Back

Anonymous 2

Hey I am on Medial • 11m

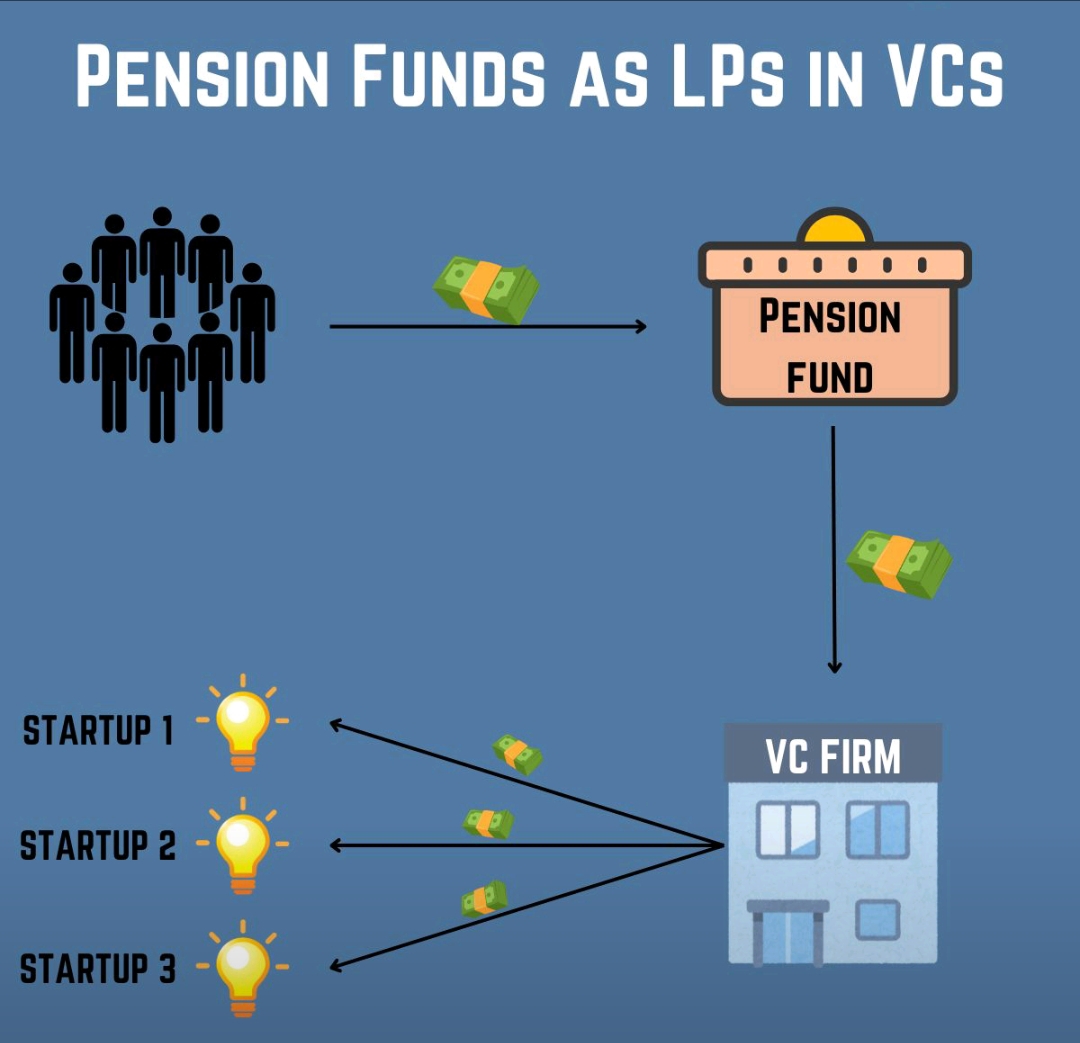

Most VC funds actually LOSE money for their limited partners. The average VC fund underperforms the S&P 500. The truth is that only about 5% of VC firms consistently generate the returns that justify the asset class. The rest are essentially playing a lottery game with other people's money while collecting management fees. It's a broken model that's persisted due to institutional investors chasing unicorns and FOMO.

More like this

Recommendations from Medial

ashish joe

Cofounder & CBO @ QU... • 9m

Rise of “Indicorns”: Are Bootstrapped Startups the Future? In a world obsessed with unicorns, a new breed of startups is quietly rewriting the rules—Indicorns. These are startups that scaled profitably without relying on VC money. Founders like Kunal

See MoreVivek Joshi

Director & CEO @ Exc... • 4m

Quick breakdown for VC analysts: Family offices vs. institutional VCs — what each brings, how their mandates, time horizons, decision-making, and involvement shape startup strategy. Learn when patient capital, values-aligned investing, and flexible d

See MoreAccount Deleted

Hey I am on Medial • 1y

Startups in India VS US - Which is Better? here's a break down of startup ecosystems of India and the U.S. There are approximately 80K startups in the U.S. and about 17,000 in India. When we compare the number of unicorns, there are about 700 pl

See More

Vijay Pawar

Real Estate Consulta... • 11m

Hello Guys i just want to know how does VC Firms make Money ? Some of the ways which i know is Through Acquisitions and whenever they help startup to raise new round they charges 2% of the total raised amounts Is there any other options that VC make

See MoreRohan Saha

Founder - Burn Inves... • 1y

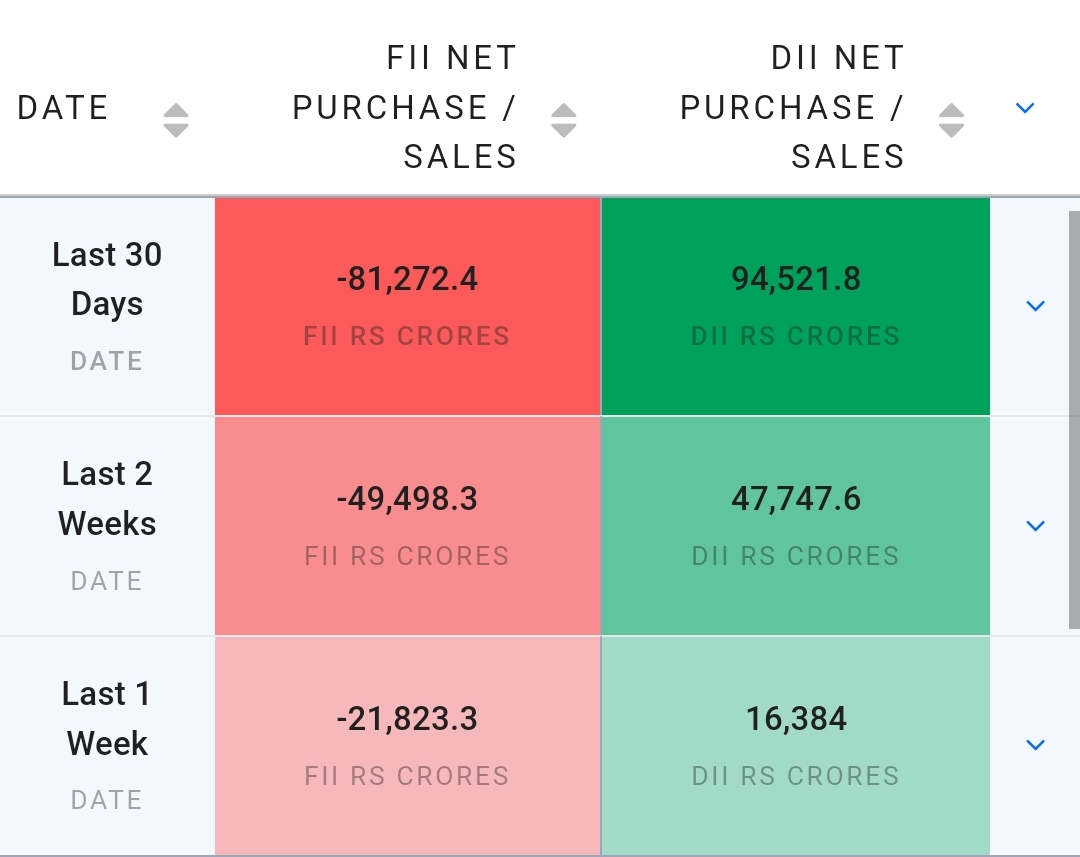

From September 27th until now, FIIs (Foreign Institutional Investors) have only been selling in the Indian market, and this trend is continuing. Looking at the current data, it also seems that Indian investors might be parking their money back into d

See MoreRohan Saha

Founder - Burn Inves... • 1y

As I mentioned earlier, Foreign Institutional Investors (FIIs) are significantly withdrawing their money from the Indian market. Many factors are working together, such as China’s economy, the US election, poor results from Indian companies, and the

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)