Back

mg

mysterious guy • 9m

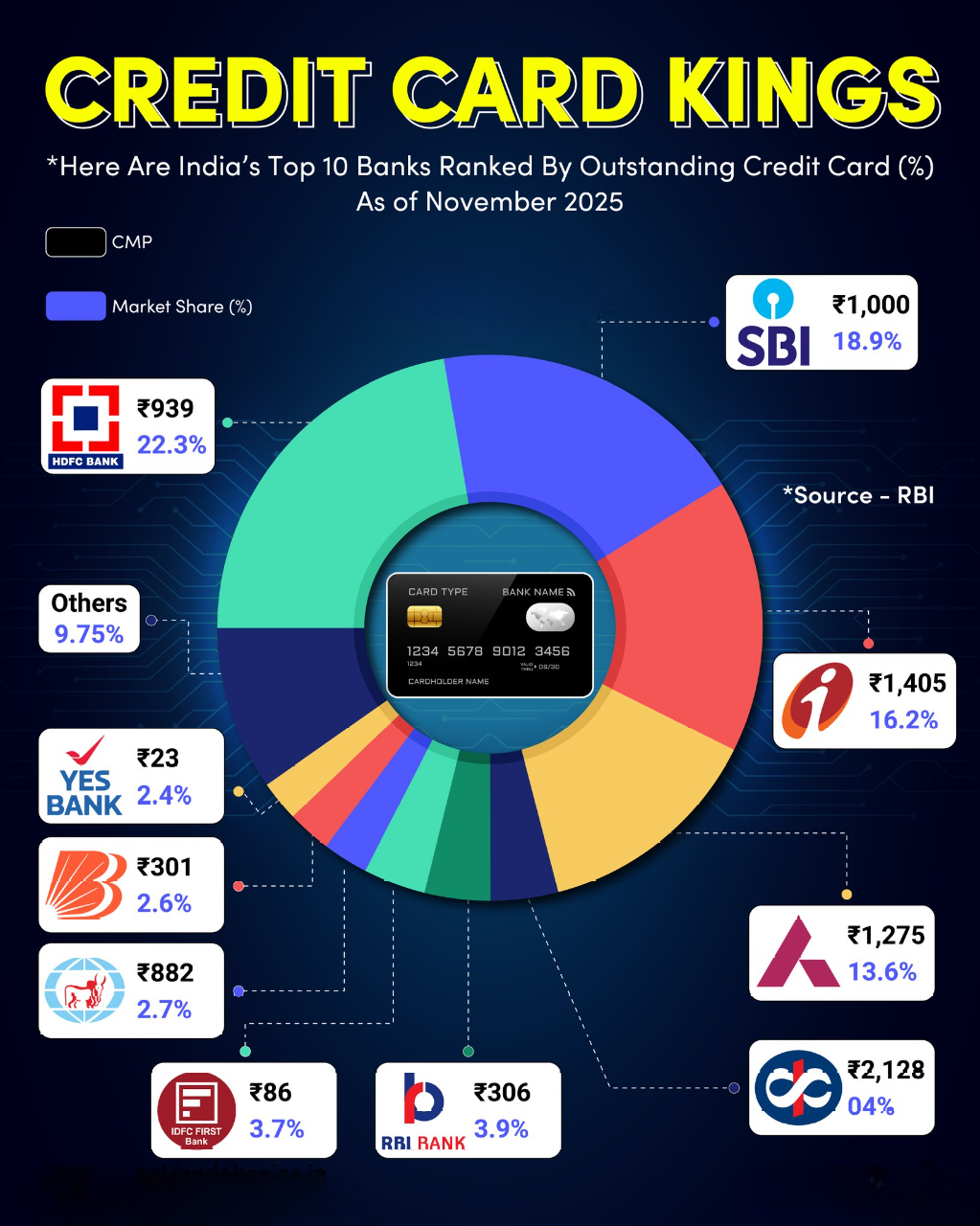

CRED Isn’t a Rewards App. It’s a Trojan Horse for India’s Affluent Most think CRED is just about paying credit card bills and earning points. But that’s just the bait. What CRED is really building is the most powerful gatekeeper for India’s top spenders. Phase 1: Acquire the Right Users CRED made itself exclusive—only for people with high credit scores. This did two things: filtered the top 1% and turned users into a tribe. Paying credit card bills became a ritual. And every interaction was data-rich—spend patterns, timing, frequency, lifestyle. Phase 2: Build Ecosystem Hooks Once trust was built, CRED layered on new plays. CRED Store = curated commerce for high-intent buyers. CRED RentPay = recurring use-case + float. CRED Travel = high-ticket use-case. CRED Mint = wealth trust layer. Each new feature isn’t random. It’s reverse-engineered from data. Phase 3: Monetize the Affluence Graph CRED doesn’t sell to the masses. It sells access to the few. Brands pay to get in front of CRED users. Financial products get distribution. And every swipe tells CRED what users want next. They aren’t chasing CAC. They’ve already won LTV. What’s the Real Product? It’s not cashback. It’s identity. It’s trust. It’s a profile of the most financially active Indians—what they buy, when they pay, how they move. CRED owns the behavior graph of India’s spenders. CRED’s Strategy Solve for status. Build rituals. Layer services. Own transaction touchpoints. Monetize attention. Key Takeaway - CRED isn’t in the rewards game. It’s quietly becoming India’s most influential fintech layer—without looking like a bank.

Replies (1)

More like this

Recommendations from Medial

Ayush

Let's build together... • 11m

CRED isn’t chasing mass users—it’s building a premium financial ecosystem. They are rapidly diversifying. With CRED Cash, CRED Pay, CRED Garage, CRED Escapes, CRED Mint, and CRED Money, is CRED on its way... So CRED gonna be the number 1 Indian s

See More

Satyam Kumar

Pocket says nil.. Mi... • 11m

CRED CRED is a members-only credit card bill payment platform that rewards its members for clearing their credit card bills on time. CRED members get access to exclusive rewards and experiences from premier brands upon clearing their credit card bil

See More

Ram Prasad Pokhrel

veer bhogya vasundha... • 1y

Hey everyone is there anyone who had knowledge of making crypto ecosystem like $notcoins $Tons $Dogs $blum $hamster and Who had knowledge of setuping a cloud system from scratch let's suppose start from 1TB of self made cloud infra which I can acce

See MoreVicky

Ask yourself the que... • 10m

Nvidia Isn’t Just Winning—It’s Redefining the Game What if I told you the most important company in the world right now might not be Apple, Amazon, or Google—but Nvidia? Once a niche GPU maker for gamers, Nvidia has now become the oxygen for AI. Fr

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)