Back

Thakur Ambuj Singh

Entrepreneur & Creat... • 11m

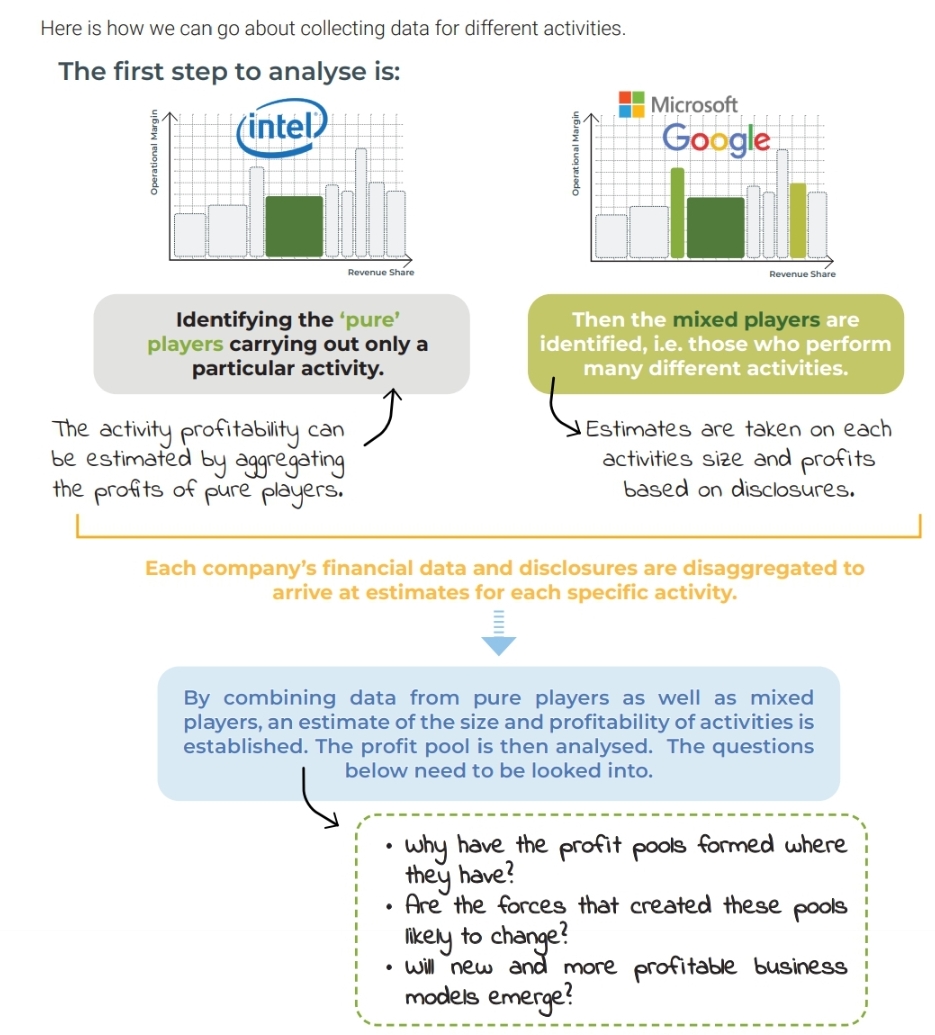

🔍 Decoding Profitability: How to Analyze Profit Pools! 💰📊 Understanding business profitability starts with: 1️⃣ Identifying ‘pure’ players – Those focused on a single activity (e.g., Intel). 2️⃣ Recognizing mixed players – Companies handling multiple activities (e.g., Microsoft, Google). 3️⃣ Breaking down financial data – To estimate profitability for each activity. By analyzing profit pools, we answer key questions: ✅ Why do these profit pools exist? ✅ Will industry forces shift? ✅ Are new, more profitable models emerging?

More like this

Recommendations from Medial

Atharva Deshmukh

Daily Learnings... • 1y

Porter's Five Forces Analysis Porter's five forces framework is a method of analyzing the competitive environment of a business. The five forces are: 1] Competition: Intensity of rivalry among existing competitors, influencing pricing, profitabil

See MorePulakit Bararia

Founder Snippetz Lab... • 1y

So how do you calculate your company’s valuation? Here’s the simplest way to think about it: 1. Forecast Future Earnings: Start with what your business makes now and apply a growth rate. Example: Year 1: $100K → Year 2: $120K → Year 3: $144K. 2.

See MoreRishabh Jain

Start loving figures... • 11m

Is This the Right Way to Analyze Stocks? A colleague recently pointed out that a structured approach is key when investing, and skipping steps can lead to costly mistakes. They follow a Top-Down Analysis Framework, which breaks down like this: 🔹 M

See MoreCA Chandan Shahi

Startups | Tax | Acc... • 11m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See MoreDhandho Marwadi

Welcome to the possi... • 10m

📊 HDFC Securities FY25 Performance Analysis A) Strong Growth Across Core Metrics Operating Revenue jumped 23% YoY to ₹3,264 Cr (vs ₹2,660 Cr in FY24), reflecting a robust uptick in broking, distribution, and retail activity. Operating Profit rose

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)