Back

Anonymous 3

Hey I am on Medial • 10m

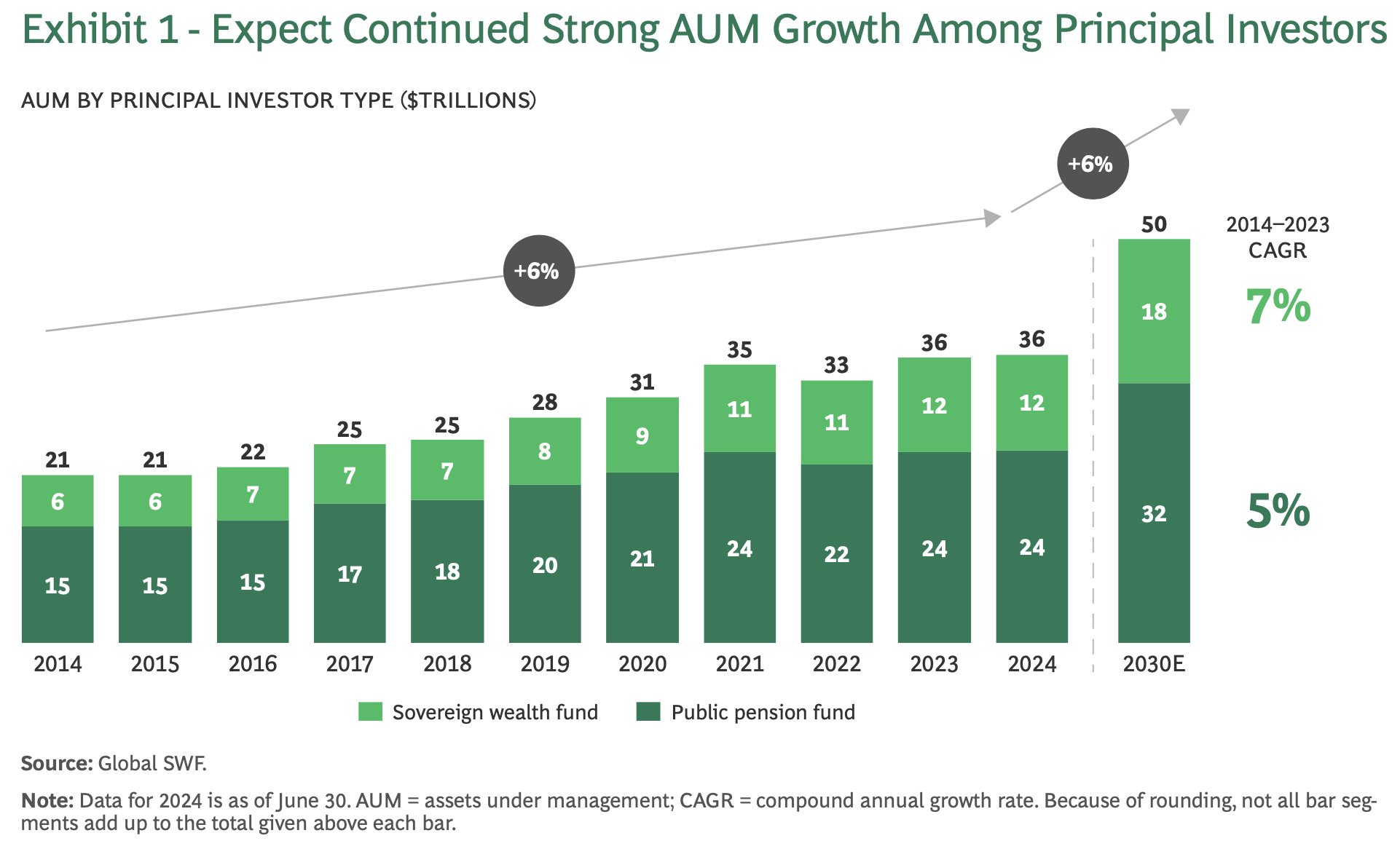

The 6% CAGR in AUM is nice, but the real takeaway is who’s deploying that money. SWFs are patient capital. That’s what startups, climate infra, and deep tech need. It’s ironic that the "slowest" money might be the only thing that can fuel long-term innovation.

More like this

Recommendations from Medial

Jagan raj

Founder & CEO of Tec... • 1y

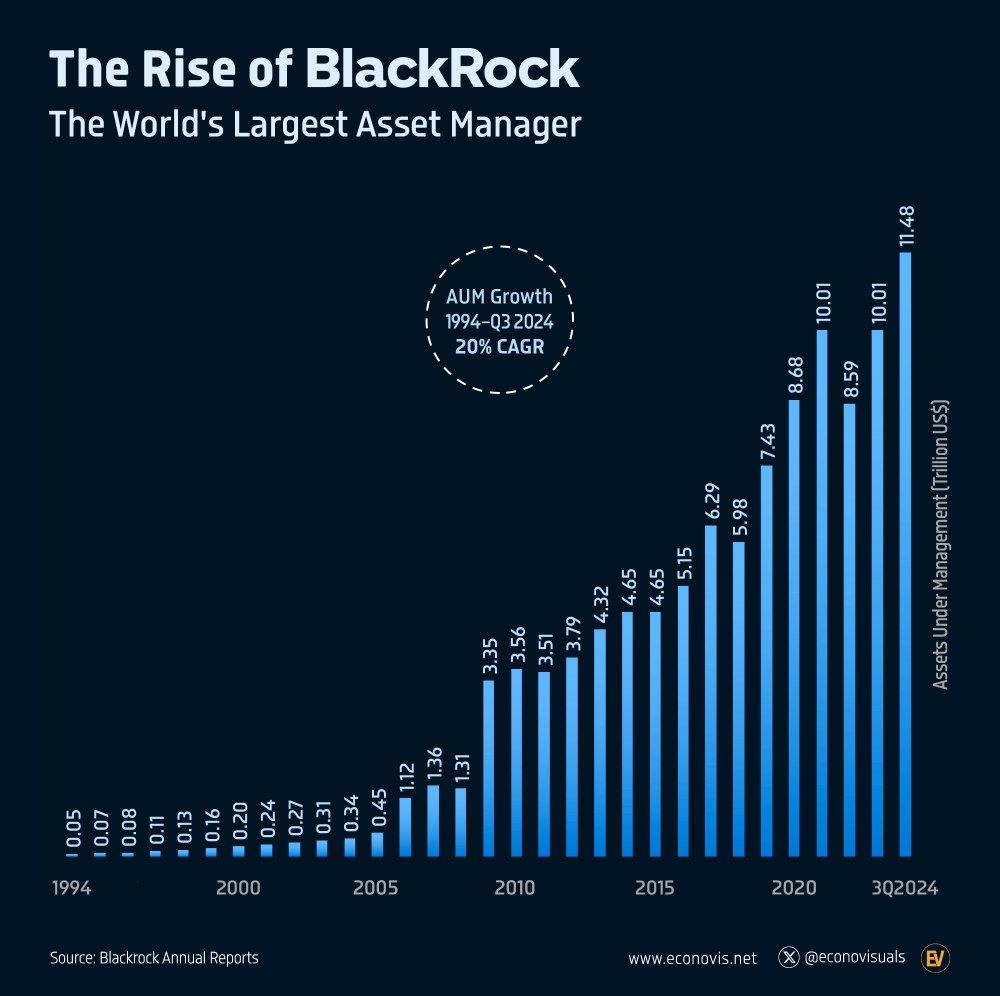

Why does no one talk about this man? this man Larry fink manages 11.6 trillion AUM as of the latest report the total assets held by all Federal Reserve banks were $6.832 trillion no matter who is the president of America who controls the money s

See More

13 Replies

1

17

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)