Back

Rohan Saha

Founder - Burn Inves... • 12m

I have heard many people say that startup investment is the best, and it gives the highest returns. Let me share my experience. I started investing in startups since 2022. So far, I have invested in 4 startups, out of which 2 have shut down, one was acquired, and one is still running. If I include the shares of unlisted public companies, I have invested in 25 non-listed companies till date, out of which 8 have failed, 12 were acquired, some resulted in losses profits. Two companies went public through IPOs, and 3 companies have their IPOs in process. Investing in startups or non-listed companies is not easy; even a slight mistake can cause all the money to be lost.

Replies (4)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 10m

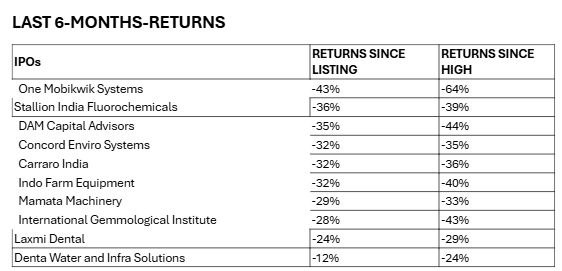

Today's startups that are going public through their IPOs have a PE ratio that, even if observed currently, is 100x or even 300x higher than the market average, despite the market sentiment being poor right now. It's unclear how these companies will

See MoreJay Pardeshi

Hey I am on Medial • 1y

Hello Everyone I am thinking of making a investment company which will fund collage start-ups and other businesses. I have the idea but i dont have the required finances to execute it. The money can also be invested in divident stocks to earn more

See MoreS A G N I K

Do. Fail. Learn. Mov... • 3m

I think SEBI should come and intervene rather stop Mutual Funds or atleast put a cap on them. Insurance Compamies and Pension Funds (MFICPF) need to stop investing in IPO companies. Here's why,, Merchant Bankers(MBs) who controls the game here. T

See MoreRavi Handa

Early Retiree | Fina... • 6m

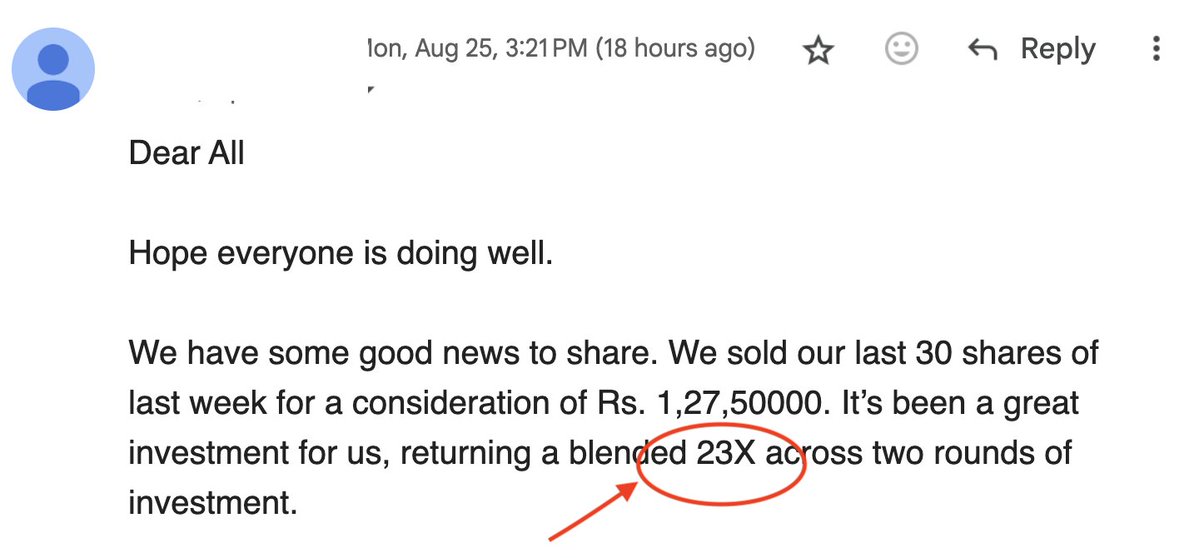

nvesting in Indian startups doesn't work often. But when it does - it gives 23X returns 😁 To learn more about Angel Investing join my Rs 2300 angel investing masterclass. Read Below. . . . . . You dumb idiot! You will get scammed one day. This

See More

Rohan Saha

Founder - Burn Inves... • 1y

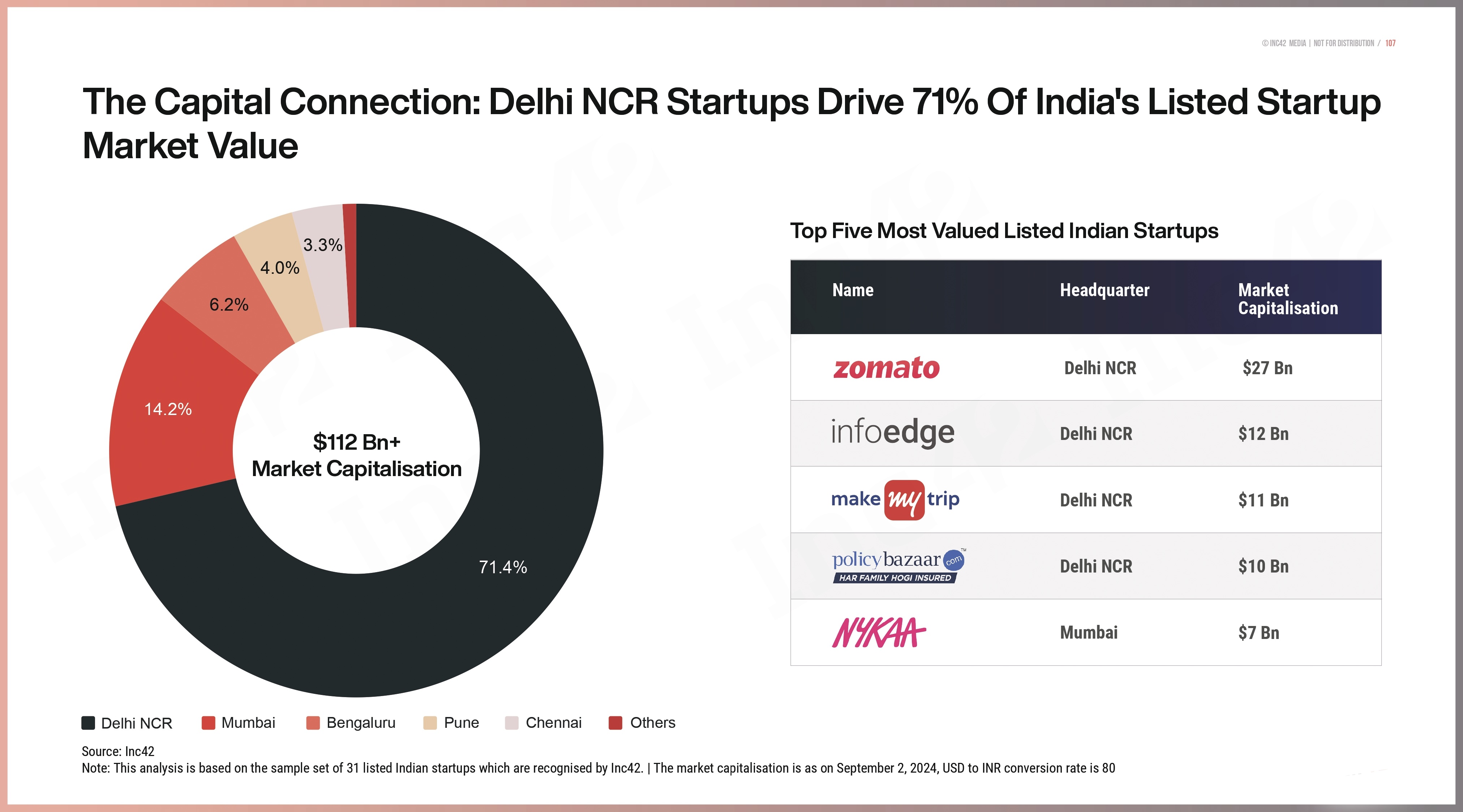

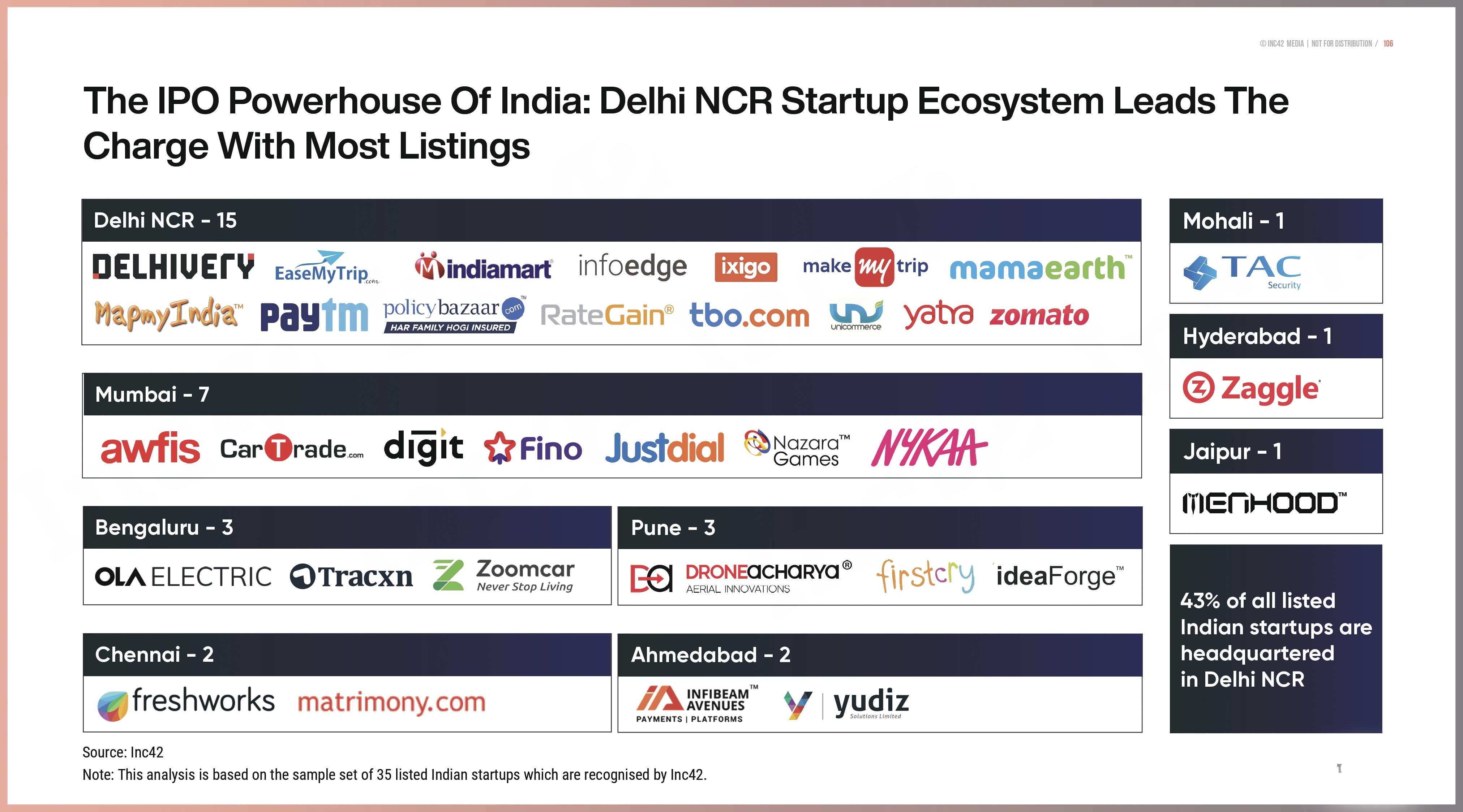

A examination of Indian startup first public offerings As the country's entrepreneurial ecosystem matures and becomes more globally competitive, Indian startup IPOs have become a crucial component of the country's capital markets. In order to give i

See More

Account Deleted

Hey I am on Medial • 1y

2024: The Year of Indian IPOs • In 2024, 13 Indian startups went public and made over Rs 29,000 crore ($3.4 billion). • These included Swiggy, Mobikwik, Ola Electric, FirstCry, Ixigo, and Unicommerce. Swiggy did well, Mobikwik was popular, and Ola

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)