Back

Aditya Arora

•

Faad Network • 11m

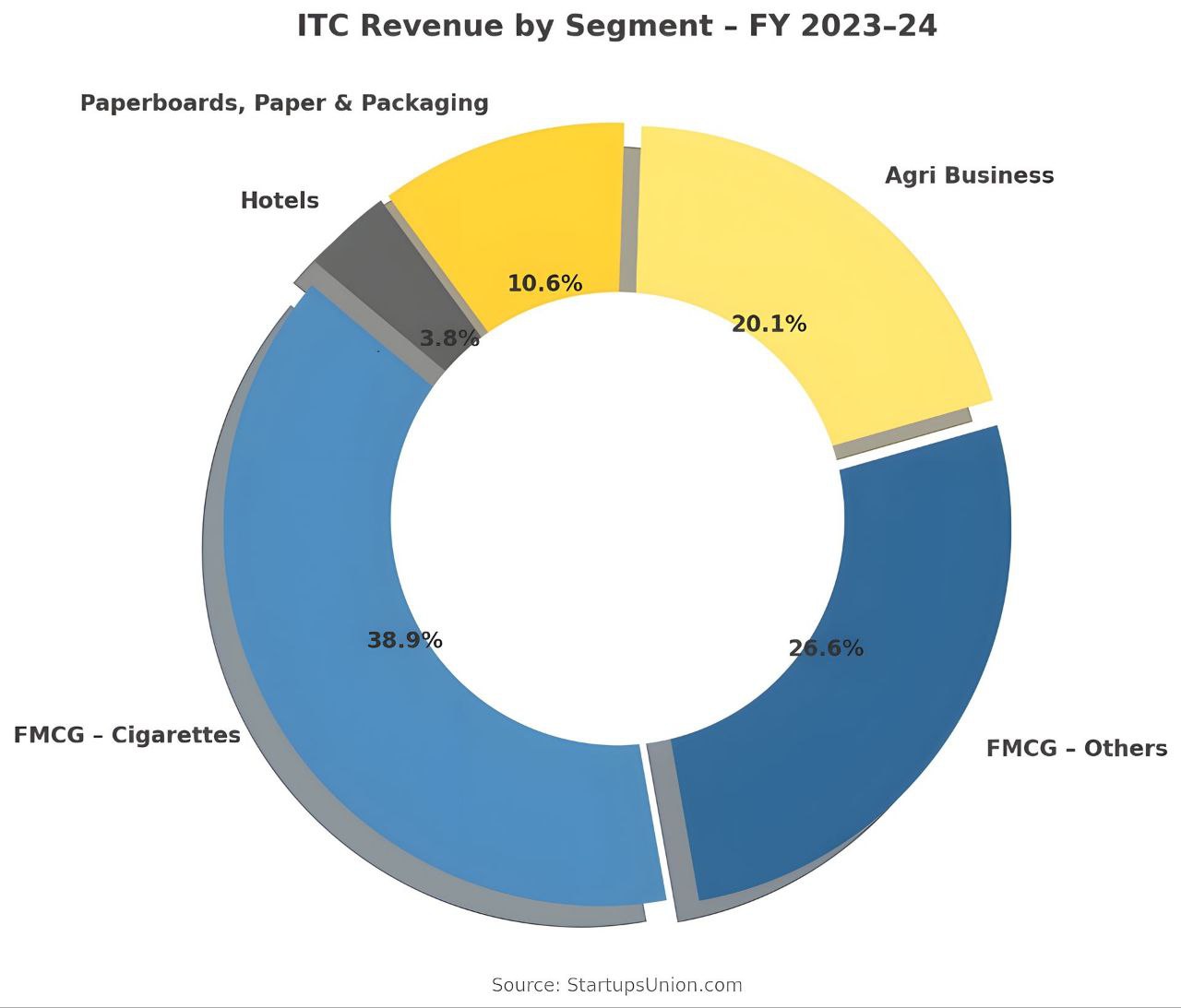

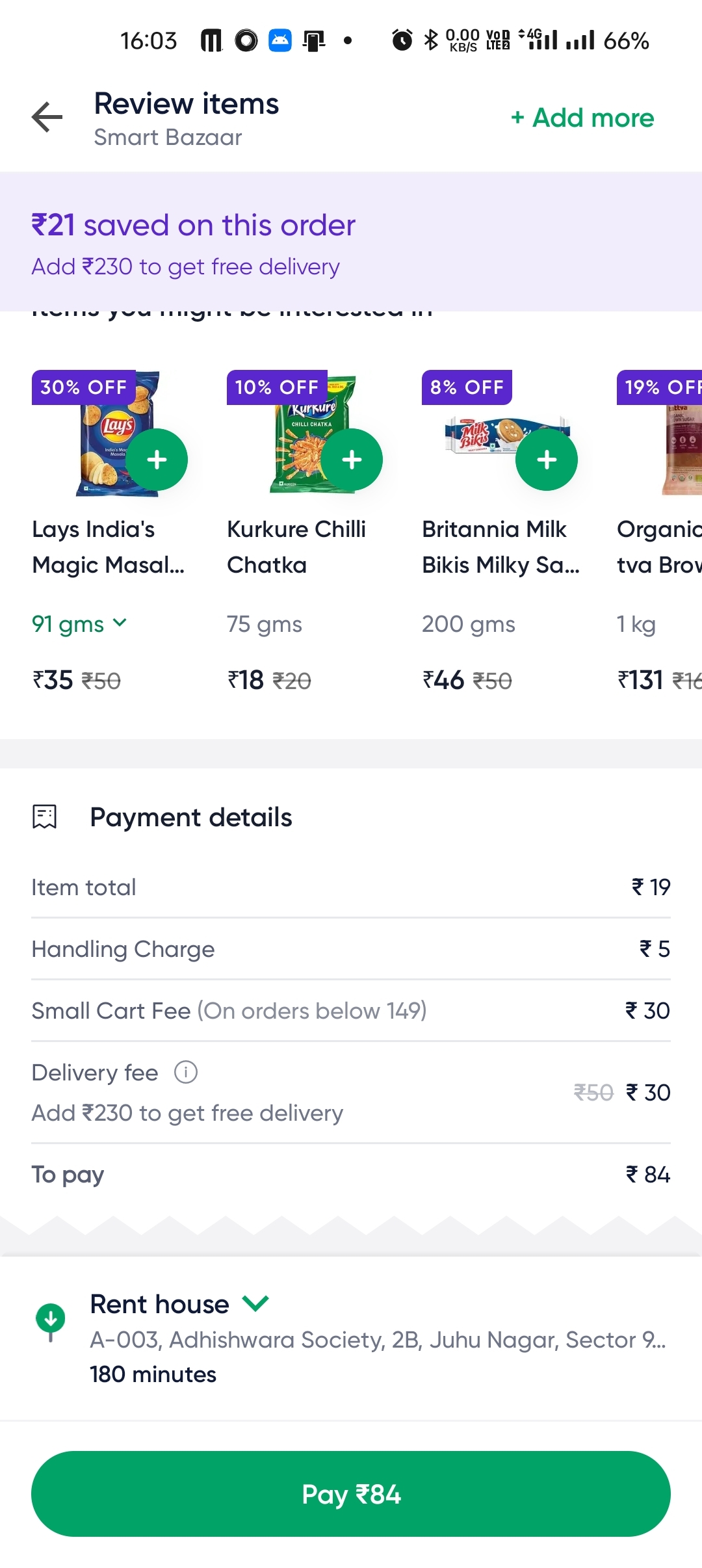

In 1999, PepsiCo had no clue that Kurkure would beat ITC and 3000 companies and become a 10,000 CR brand two decades later. Here is how they did it in five steps.👇 1. Unlike Western chips, Kurkure's masala-coated corn puffs created a distinct snacking experience, different from bhujia and sev. While competitors imported global flavours, Kurkure focused on regional spice blends like Masala Munch and Green Chutney Rajasthani Style. ✅ 2. The uber-famous "Tedha Hai Par Mera Hai" campaign, with Juhi Chawla as the brand face, positioned it as quirky yet lovable, making Kurkure a household favourite, which was positioned as the go-to snack in all festivals. 🎊 3. Kurkure also adopted a deep distribution model, reaching Kirana stores, supermarkets, and roadside stalls with prices of just Rs 5 and Rs 10. Knowing its target was kids, it was at every school canteen and bus station. By 2005, Kurkure was in over 1.2 million stores. 🙌 4. It also upsold combo packs,multi-pack discounts, and cross-selling with Pepsi bottles. PepsiCo's strategic ad spend delivered massive ROI. With an initial marketing investment of ₹20 crore, Kurkure's sales crossed ₹1000 crore by 2013. 💰 5. As it kept scaling, it diversified into e-commerce with new products—Solid Masti, Puffcorn, Baked Kurkure and Multigrain—attracting health-conscious consumers. By 2022, online grocery sales contributed ₹150 crore, and Kukure's overall sales crossed ₹2500 crore. 📈 ➡️ITC came with Tedhe Medhe, and regional players like Balaji, Yellow Diamonds, and 3000+ brands came to fight—no one came even close to shaking KURKURE. 💪 Today, Kurkure is a 10,000 CR brand present in over 2.5 million stores across India and still has over 30% market share after twenty years. 🙏

Replies (4)

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

"ITC Invests ₹111 Crore in EIH and Leela Mumbai Ahead of Hotel Demerger" "ITC Acquires Stakes in EIH and Leela Mumbai Worth ₹111 Crore Before Hotel Demerger" ITC Ltd Consolidates Stakes in Oberoi and Leela Ahead of Hotel Business Demerger ITC Ltd,

See MoreVikram Kumar

Founder at Stockware • 1y

Just came across this update—Licious is expanding into offline stores, with FY24 offline revenue expected to cross ₹500 crore! 🥩📈 However, their overall operating revenues fell by 8% to ₹685 crore compared to the previous year, primarily due to wea

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

Mukesh Ambani’s FMCG business is highly underperforming 📛📛 Yet, what we see the media do is celebrate the sub-par execution by over-emphasising on the Rs 3k crore sales figure for FY24. It’s only on a deeper deepdive, that you see things as they

See MoreROSTOZON

Stay with Community • 1y

Quick commerce unicorn Zepto recorded a 120% surge in revenue in FY24, growing from 2,026 crore in FY23 to ₹4,455 crore. This growth is driven by a shift in consumer preferences, with more customers opting for 10-minute deliveries over traditional e-

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)