Back

Shan Trades

I am full time trade... • 10m

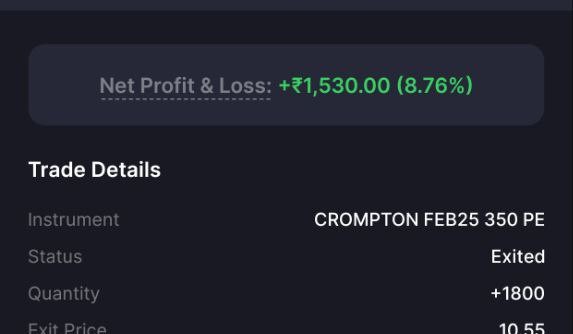

📈 1️⃣ Liquidity Concepts: 🔵 Buy-Side Liquidity (BSL): The market took out buy stops before reversing sharply. 🔴 Sell-Side Liquidity (SSL): Marked as the target where price is expected to reach. 📍 Market Structure Shift (MSS): • A key bearish reversal occurred after liquidity was taken at the top. • This shift signals that Smart Money has engineered liquidity and is now driving price lower. 📉 2️⃣ Entry & Order Blocks: • Institutional Order Flow Entry Drill (IOFED) is marked in the red zone, where price reacts before moving lower. • Order Block (OB Open): This was a high-probability entry for shorts. • Optimal Trade Entry (OTE): The best discount for smart money to enter short. 📊 3️⃣ Fair Value Gaps (FVG): • Multiple FVGs (blue zones) acted as resistance, confirming bearish momentum. • Price filled inefficiencies before continuing lower. 🛑 4️⃣ Final Target: Sell-Side Liquidity (SSL) • Price aggressively moved down, seeking the next liquidity pool. • This aligns with ICT’s model of liquidity engineering—grabbing buy stops, shifting structure, then running sell stops. 🚀 Classic ICT Setup Breakdown: ✅ BSL taken → MSS → IOFED/OB Entry → FVG confirmation → SSL Target hit

Replies (3)

More like this

Recommendations from Medial

Rajan Paswan

Building for idea gu... • 1y

We've covered dilation and the Board of Directors(BOD). Now, let's delve into Tag-Along Rights—An Essential Topic Imagine your startup takes off! A major player wants to buy the company, and your majority shareholder is ready to cash in. But what ab

See MorePulakit Bararia

Founder Snippetz Lab... • 6m

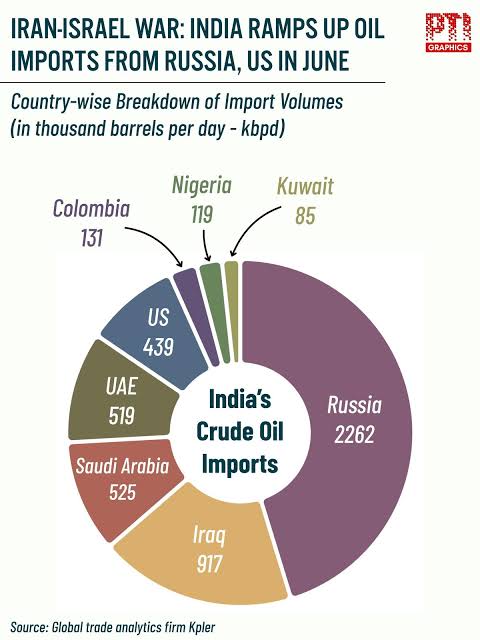

India currently imports 40% of its crude oil from Russia — around 2 million barrels a day — and it comes at a discounted price, $2–$5 cheaper than global rates. But what if that stops? The economic cost alone would be massive. India would end up s

See More

Aditya Arora

•

Faad Network • 5m

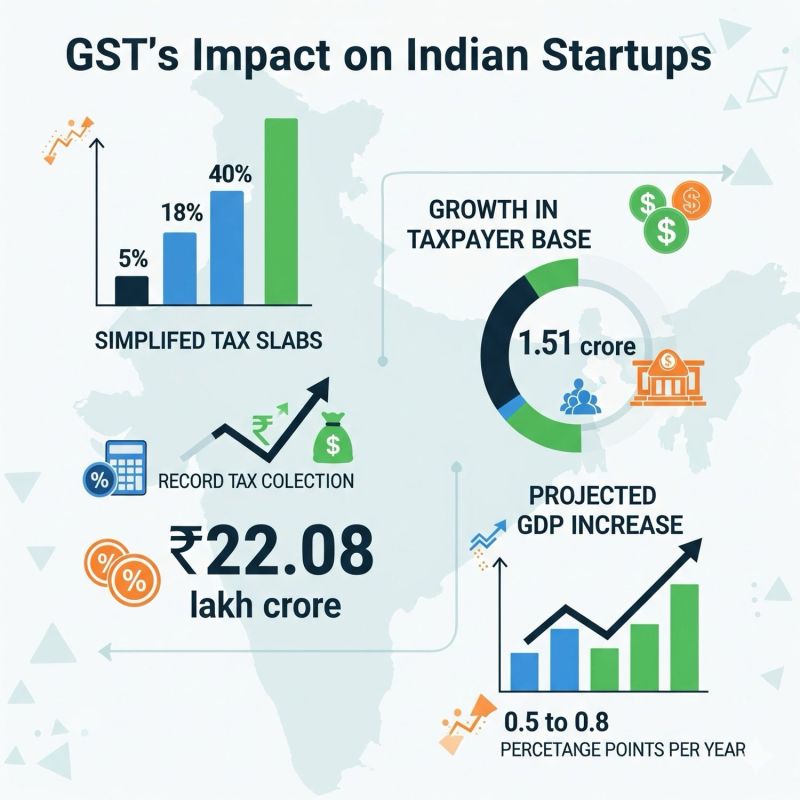

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)