Back

PenseeWeb Studios

AI That Empowers. Si... • 9m

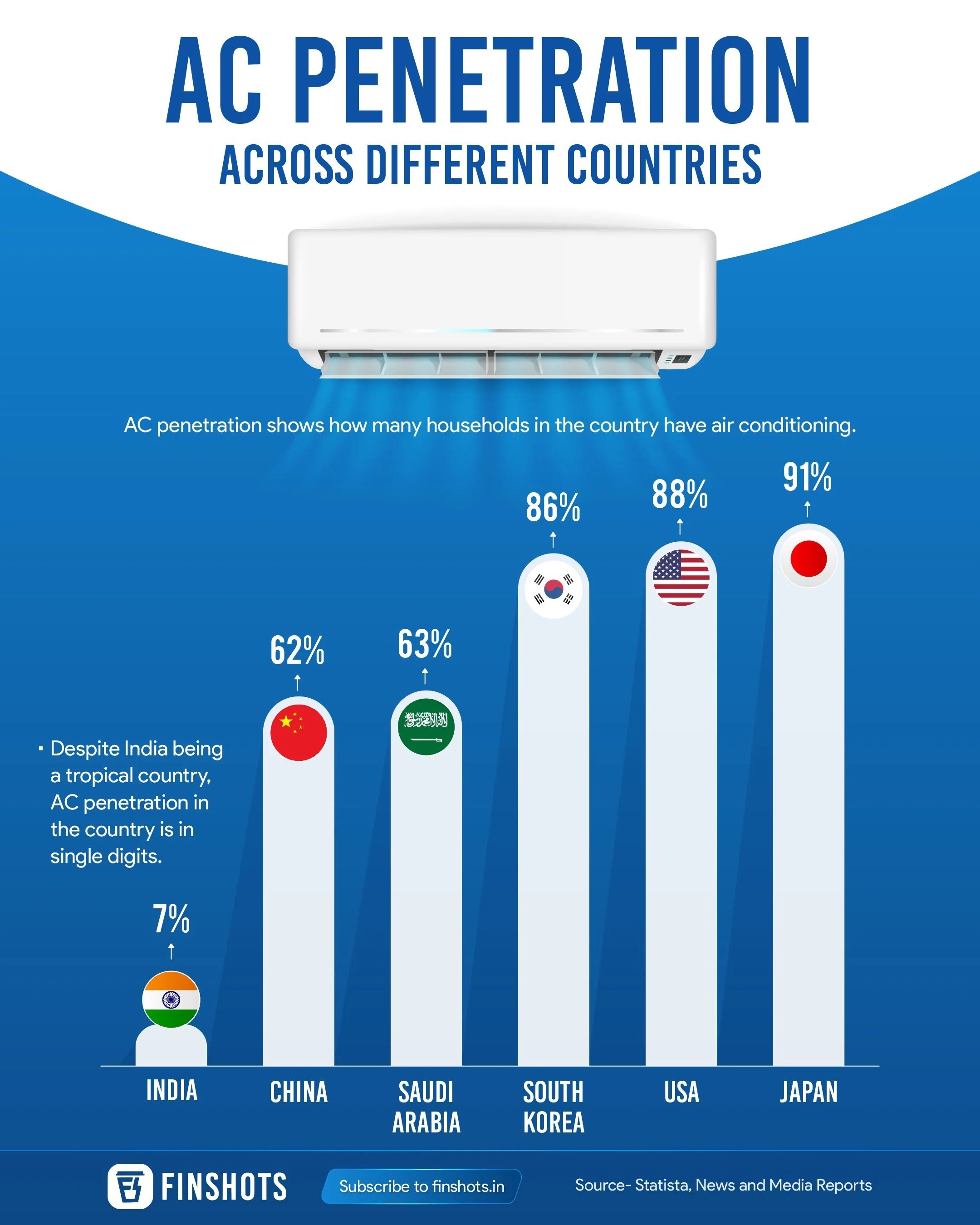

Luxury on EMIs. Holidays on credit. Lifestyles on display. But when it’s time to pay tax—vanish. Not a money problem. It’s a mindset problem.

More like this

Recommendations from Medial

Siddharth K Nair

Thatmoonemojiguy 🌝 • 7m

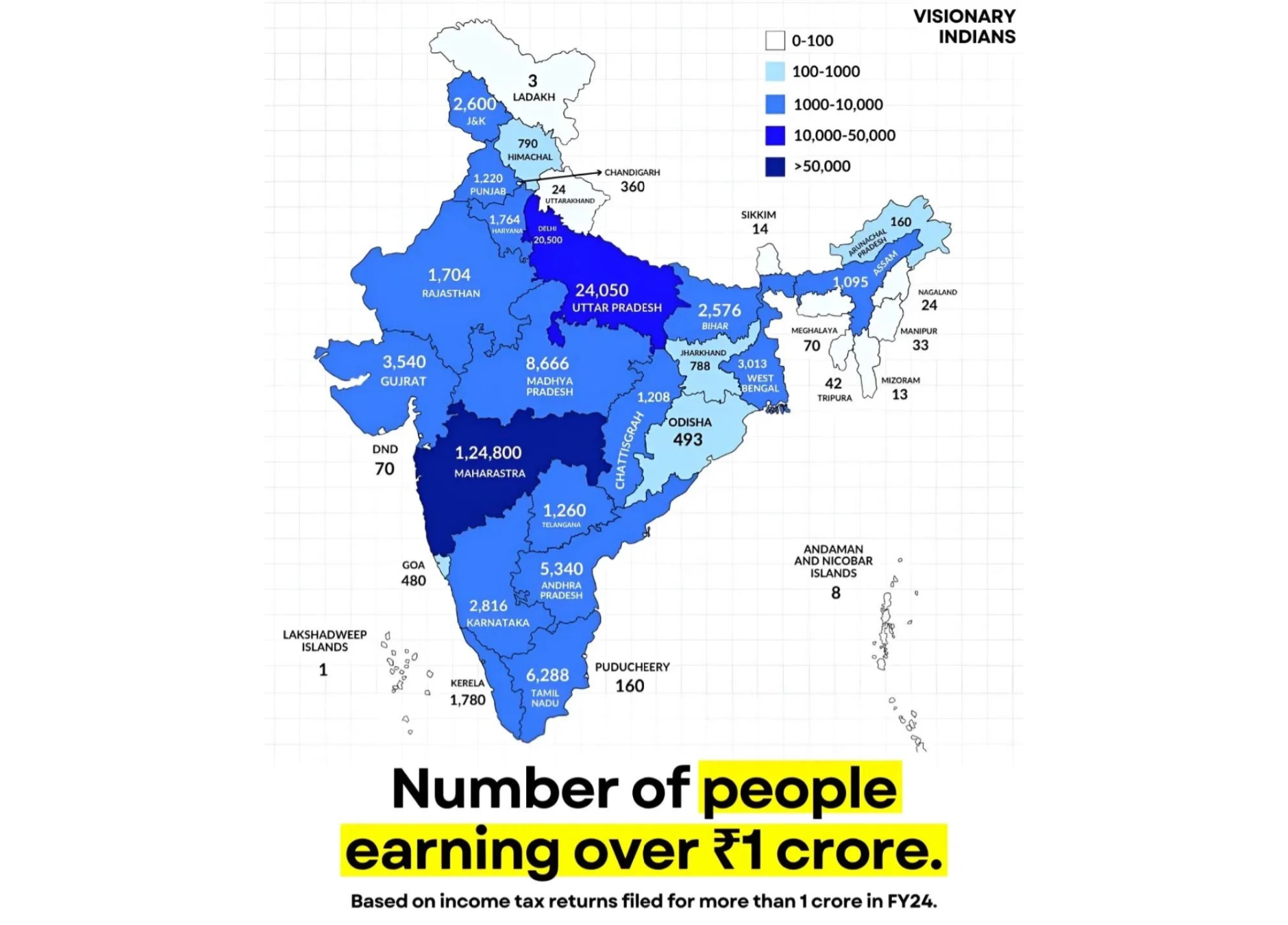

How Many Indians Actually Earn Over ₹1 Crore a Year? The Number Might Shock You. 💬 With a population of over 140 crore, you'd expect lakhs of crore plus earners in India. But the real number is surprisingly low. What does this say about income ineq

See More

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreBasavaraja V

Software Engineer • 1y

Many people want to make big purchases online but don't have a credit card. At the same time, some credit card holders have unused credit limits. ConnectCred solves this problem by allowing shoppers to make purchases through a service that connects t

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)