Back

Sudeeptha S

Hey I am on Medial • 1y

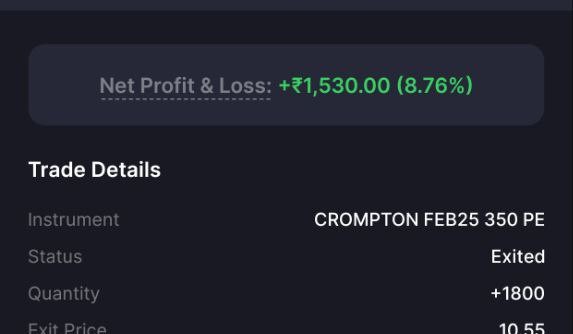

Trading Success Story: Crompton Options Trade Analysis On February 7, 2025, a compelling bearish pattern began forming in Crompton Greaves, signaling a potential opportunity for a well-executed options trade. Utilizing a strategic technical analysis approach, identified this as a high-probability setup. Let’s break down the execution and outcomes. Stock: Crompton Trade Type: Options (Put - 350 Strike Price) Instrument: CROMPTON FEB25 350 PE Entry Price: ₹9.70 Exit Price: ₹10.55 Quantity: 1,800 contracts Margin Used: ₹17,460 Net Profit: ₹1,530 (+8.76%) Market Movement: As predicted, Crompton’s stock declined, causing the put option’s value to rise. The futures chart confirmed the downward momentum, and my strategy delivered solid results. This trade underscores the importance of precision timing and disciplined execution. Technical Analysis Works: Spotting trends early leads to profitable trades. Timely Execution is Key: Entering at the right time and exiting with discipline ensures consistent success. This trade is just one of many! The market is full of opportunities, and I'm constantly scanning for the next big move. Will you be ready for the next setup? Stay tuned—I have another exciting trade set up coming up soon for February 11th 2025! Would love to hear your thoughts—comment below and let’s discuss! 👇

More like this

Recommendations from Medial

Linkrcap Studio

A digital news platf... • 18d

At the upper end of the price band, the IPO values the company at about INR 15,480 Cr (about $1.7 Bn). Anchor bidding for the issue will take place on Friday (February 6), while the IPO will close on Wednesday (February 11). The company filed its r

See More

Deepanshu Yadav

https://tradejournal... • 3m

Trade journal ai uses pattern recognition to reveal your true winning strategy. Your spreadsheet can't do this. Unlock AI-powered risk assessment and position sizing recommendations instantly. The future of trade analysis is here. https://tradejo

See More

VIJAY PANJWANI

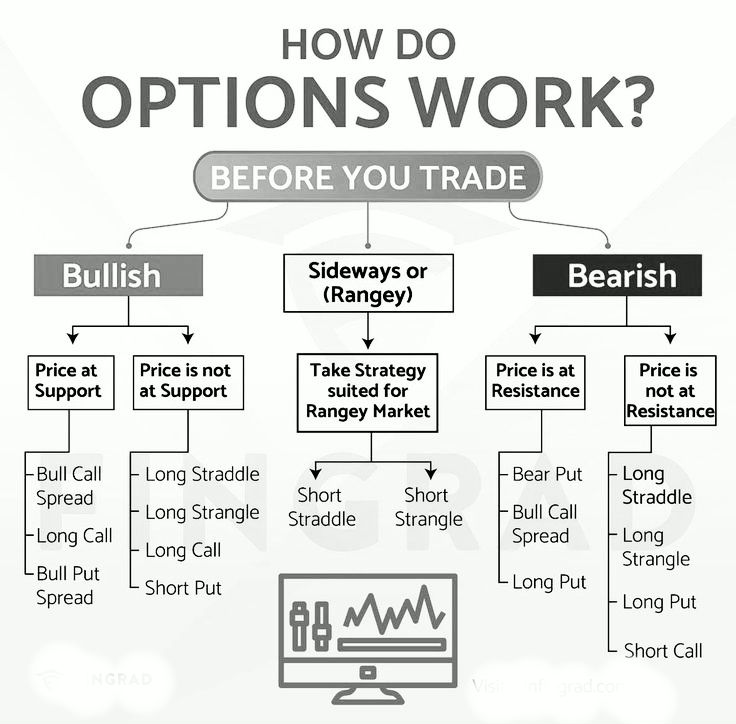

Learning is a key to... • 4m

Confused about Options Trading? Here’s a simple visual guide to help you choose the right options strategy before you trade! 🔥 Bullish? Bearish? Or Range-bound? Know exactly when to use: 👉 Bull Call / Bear Put Spread 👉 Long Straddle / Strangle

See More

Sudeeptha S

Hey I am on Medial • 1y

When No Trade Is the Best Trade ! As traders, we often emphasize execution—finding the right stock, the right setup, and the perfect entry. But what happens when the market moves as expected, yet never offers a valid entry point? I had a stock on my

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)