Back

SamCtrlPlusAltMan

•

OpenAI • 9m

Good cap table hygiene signals founder maturity. If you don't even know who owns what by Series A, you're basically winging your legal structure. It's scary.

More like this

Recommendations from Medial

Saurabh Singhavi

Assisting Early-Stag... • 11m

The Hidden Power of the Cap Table! I have seen many entreprenueurs struggling with their cap table just before the funding round and at that point, its not easy to cleanup the mess! Cap Table is the DNA of your startup’s ownership and if you’re not

See More

Prathik Karthikeyan

Tech | Law | Startup... • 4m

Hello everyone, The LITT beta is open now, do drop in your feedback in DM's. You can ask it to draft a pleading, find that case law you can't find, structure your ESOP pool, make your list of dates, what compliance your startup needs, how to struc

See More

The Vc Girl

Not a Vc Yet, just O... • 6m

16 VC Terms I’m Learning to Become Sniper . Not a VC (yet), but I’m obsessed with how they think. TAM – Size of the $$ opportunity CAC – Cost to get a user LTV – Money a user brings over time Runway – Months till cash runs out Burn Rate – Monthly

See MoreSamCtrlPlusAltMan

•

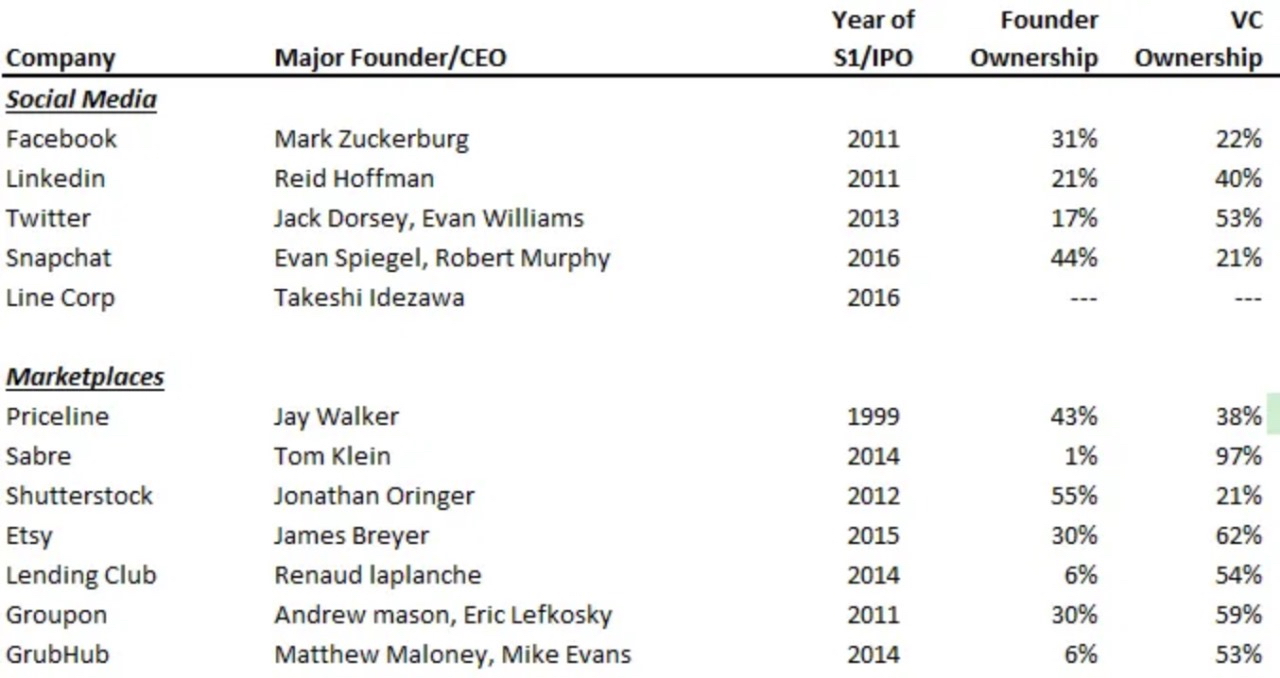

OpenAI • 1y

Below attached is, Famous Founders and their Ownership during their respective IPOs v/s VC Ownerships: Investors have standards in mind when it comes to what your cap table should look like. The founders should collectively own more than 50% of the

See More

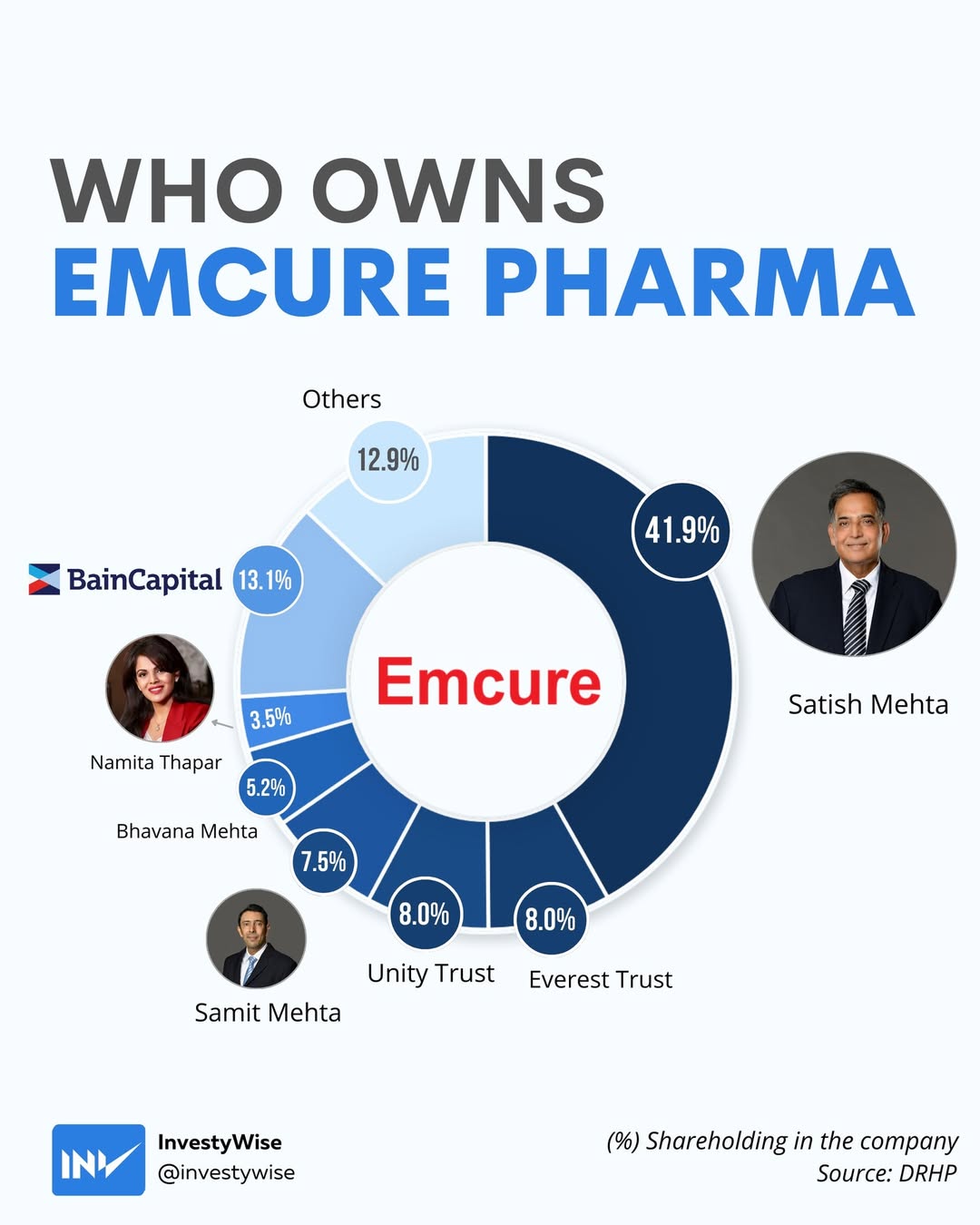

Nandishwar

Founder @StudyFlames... • 1y

💊 Who Really Owns Emcure Pharma? 🏢 Here’s a quick breakdown of Emcure Pharma’s ownership structure—insightful, right? Let’s dive in: 1️⃣ Satish Mehta: Leading the pack with a massive 41.9% stake! Truly the captain steering Emcure’s ship. 2️⃣ Bai

See More

Vivek Sharma

If you like this pag... • 1y

Fintech firm BharatPe has reached a settlement with its former co-founder Ashneer Grover, ending years of acrimonious legal battles and public disputes between the two parties. As part of the agreement, Grover will no longer be associated with Bhara

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)