Back

Rohan Saha

Founder - Burn Inves... • 12m

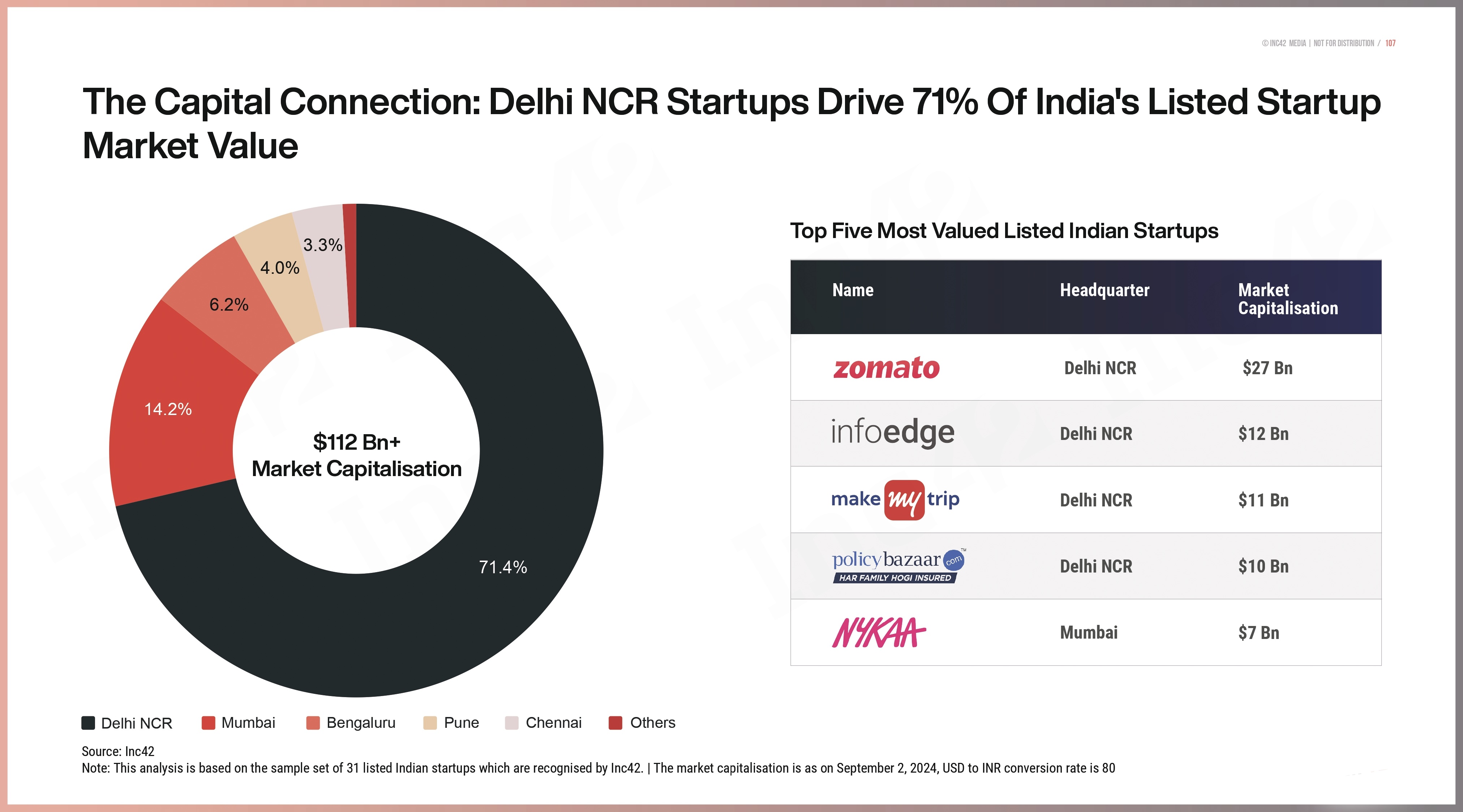

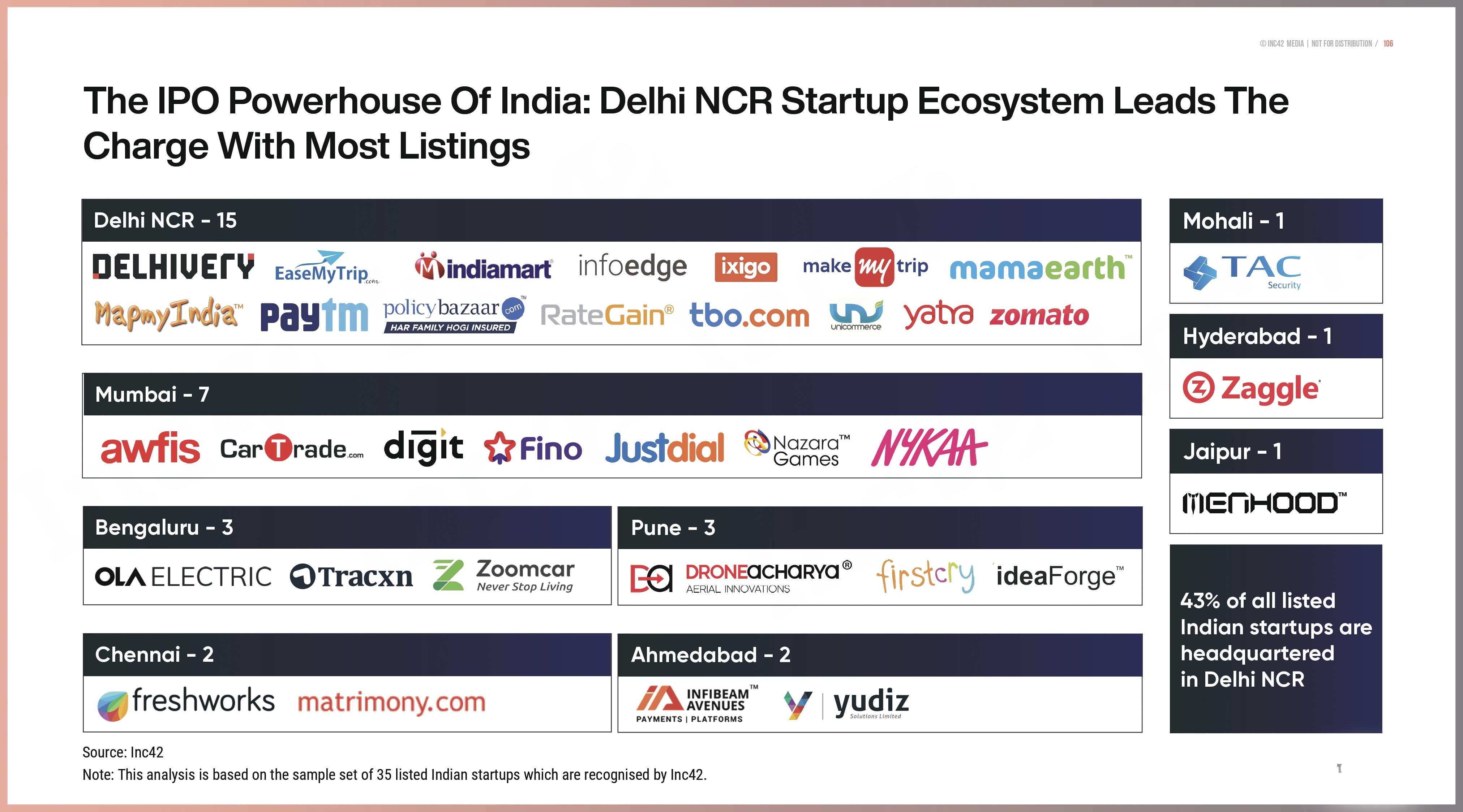

A examination of Indian startup first public offerings As the country's entrepreneurial ecosystem matures and becomes more globally competitive, Indian startup IPOs have become a crucial component of the country's capital markets. In order to give investors, analysts, and policymakers a comprehensive understanding, this survey note offers a detailed examination of the historical background, recent trends, market conditions, regulatory environment, success stories, cautionary tales, and future outlook for Indian startup IPOs. Historical Background The pattern of initial public offerings (IPOs) for Indian startups has changed dramatically, with a major uptick starting in 2021. Before this, businesses like JustDial (listed in 2013) and MakeMyTrip (listed on NASDAQ in 2010) had gone public, but because of their age and business methods, they were not categorized as modern tech startups. Zomato was the first significant Indian company to go public on the main board, having been created in 2008 and coming public in 2021. This was the beginning of the contemporary wave. A move towards tech-driven businesses was then indicated by Nykaa (formed 2012, IPO 2021), PolicyBazaar (established 2008, IPO 2021), and Delhivery (launched 2011, IPO 2022). Due to excellent market. circumstances and investor hunger, 2021 was a historic year for the IPO of several unicorns and high-growth companies. The Results of Recent Indian Startup IPOs In July 2021, Zomato went public, raising ₹9,375 crore at a price range of ₹72–76 per share. On the first day, it closed at ₹126 per share after being oversubscribed 38.2 times and listed at a 65% premium (Zomato IPO Performance). Driven by strategic efforts like the relaunch of Zomato Gold, Zomato reported considerable revenue growth after the IPO, with Q3 FY24 sales at ₹3,288 crore and a profit of ₹138 crore. Nykaa: Listed in 2021 as well, Nykaa has consistently increased its stock price, demonstrating solid financials and market approval, especially in the e-commerce beauty and fashion sector. Listed in 2021, PolicyBazaar has seen stock price swings but has typically done well thanks to its leading position in online insurance aggregation. Following their initial public offering (IPO), certain firms, like Zomato and Nykaa, have seen profitability and stock price growth, while others, like Delhivery, initially underperformed as a result of investor mood and market circumstances. The Indian startup initial public offering (IPO) market is strong as of February 2025, and a lot of activity is expected. Thirteen new-age tech companies listed in 2024, raising a total of ₹29,070 crore, which is a striking contrast to the five listings in 2023 and three in 2022. This indicates a recovery from the funding winter, but there are still issues, such as high valuations, concerns about profitability for loss-making entities, and the need for sustainable business models. Investors are increasingly interested in companies with clear routes to profitability, which could affect the success of future IPOs.

More like this

Recommendations from Medial

Nandishwar

Founder @StudyFlames... • 1y

INDIA'S IPO BOOM: A JOURNEY THROUGH YEARS! 🚀 India’s IPO market has been on fire, witnessing a massive surge in companies going public and raising huge funds. Here’s how the IPO trend evolved from 2017 to 2024: 📊 The Highlights 1️⃣ 2024: The B

See More

Ashish Singh

Finding my self 😶�... • 1y

🤯Lenskart is planning to go public by the end of 2025, targeting a valuation of $7-8 billion. The company aims to raise $750 million to $1 billion through its IPO. Despite reporting a minor loss of ₹10 crore on revenues of ₹5,427 crore in FY24, Lens

See More

ProgrammerKR

Founder & CEO of Pro... • 10m

India’s startup engine is revving up again! BlueStone and Aye Finance just got SEBI's nod for their IPOs. From handcrafted jewelry to fintech, Indian companies are stepping onto the public stage with confidence. #IPO #StartupIndia #Fintech #JewelryB

See MoreROSTOZON

Stay with Community • 1y

Billionaire Mukesh Ambani is preparing for Reliance Jio's IPO, expected to raise Rs 35,000-40,000 crore, marking one of the largest IPOs in Indian history. Valued at $120 billion, the IPO is set for the second half of 2025. It will include both exist

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)