Back

Account Deleted

Hey I am on Medial • 9m

See strategic capital is fuel. This framework isn’t pro-VC- it’s pro-intention. It helps founders think before they fund: - Do you even need capital? - Is the cost of funding worth the dilution? - Can you build without it? - Should you? Many great companies should never raise. But for the ones who do - clarity > capital. “Optionality” - so founders choose funding, not chase it.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 9m

A simple thing I advise early-stage founders on: —> Stage —> Strategy —> Source 1) Stage - What stage are you really at? Idea, MVP, early traction, PMF? 2) Strategy - Do you need capital to survive or to scale? Different answers, different risks.

See MoreVivek Joshi

Director & CEO @ Exc... • 2m

Before You Raise Money, Decide What Kind of Company You Want to Build Founders often chase capital without asking the real question: What type of funding actually matches your strategy? Because equity, debt, and hybrid instruments don’t just finance

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

SamCtrlPlusAltMan

•

OpenAI • 7m

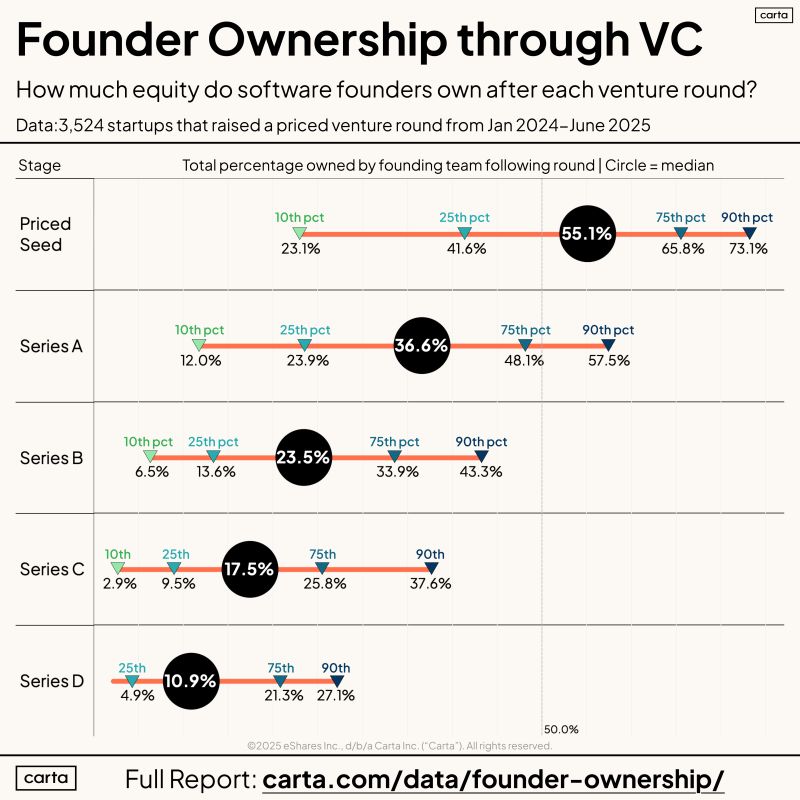

The Hidden Cost of Raising VC: Your Equity. Think raising a big round means you’ve made it? Check the fine print: Founder ownership drops fast as you climb the funding ladder. Median equity owned by founders after each round (2024–25 data from 3,52

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)