Back

Poosarla Sai Karthik

Tech guy with a busi... • 11m

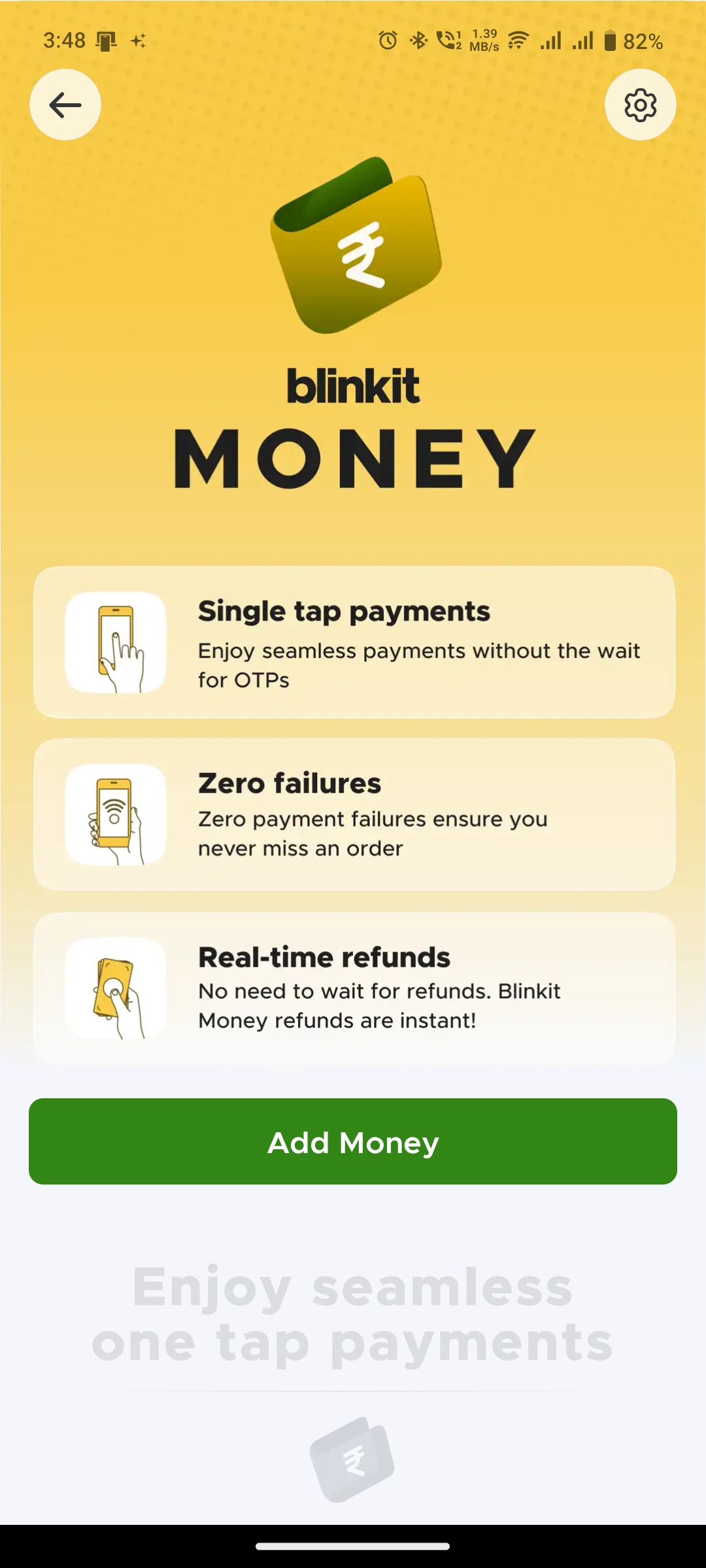

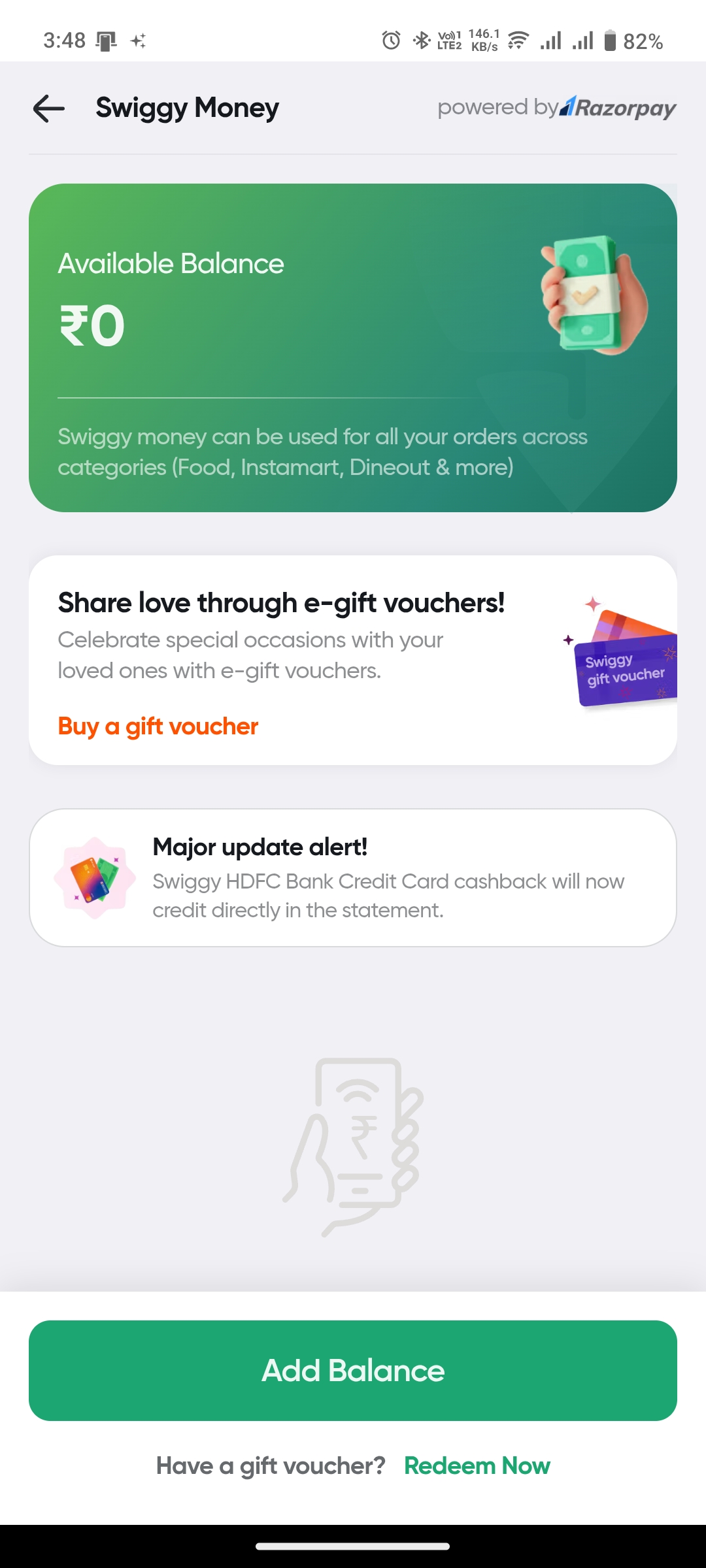

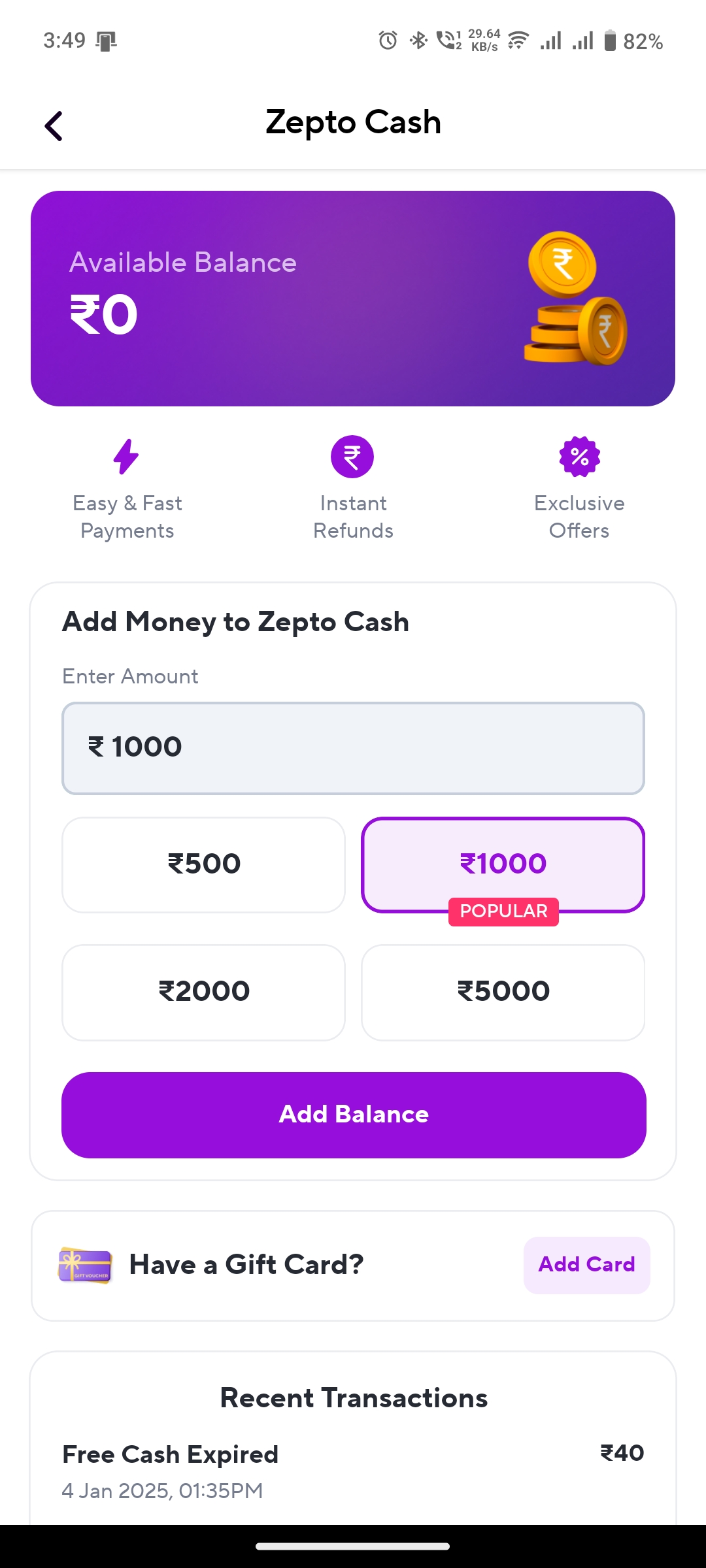

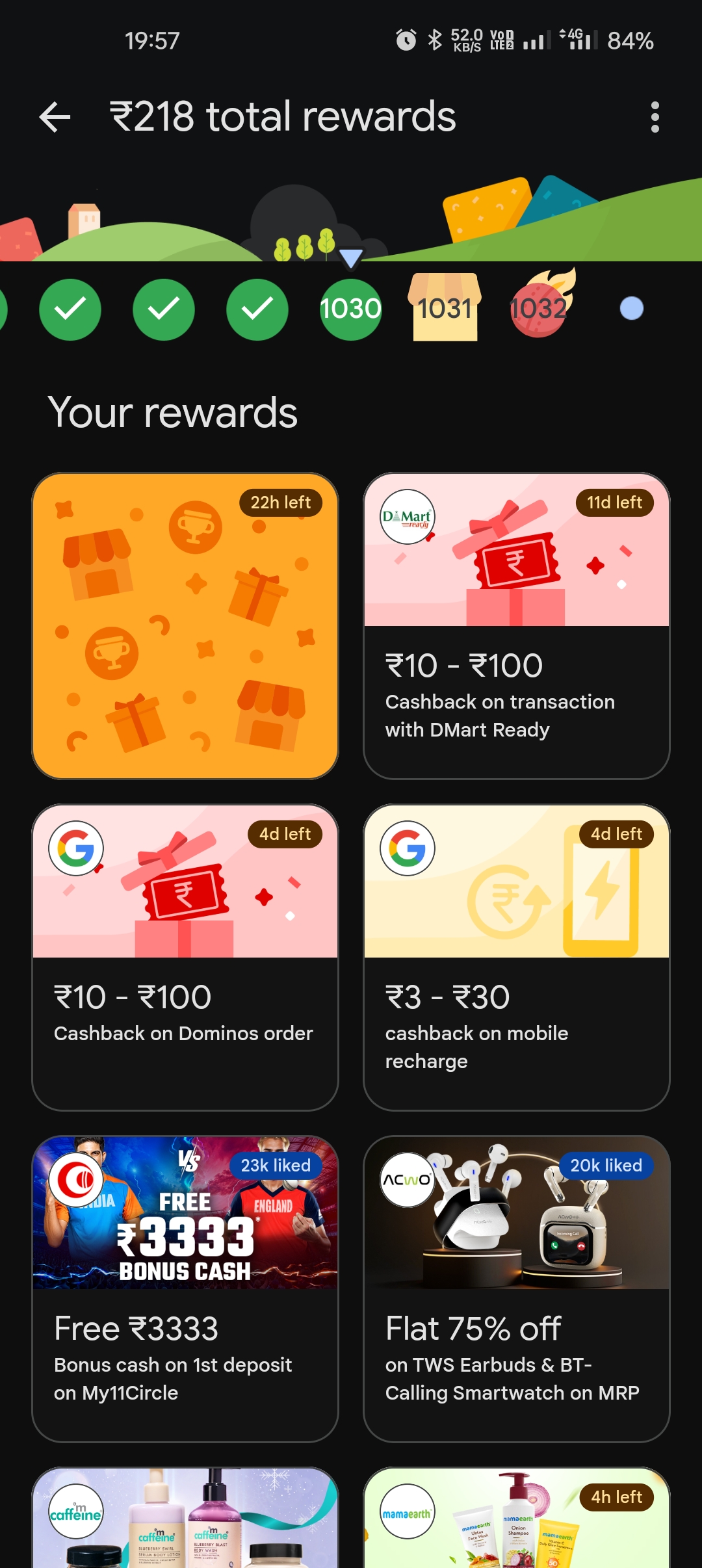

Yeah the burn’s real, no denying that. But Super money isn’t playing the short game. Cashbacks are just the hook-same playbook GPay and PhonePe used early on. They’ll dial it back once the user base is sticky. What makes this interesting is the Flipkart angle. They’re not just building a payments app-they’re setting up a whole fintech ecosystem. FDs, secured credit cards, and who knows what else coming next. So yeah, high burn for now-but it’s a smart burn with a bigger plan behind it.

More like this

Recommendations from Medial

Poosarla Sai Karthik

Tech guy with a busi... • 11m

Super.money dropped in July 2024, backed by Flipkart—and didn’t take long to shake up the UPI game. Fast forward to Feb 2025, and it’s already sitting at #5 among third-party UPI apps with 139M+ transactions and 0.86% market share. Not bad for the n

See MoreTharshith

Let's connect to tra... • 6m

Just gave Medial a spin… literally. 🔄 Two circles, one name, and a twist that says “dial me when it’s about creativity!” 🎯 If words could dance, they’d groove around this ring. Catchy slogans, witty lines, and brand sparks – that’s what I bring to

See More

Vedant Tiwari

Founder of VedspaceA... • 1y

Guysss... How to calculate the burn rate? like a initial startup... who's in initial stages... And a investor asking how much you need??? as our last post, a lot of you suggested some of the great ideas.... thanks for that... one of them was, burn

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)