Back

Dr Sarun George Sunny

The Way I See It • 9m

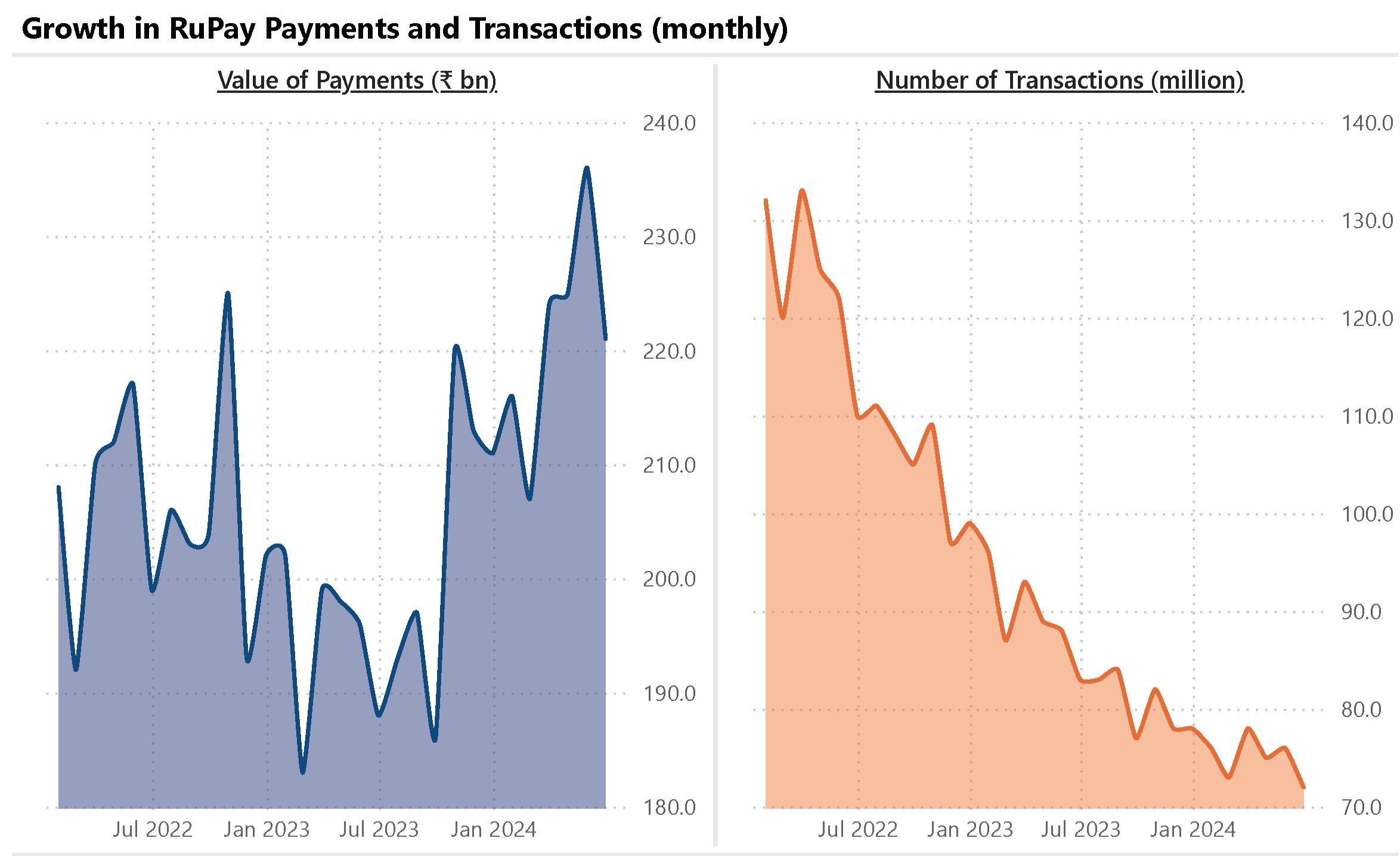

It's mixed bag for the Indian economy.On the positive side, it reflects rising consumer confidence, increasing digital adoption, and stronger demand ,which can fuel GDP growth, retail expansion, and financial sector development. But on the flip side, if this growth is driven more by borrowing than income growth, it could signal rising household debt and potential defaults later on which will ruin everything In short: great for economic growth , but needs healthy financial discipline to stay sustainable.

More like this

Recommendations from Medial

Anubhab Mohanty

Strategic Vision. Me... • 2m

Jaipur’s granite industry is booming — factories expanding, markets pulling huge demand, exports rising. But on-ground? Cash-only demands, extra charges, mixed commitments… Big growth. Bigger gaps. The industry has potential, but trust needs to catc

See More

Akshat kumar Jain

Front end developmen... • 1y

Indian household debt has skyrocketed, reaching Rs 120 trillion in March 2024, a 56% increase since June 2021. This has pushed the debt-to-GDP ratio to 42.9%, raising concerns about consumer spending. With housing loans comprising 30% and vehicle

See MoreKarnivesh

Simplifying finance.... • 2m

When I started analysing the Media & Entertainment industry, I expected a simple growth story driven by OTT and digital consumption. What I found instead was a much more layered picture. Yes, the industry is expanding fast. But beneath that growth l

See MoreRosa

Marketer & Storytell... • 5m

The year 2025 has delivered a reality check for India’s startup ecosystem. On one side, there are success stories of unicorns, IPOs, and innovation-led growth. On the other, a rising wave of closures has shown how fragile many ventures remain. After

See MoreDhandho Marwadi

Welcome to the possi... • 10m

📊 HDFC Securities FY25 Performance Analysis A) Strong Growth Across Core Metrics Operating Revenue jumped 23% YoY to ₹3,264 Cr (vs ₹2,660 Cr in FY24), reflecting a robust uptick in broking, distribution, and retail activity. Operating Profit rose

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)