Back

Rohan Saha

Founder - Burn Inves... • 10m

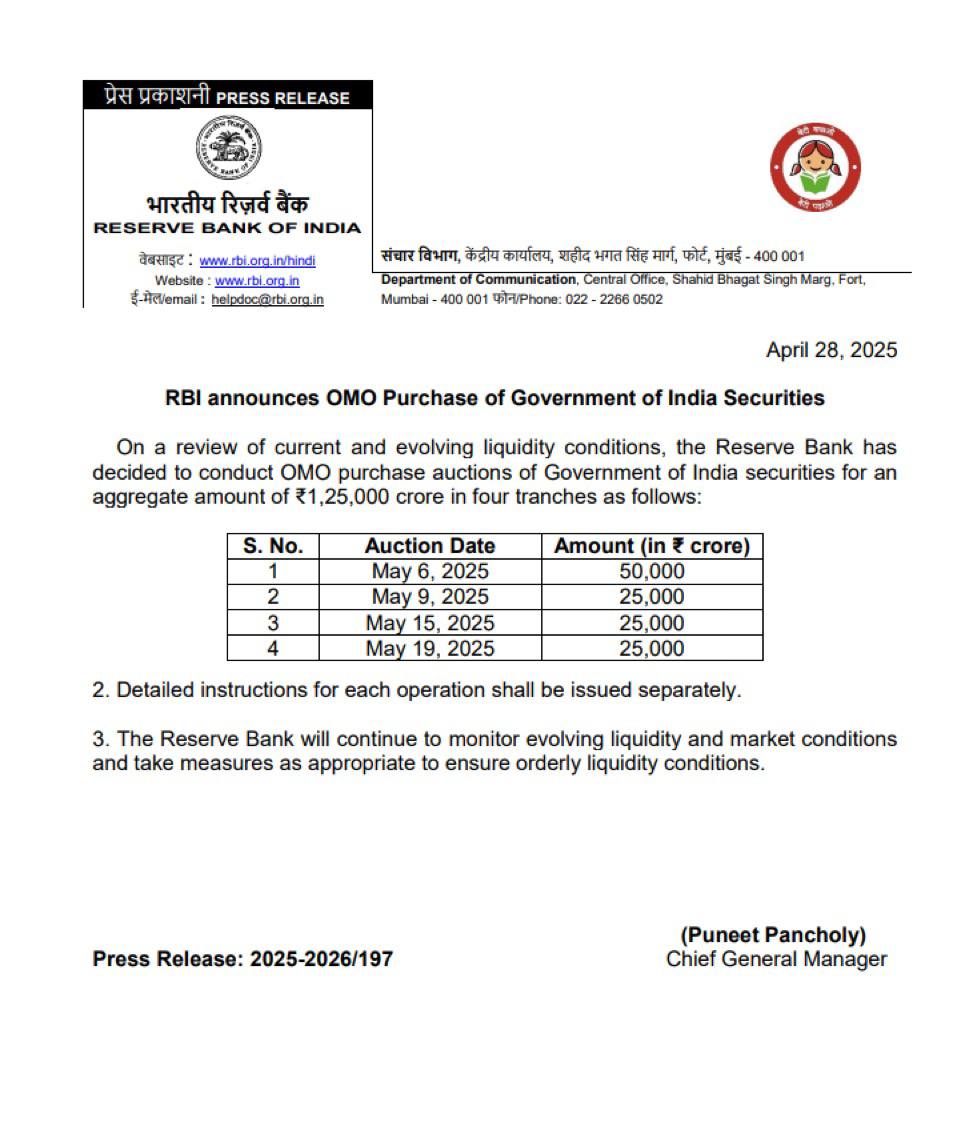

RBI GOVERMENT BONDS buy bank kar raha hai banks se taki liquidity bade or banks jada loans de paye

More like this

Recommendations from Medial

Ansh Kadam

Founder & CEO at Bui... • 1y

How does RBI earn money ? & why the RBI is more of a banker than a regulator. Last year, the RBI transferred over ₹87,000 Crore to the government, and it's expected to surpass ₹1,00,000 Crore in FY 2025. But how does the RBI generate this enormous

See More

Priyant Dhrangdhariya

Head of Finance @ Th... • 1y

India’s Gold Loan Market: A Glittering Opportunity The Sparkling Growth: Bajaj Finserv Ltd., a diversified NBFC, predicts India’s gold loan market—valued at $55.52 billion in 2022—will soar to $124.45 billion by 2029. A 12.22% annual growth fuels t

See MoreRabbul Hussain

Pursuing CMA. Talks... • 1y

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points to 6.25%, the first rate cut in nearly five years. What is the repo rate? It’s the rate at which the RBI lends money to commercial banks. A lower repo rate means cheaper loans

See MorePoosarla Sai Karthik

Tech guy with a busi... • 3m

RBI Hints at a Rate Cut: RBI Governor Sanjay Malhotra says there’s room to cut the repo rate as inflation cools and the data lines up. Many expect a 25 bps cut in December. Let’s break down what this actually means on the ground. Lending and Banki

See MoreTushar Aher Patil

Trying to do better • 1y

Day 4 About Basic Finance Concepts Here's Some New Concepts Financial Markets and Institutions Stock Markets: Where shares of publicly traded companies are bought and sold (e.g., New York Stock Exchange) Bond Markets: Markets where debt securitie

See More

Pranjal Majumdar

Hey I am on Medial • 1y

"Big Changes in Credit Score Rules by RBI – Here’s How It Affects You!" Starting January 1, 2025, the RBI has introduced new rules that will make credit score updates faster and more accurate. Here’s what you need to know: ✅ Credit Score Updates Ev

See MoreRohan Saha

Founder - Burn Inves... • 8m

The Rise Of NeoBanks - Back in 2015-16 India had a massive fintech moment thanks to neobanks but no one really talks about it now. It is like that chapter in our digital journey that just got skipped. Freo was the first to introduce neobanks in In

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)