Back

Saket Sambhav

•

ADJUVA LEGAL® • 9m

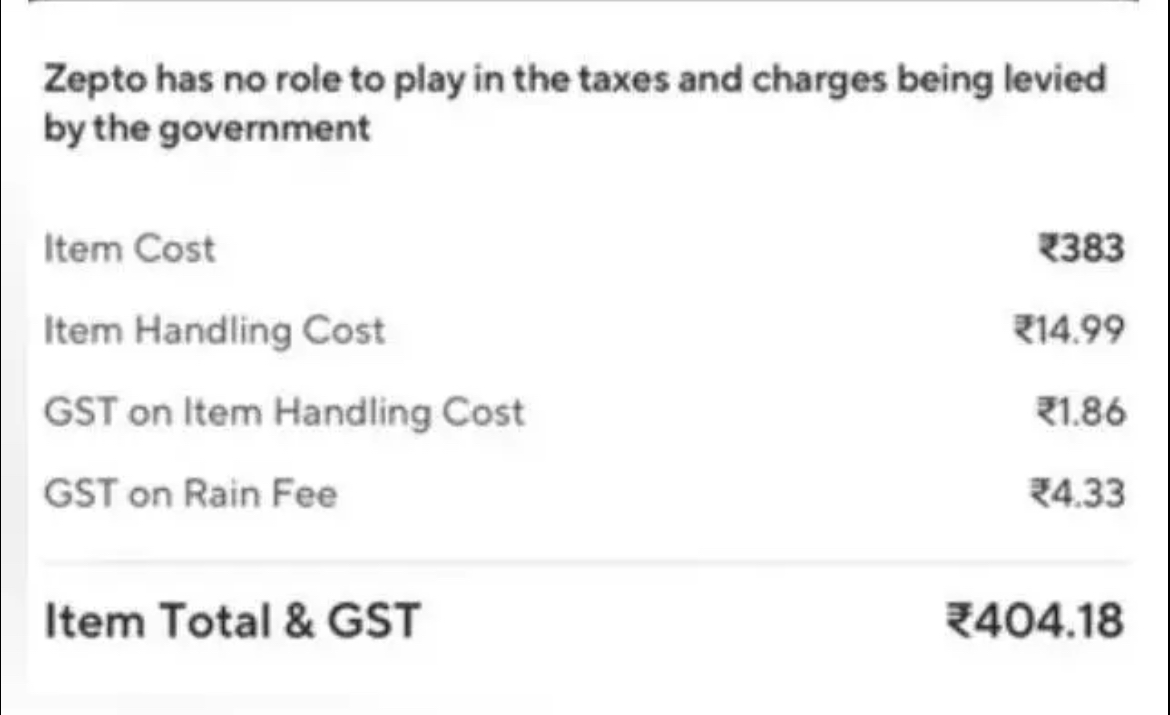

Rain rain go away... Else, we would have a tax to pay... 😂

2 Replies

2

Replies (2)

More like this

Recommendations from Medial

Rishi Chavan

Inquisitive • 11m

How ethically and morally correct do you consider yourself? Suppose while walking you see a food stall which has a massive crowd around just to eat the famous VadaPav or your favourite snack for ₹15. You also get tempted and decide to have one. You

See More12 Replies

1

15

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)