Back

Vishu Bheda

•

Medial • 12m

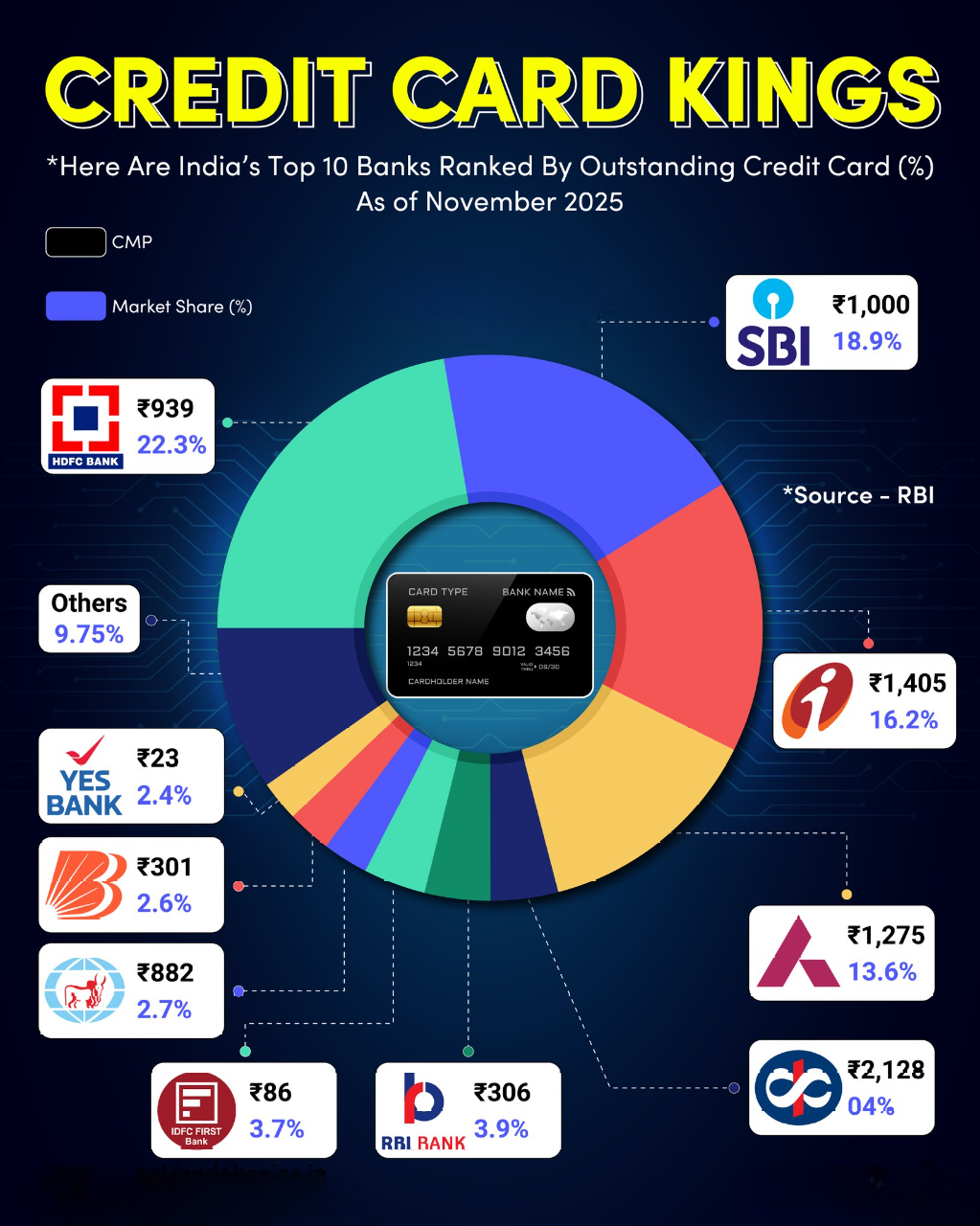

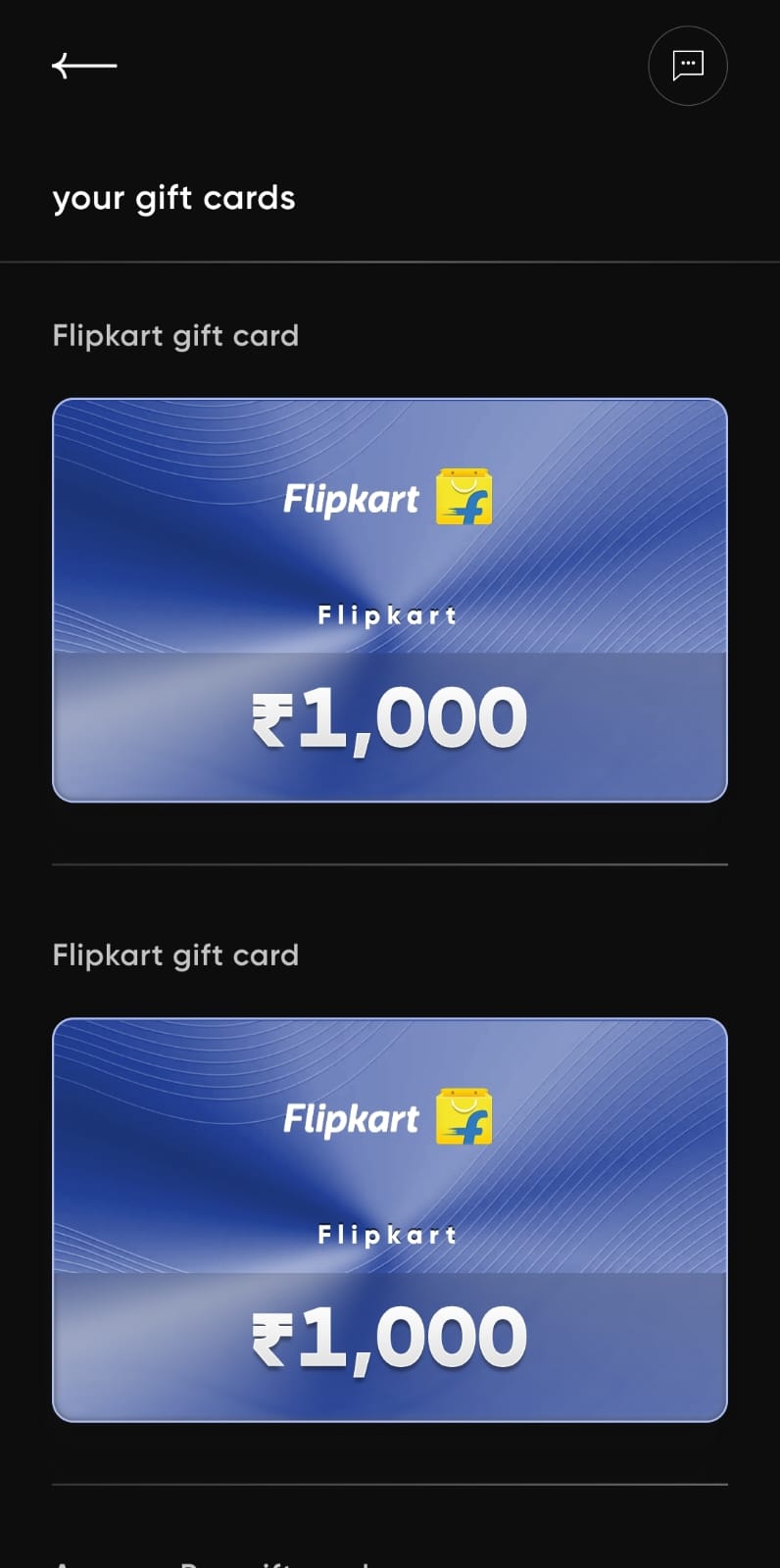

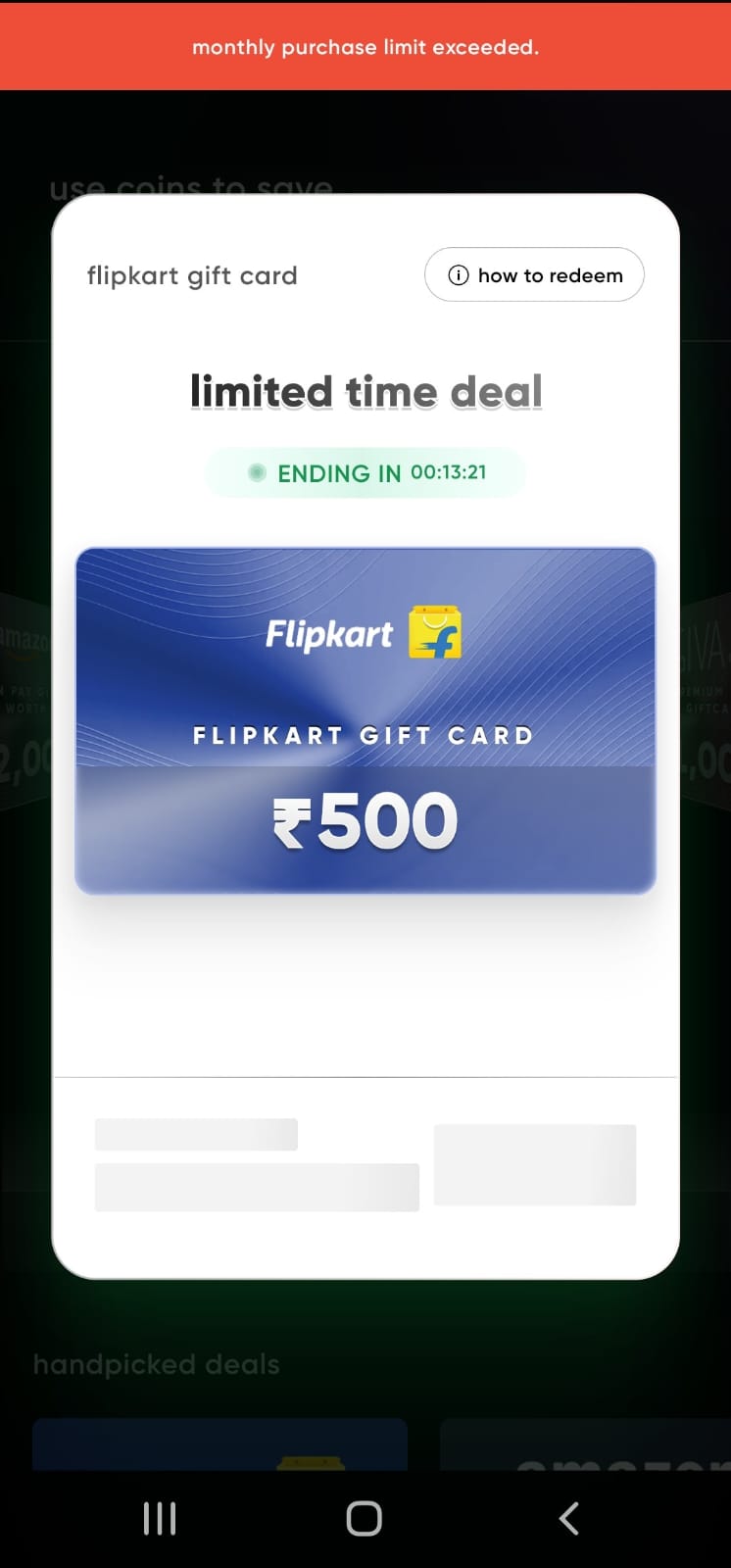

𝗗𝗮𝘆 𝟳 𝗼𝗳 𝗧𝗵𝗲 𝗜𝗻𝗱𝗶𝗮𝗻 𝗦𝘁𝗮𝗿𝘁𝘂𝗽 𝗪𝗮𝗿 𝗦𝘁𝗼𝗿𝗶𝗲𝘀: 𝗖𝗥𝗘𝗗 𝘃𝘀. 𝗧𝗿𝗮𝗱𝗶𝘁𝗶𝗼𝗻𝗮𝗹 𝗕𝗮𝗻𝗸𝘀 – 𝗧𝗵𝗲 𝗖𝗿𝗲𝗱𝗶𝘁 𝗖𝗮𝗿𝗱 𝗟𝗼𝘆𝗮𝗹𝘁𝘆 𝗪𝗮𝗿 𝟮𝟬𝟭𝟴 – 𝗔 𝗦𝘁𝗮𝗿𝘁𝘂𝗽 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲𝘀 𝗜𝗻𝗱𝗶𝗮’𝘀 𝗕𝗮𝗻𝗸𝗶𝗻𝗴 𝗚𝗶𝗮𝗻𝘁𝘀 For decades, India’s credit card industry was controlled by traditional banks—HDFC, ICICI, SBI, and Axis. They decided who got credit, how rewards worked, and what benefits customers received. But there was a major problem. Credit card rewards were confusing. Points were hard to redeem, cashback had conditions, and most users never fully utilized their benefits. That’s when Kunal Shah, the founder of FreeCharge, saw an opportunity. He asked a simple question: Why should banks have all the power over credit card users? With that thought, he launched CRED—a platform that rewarded users just for paying their credit card bills. At first, people didn’t understand it. But soon, it became one of India’s most talked-about startups. --- 𝗖𝗥𝗘𝗗 – 𝗧𝘂𝗿𝗻𝗶𝗻𝗴 𝗖𝗿𝗲𝗱𝗶𝘁 𝗣𝗮𝘆𝗺𝗲𝗻𝘁𝘀 𝗜𝗻𝘁𝗼 𝗮 𝗦𝘁𝗮𝘁𝘂𝘀 𝗦𝘆𝗺𝗯𝗼𝗹 CRED didn’t just make bill payments rewarding—it made them exclusive. Only high-credit-score individuals (750+) could join. Users earned CRED Coins for every rupee spent on bill payments. Coins unlocked discounts on top brands, premium experiences, and cashback offers. CRED wasn’t positioned as a fintech company. It was a luxury brand. For premium credit card users, it wasn’t just about payments—it was about status, rewards, and an elite experience. In just two years, CRED became the default app for India’s top credit card holders. But as CRED grew, banks started feeling the pressure. --- 𝗧𝗿𝗮𝗱𝗶𝘁𝗶𝗼𝗻𝗮𝗹 𝗕𝗮𝗻𝗸𝘀 𝗙𝗶𝗴𝗵𝘁 𝗕𝗮𝗰𝗸 At first, banks ignored CRED. But soon, millions of their most valuable customers were shifting to CRED for payments. That’s when banks started fighting back: HDFC, ICICI, and SBI revamped their loyalty programs. They launched better cashback and direct redemption options. They improved their mobile banking apps to compete. CRED had forced banks to modernize their digital experience. But there was one big question hanging over CRED’s future. --- 𝟮𝟬𝟮𝟭 – 𝗧𝗵𝗲 𝗠𝗼𝗻𝗲𝘁𝗶𝘇𝗮𝘁𝗶𝗼𝗻 𝗖𝗵𝗮𝗹𝗹𝗲𝗻𝗴𝗲 For years, critics asked: How does CRED make money? It wasn’t charging users. It wasn’t issuing credit cards. It was spending millions on rewards and IPL sponsorships. Was CRED just burning investor money without a sustainable plan? Then, in 2021, CRED revealed its real strategy—monetization through lending and payments. CRED Cash: Instant loans for high-credit users. CRED Pay: A UPI-based payment gateway. CRED Mint: Peer-to-peer lending with high returns. With these moves, CRED stepped directly into the banks’ territory. --- 𝟮𝟬𝟮𝟰 – 𝗪𝗵𝗼’𝘀 𝗪𝗶𝗻𝗻𝗶𝗻𝗴 𝘁𝗵𝗲 𝗪𝗮𝗿? CRED dominates the premium credit card market. Traditional banks are still strong but struggling to match CRED’s user experience. CRED is growing fast, but its profitability remains a challenge. The real war isn’t over—it’s just changing. As India’s fintech revolution accelerates, the battle between CRED and traditional banks is only getting more intense. Will CRED replace banks in the credit card ecosystem? Or will banks fight back harder? The next few years will decide. --- This was just Day 7. Tomorrow, we uncover Nykaa vs. Myntra – The Battle for India’s Fashion & Beauty Empire. Follow Vishu Bheda now—because the battles are only getting bigger.

Replies (4)

More like this

Recommendations from Medial

Satyam Kumar

Pocket says nil.. Mi... • 10m

CRED CRED is a members-only credit card bill payment platform that rewards its members for clearing their credit card bills on time. CRED members get access to exclusive rewards and experiences from premier brands upon clearing their credit card bil

See More

Aatif dehalvi

Hey I am on Medial • 11m

Business Idea: Enabling Credit Card Discounts and Cashback for Non-Credit Card Users In today’s digital shopping era, e-commerce platforms like Flipkart, Amazon, and others frequently offer discounts and cashback deals, especially for customers using

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)