Back

Anonymous

Hey I am on Medial • 2y

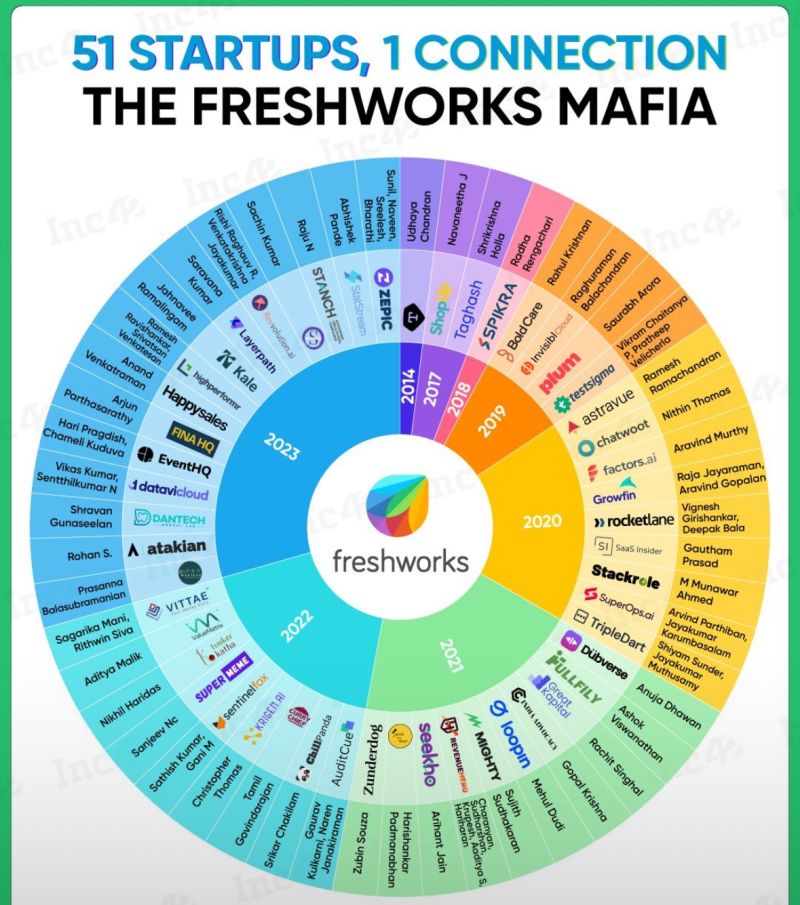

Meet Girish Mathrubootham, who left Zoho to build an 80,000 crore software giant. Despite being called a rickshaw puller due to a drop in grades, Girish worked his way up in HCL Cisco and Zoho. Inspired by Zendesk's price hike, he founded Freshdesk in 2010, providing a fresh approach to customer queries. Facing challenges, Freshworks expanded to FreshService in 2014 and FreshSales in 2017. By 2018, Freshworks achieved unicorn status with 100,000 customers and a 10,000 crore valuation. In 2020, it listed on NASDAQ at an 80,000 crore valuation, becoming the first Indian SaaS company on the US stock market. As of the latest update, Freshworks has grown to a 4000 crore revenue with six products and 5400 global employees, making 500 employees crorepati through its IPO. 🚀💪

Replies (5)

More like this

Recommendations from Medial

Shanu Chhetri

CS student | Tech En... • 7m

Zoho just acquired Kochi-based Asimov Robotics, a startup that makes robots for hospitals and industries, to boost its AI and robotics R&D in India. Asimov’s last known valuation was ₹2.5 crore (2015), but by May 2025, their annual revenue was around

See More

Satyam Kumar

Pocket says nil.. Mi... • 8m

"His TV broke. So he built a billion-dollar startup." In 2009, Girish Mathrubootham bought a TV. It broke during shipping. The company gave terrible service. He got angry ... and got an idea. He quit his job, started building a better customer sup

See More

Ansh Kadam

Founder & CEO at Bui... • 1y

Here’s how Girish Mathrubootham turned a broken TV into a $13 Billion dollar company, and how you can also turn simple events into billions. In 2010, Girish was VP of Product Management at ZOHO Corporation when a frustrating personal experience chan

See More

Vishu Bheda

AI did the magic • 1y

India’s Most Profitable Startups: Zoho and Zerodha Lead the Way India's startup ecosystem is witnessing a shift towards profitability, with companies like Zoho and Zerodha setting new benchmarks. # Zoho: Leading the Charge Chennai-based Zoho stand

See More

HigherLevelGames

Learning | Earning • 1y

Game Changing Growths of India [ PART 2 ] Until 2011 - AdventNet, Inc provided network management software. Later in 2009, the company was renamed as "Zoho Corporation" and thus started a revolution which is still unknown by many Indians. Sridhar V

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)