Back

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreReyansh Rathod

Entrepreneur • 10m

Friends, have you ever thought that paying tax is our responsibility, but why does it seem like a deep trap? India's tax system is so complicated that the common man gets confused! On one hand, the changing rules of GST, on the other hand, the high r

See MoreWomenCare

Santan social networ... • 7m

Is there a way around Stripe Payments, since the software I am using only supports Stripe and two other payment gateways and all of them require an American(US) business entity. Being an Indian business entity, how should I use Stripe being in Indi

See MoreGaurav Teli

Working on Visionary... • 1y

Just because of single point I got stuck on my idea ..... I am building an application where tour operators register their packages, and users can book those trip packages. However, the package prices are usually quite high, often over ₹10,000, so a

See MoreAditya Bandale

Founder at Omnicassi... • 1y

How much did if takes to have a copyright registration for your business. I feel like i am ripped of as there are no public domains or channels where you can check the status. Advocate and the company is not being clear about the process even after p

See MoreOwl Maniac

Rethink and Breakdow... • 1y

Govt wants to uplift people from poverty to middle class. Actual Meaning: Govt wants more tax paying people while the current tax paying people can keep paying. Actual result: Middle class people can keep working like donkeys for the rest of thei

See MoreAditya Arora

•

Faad Network • 3m

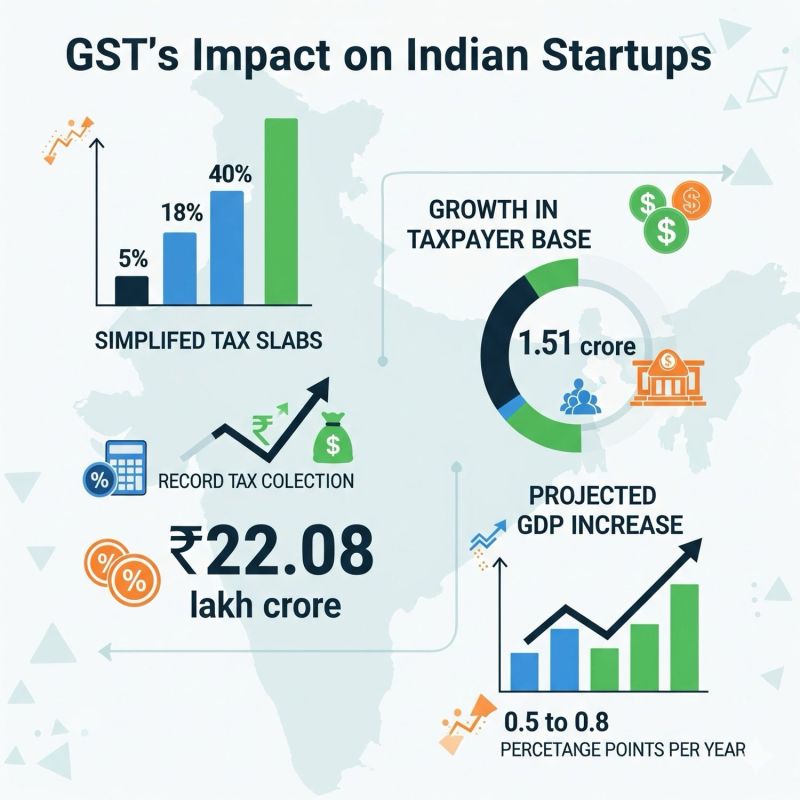

Why are the latest GST reforms being rightly called the Next Gen GST reforms for Startups and MSMEs? Here's why. ⬇️ In 2017, the government rolled multiple taxes (excise, VAT, service tax, entry tax, etc.) on differentiated products into "One Natio

See More

Download the medial app to read full posts, comements and news.