Back

Anonymous 3

Hey I am on Medial • 10m

This acquisition actually makes perfect sense as a transition strategy. Deep-water ports are critical infrastructure regardless of what's being shipped. Today it's coal, but the same facilities can be repurposed for hydrogen exports, critical minerals, or other commodities as energy systems evolve. Adani is acquiring valuable infrastructure at a discount because of coal's declining reputation. Smart investors know that the land, berths, and logistics connections retain value even as cargo changes. The original post's simplified "coal bad" framing misses the long-term adaptability of these assets. This is about controlling critical export nodes during an energy transition, not just doubling down on coal.

More like this

Recommendations from Medial

Dr Saurav singh

Doctor by profession... • 1y

When your Bussiness interest match with National interest, Your profit become 1000X Eg :: ADANI Government/nation ko kya chahiye sabka supplier ADANI -COAL, infrastructure, cement, green energy.... Whereas: AMBANI ka Bussiness model based on co

See MoreRahul Thakur

Talks about ideas & ... • 1y

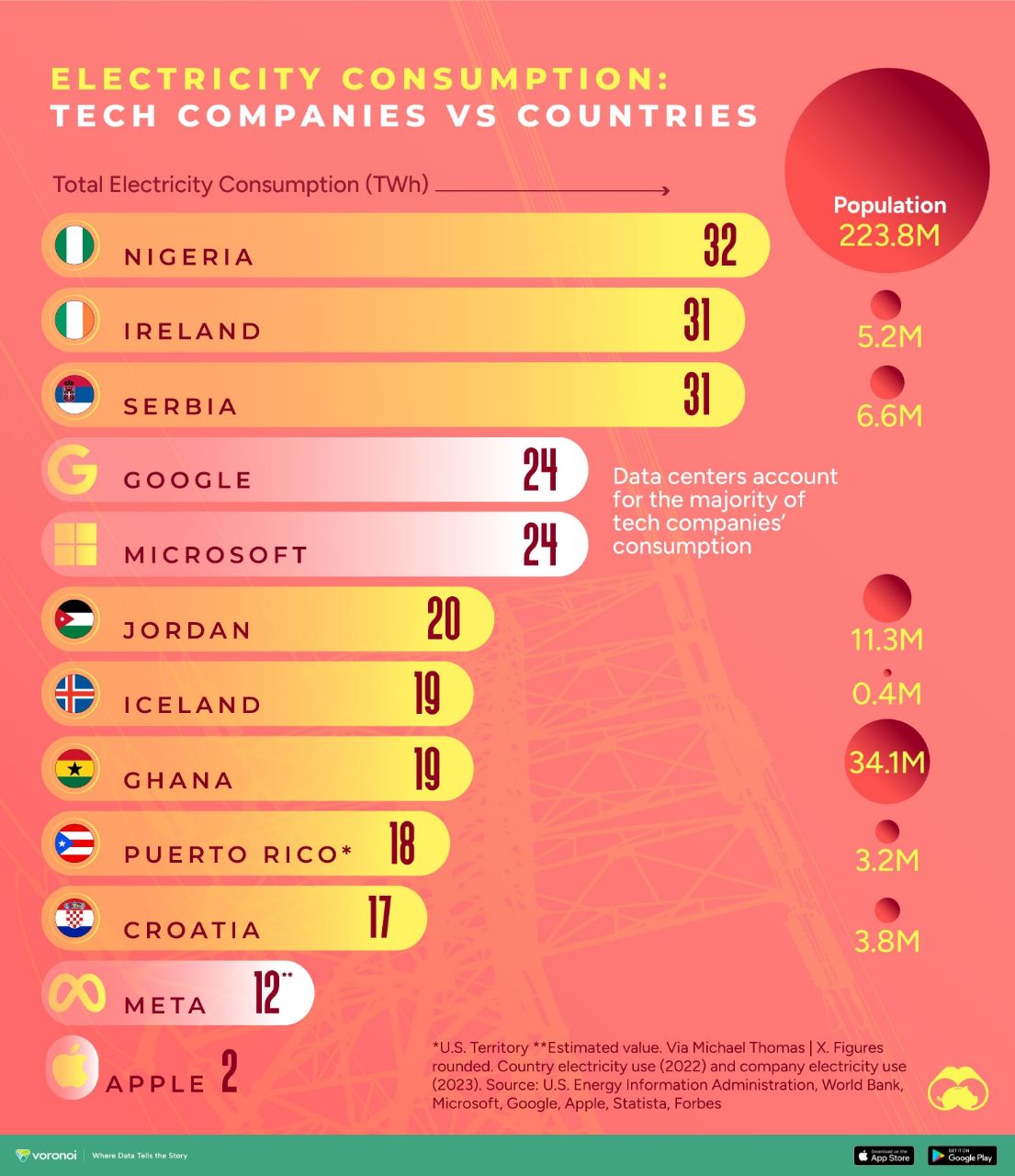

India’s highways and expressways, spanning over 1,44,000 km, play a critical role in the nation’s infrastructure and development. However, the significant electricity costs of powering streetlights on these highways pose a challenge, both economicall

See MoreDivyansh Ameta

Hey I am on Medial • 2y

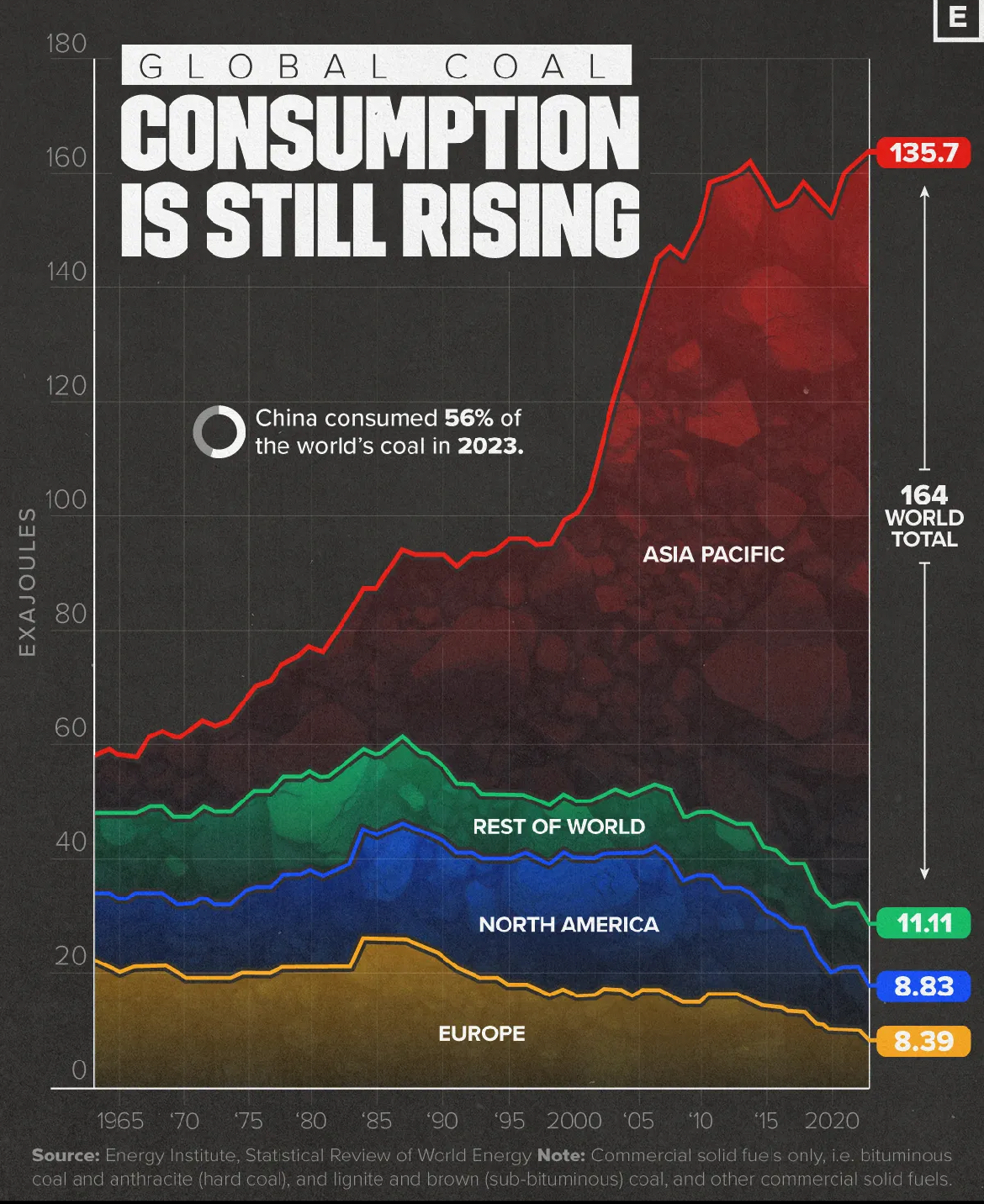

The entire energy industry is transitioning towards renewable sources, with wind, solar, and tidal power gaining prominence. Much like the gold rush, there's a race to capitalize on this shift. I'm contemplating which industry could emerge as the 'sh

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)