: Insights from Chirag Setalvad Midcap and Smallcap Corrections: Froth Persists The midcap and smallcap indice

See MoreJayant Mundhra

•

Dexter Capital Advisors • 10m

It’s really strange how ATHER is moving just weeks ahead of the much-awaited IPO. So much is not adding up 🙏🙏 And I am a tad bit nervous - What if there is more than what’s known to the public? Let me explain in depth. .. You see, Ather last ra

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)