Back

VCGuy

Believe me, it’s not... • 9m

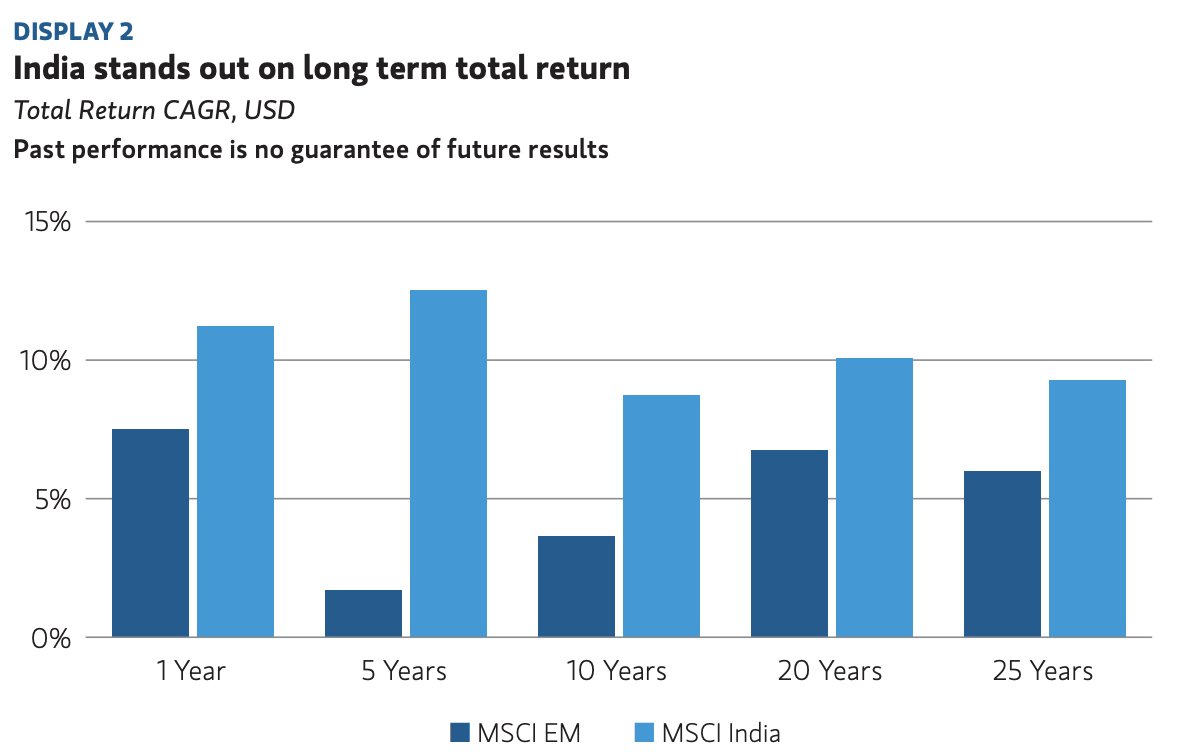

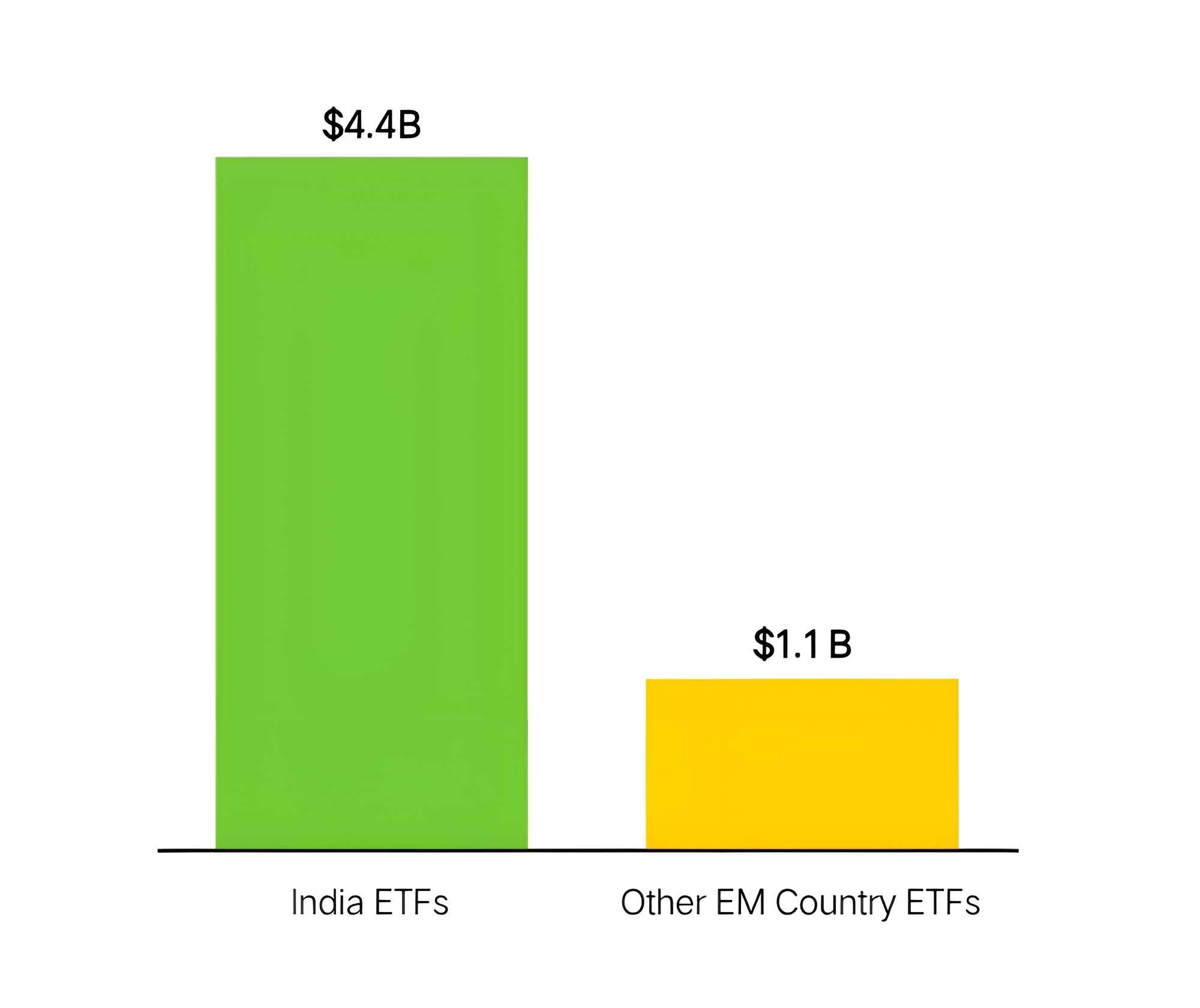

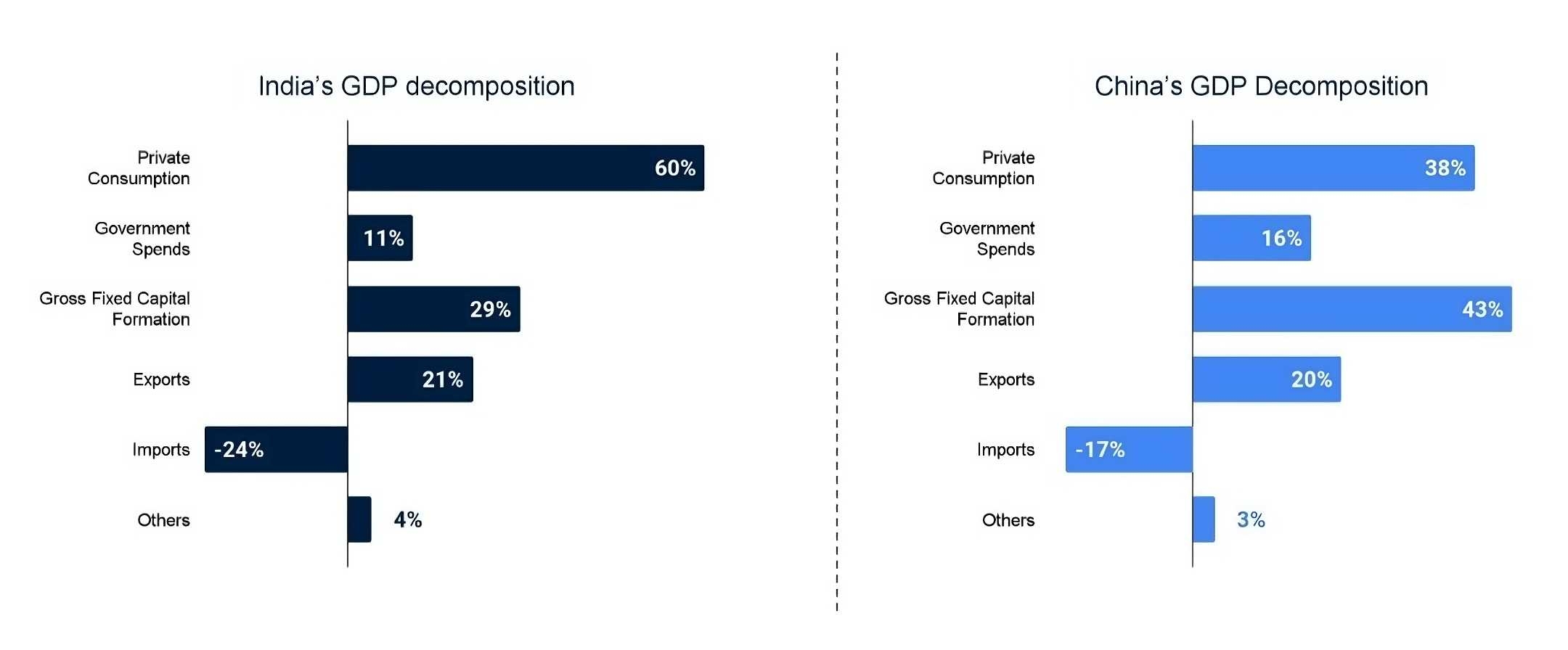

- Contributes 3.5% of global GDP but makes up only 1.9% of MSCI ACWI index (tracks large and mid-cap stocks across 23 developed and 24 emerging markets) → Notably, ~10% of the world's high-quality companies are from India (15%+ ROIC & revenue CAGR) [Massively underrepresented compared to potential] India has consistently beaten MSCI Emerging Markets Index ⤵️ 🧠 Infrastructure developed over the past 10 years is now paying off- - Aadhaar: 1.3B biometric IDs - UPI: 60% of GDP flows through it - 500M new bank accounts since 2014 - Mutual fund SIPs: $25B/yr - Corporate taxes cut from 35% → 25% (2019) 🌐GDP to more than double - - India’s nominal GDP forecast: → $3.5T (2022) → $8.1T (2032) 📈 Where’s the alpha? - Retail credit/GDP is just 42%, much lesser compared to global avg. - Report suggests that premium consumers, mainly middle class earning >$8,000 will double by 2031 I was surprised to learn →Food delivery is still at ~10% penetration. All room for growth📈 ⏭️India is where the U.S. was in 1980 — GDP grew ~7.6%, PCE(personal consumption exp.) ~8.1%, which led the S&P 500 to a 12.6% CAGR. India could follow a similar growth path this decade.

More like this

Recommendations from Medial

Poosarla Sai Karthik

Tech guy with a busi... • 7m

The nail polish segment was valued at $16.2 billion in 2023 and is projected to expand to roughly $25.8 billion by 2030- a solid CAGR of ~6.9%. Whereas others estimate the range at $15–16 billion in 2024 and forecast up to $30 billion+ by 2032–2034

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)