Back

Vishu Bheda

•

Medial • 10m

𝗜𝗻𝘃𝗲𝘀𝘁𝗶𝗻𝗴 𝗶𝗻 𝗦𝗮𝗮𝗦 𝗶𝘀 𝗷𝘂𝘀𝘁 𝗯𝗲𝗮𝗻 𝗰𝗼𝘂𝗻𝘁𝗶𝗻𝗴. Most people think SaaS investing is complicated. But smart investors know — it’s just simple maths. 𝗟𝗲𝘁 𝗺𝗲 𝗯𝗿𝗲𝗮𝗸 𝗶𝘁 𝗱𝗼𝘄𝗻 𝗳𝗼𝗿 𝘆𝗼𝘂 𝗶𝗻 𝗮 𝗲𝗮𝘀𝘆 𝘄𝗮𝘆. 𝐈𝐦𝐚𝐠𝐢𝐧𝐞 𝐲𝐨𝐮 𝐫𝐮𝐧 𝐚 𝐭𝐢𝐟𝐟𝐢𝐧 𝐬𝐞𝐫𝐯𝐢𝐜𝐞 𝐢𝐧 𝐌𝐮𝐦𝐛𝐚𝐢. 100 people pay you ₹2000/month for lunch. You know every month ₹2,00,000 is guaranteed unless they cancel. That's called 𝐑𝐞𝐜𝐮𝐫𝐫𝐢𝐧𝐠 𝐑𝐞𝐯𝐞𝐧𝐮𝐞. Now replace tiffin with Software. That’s 𝐒𝐚𝐚𝐒. → Zoho, Freshworks, Razorpay — all SaaS companies. → Their customers pay them monthly/annually like a tiffin subscription. 𝗦𝗼 𝘄𝗵𝗮𝘁 𝗱𝗼 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀 𝗰𝗵𝗲𝗰𝗸? Not brand. Not hype. Not marketing. They check 𝐧𝐮𝐦𝐛𝐞𝐫𝐬 like: 𝐂𝐀𝐂 = How much to get 1 customer 𝐋𝐓𝐕 = How much 1 customer will pay before leaving 𝐂𝐡𝐮𝐫𝐧 = How many cancel per month 𝐌𝐑𝐑 = Monthly predictable income 𝗥𝗲𝗮𝗹 𝗲𝘅𝗮𝗺𝗽𝗹𝗲? → Freshworks spends ₹5000 to get a customer who pays them ₹50,000 in lifetime = Profit. → Razorpay SaaS tools lock in startups for years = Stable revenue. → Zoho barely spends on ads. Their customers stay for 5-10 years = Investor’s dream. 𝗕𝗶𝗴 𝗟𝗲𝘀𝘀𝗼𝗻 𝗳𝗼𝗿 𝗜𝗻𝗱𝗶𝗮𝗻 𝗳𝗼𝘂𝗻𝗱𝗲𝗿𝘀? SaaS is not Bollywood. It's not about drama. It's about data. Count your beans well → Investors will love you. Ignore your numbers → Investors will avoid you. Simple game. Smart game. Desi style bean counting. Follow Vishu Bheda for more such simple breakdowns related to startup world!

Replies (3)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 2y

Meet Girish Mathrubootham, who left Zoho to build an 80,000 crore software giant. Despite being called a rickshaw puller due to a drop in grades, Girish worked his way up in HCL Cisco and Zoho. Inspired by Zendesk's price hike, he founded Freshdesk i

See More

Kumod Yadav

Building Voltko, Kri... • 6m

Dear Medial, Let suppose I am a trial user and forget to cancel auto pay and next month money deducted automatically so if I request you that I don't want to continue with a subscription (on the same day of deduction) will you refund? if not then wh

See MoreNIKUNJ TULSYAN

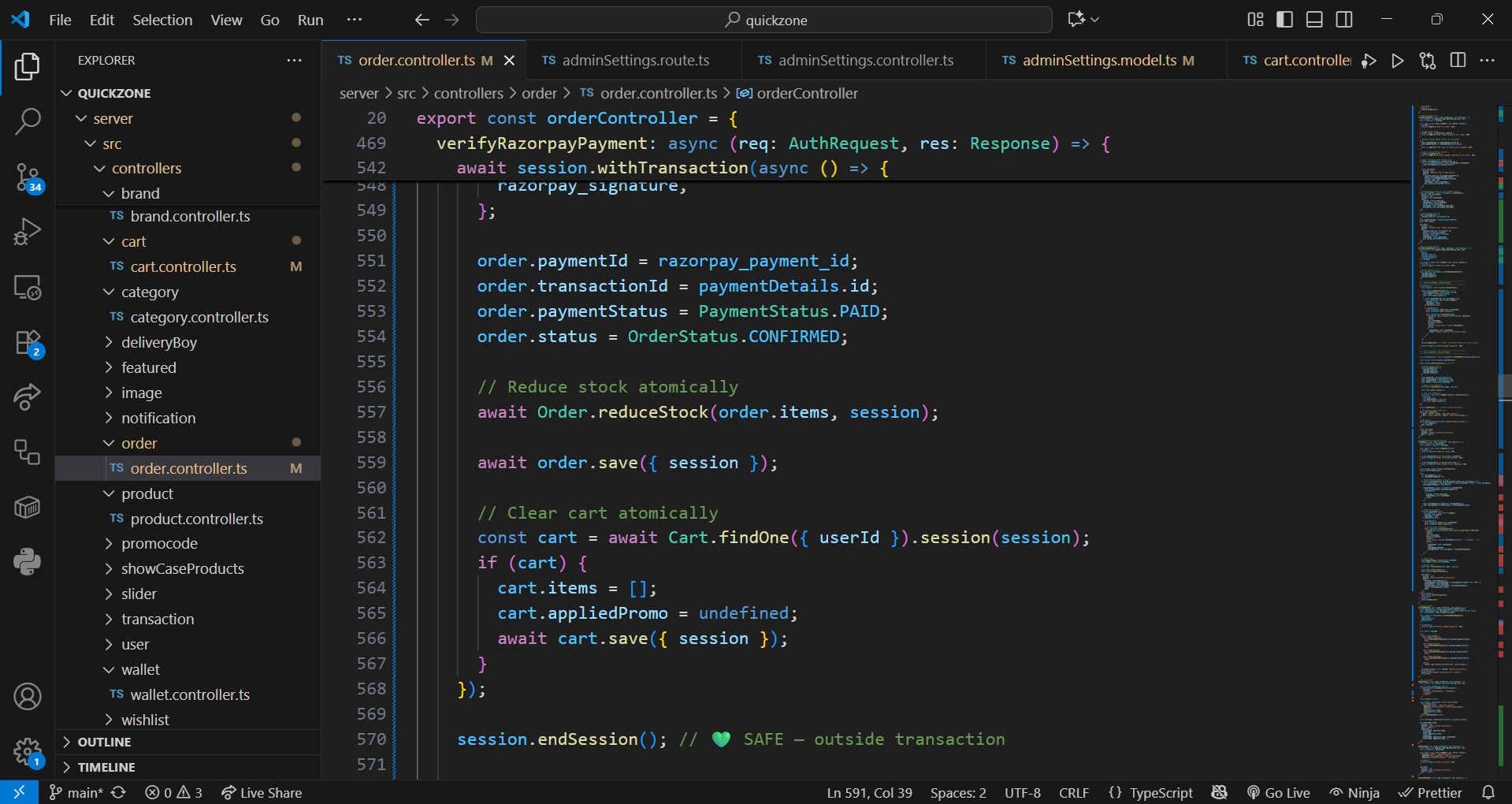

Building Flex Aura |... • 10m

Day 6 of building a SAAS in public My first Saas is almost done and will be live in a day or two once payment is integrated. Stripe is not available in India and other platforms like Razorpay are taking too much time to confirm. Hoping for the best

See MoreRavi Handa

Early Retiree | Fina... • 1y

Was speaking to a friend who does performance marketing for apparel brands. Not big ones but D2C folks who have ad spends of ~5 Lakhs per month. Most D2C folks I know, lose money. But according to him, not in apparels. Everyone makes money in it.

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)