Back

Anonymous 3

Hey I am on Medial • 11m

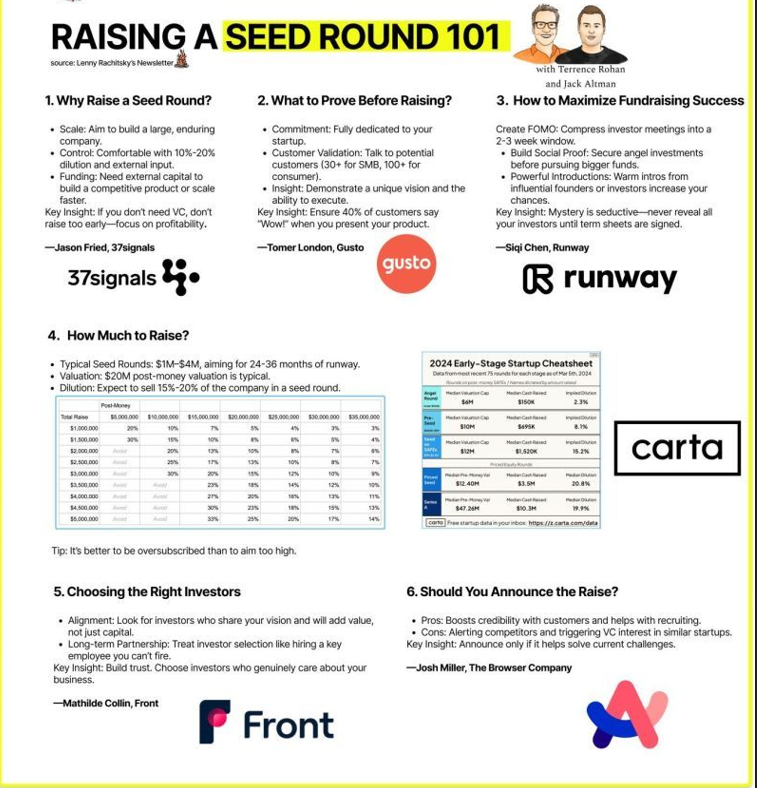

Everyone romanticizes raising capital, but 10-20% dilution this early means you’re giving away a chunk of your company before proving long-term viability. Bootstrap if you can, because once you’re on the VC treadmill, there’s no easy way off.

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 1y

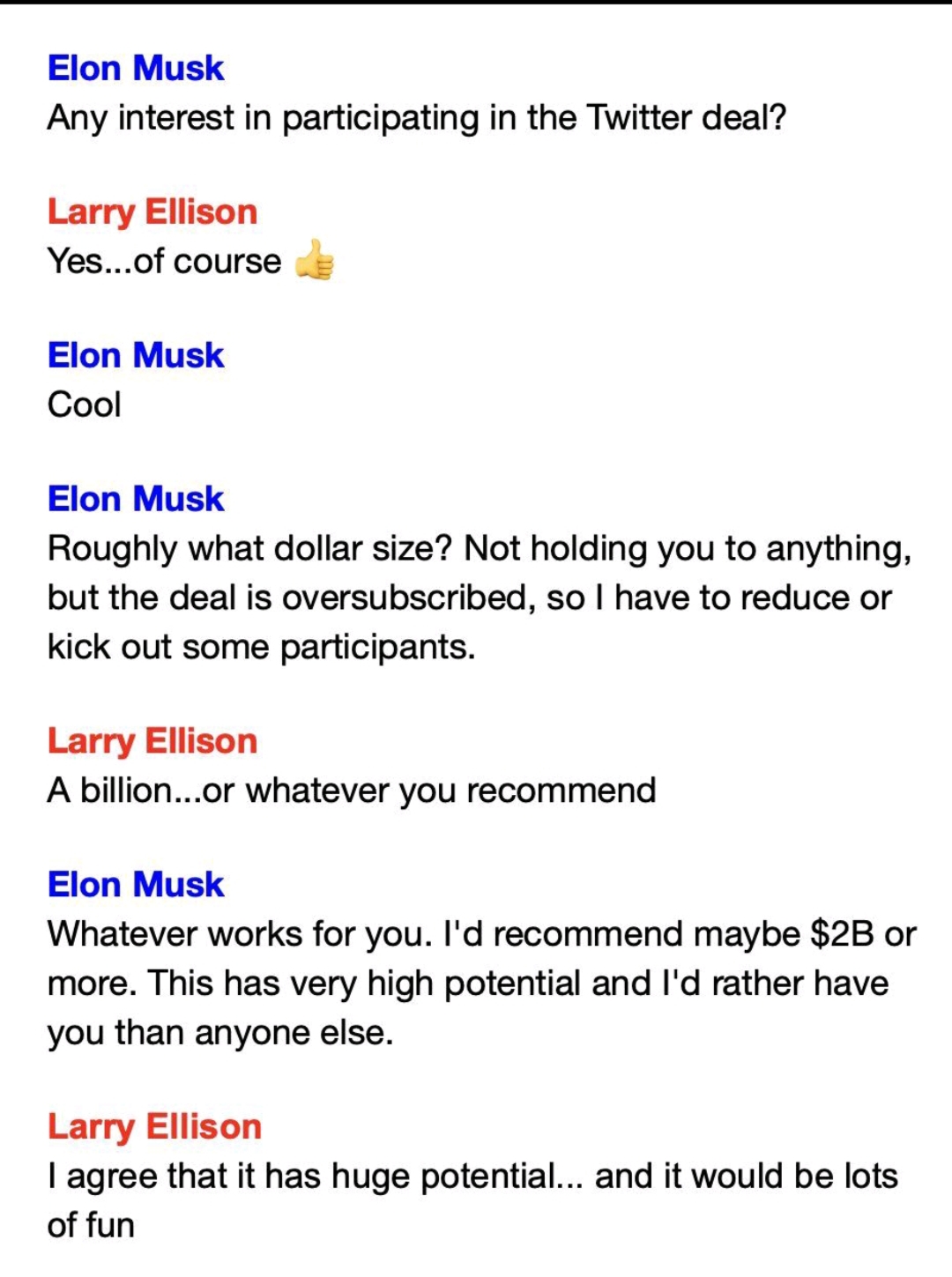

"Conversation between Elon Musk & Oracle CTO on acquiring Twitter" No B.S, It's On-Point🔥 If you remember a long time ago, I already mentioned that Raising 1 Crore & Raising 1000 Crores is a large difference either in Conversations or Persons B

See More

Nithin Augustine k

DAY ONE • 1y

Burning through funds to capture Market share is TRENDING. For that startup sacrifice the control they have on the business. To what extent should we raise funds and what all things should we consider about the VC from which we are raising funds. OR

See MoreSamCtrlPlusAltMan

•

OpenAI • 7m

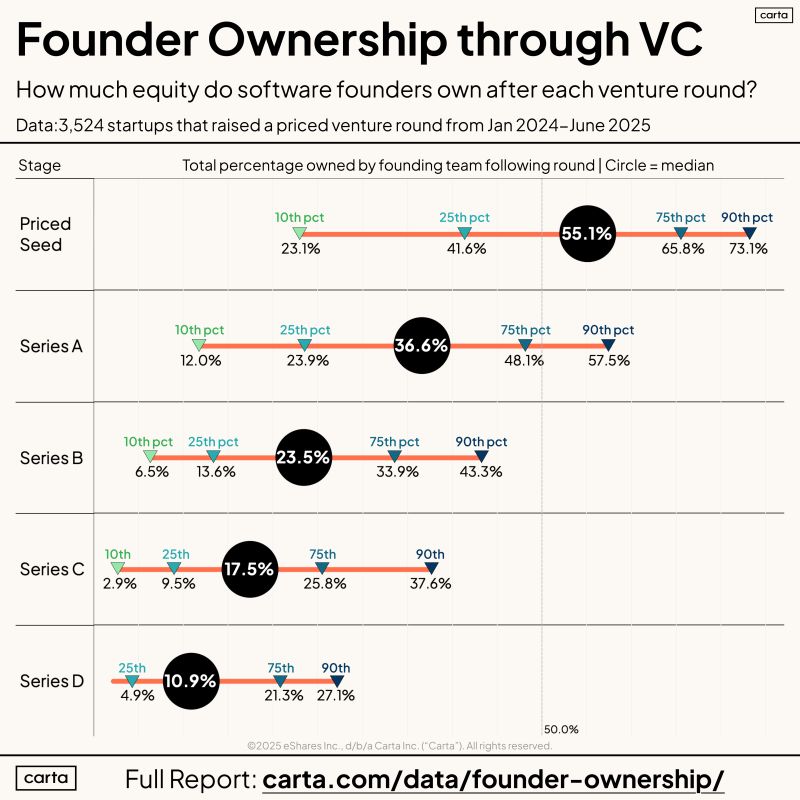

The Hidden Cost of Raising VC: Your Equity. Think raising a big round means you’ve made it? Check the fine print: Founder ownership drops fast as you climb the funding ladder. Median equity owned by founders after each round (2024–25 data from 3,52

See More

Mr Shiva Raj

Challenging Norms, C... • 1y

🛑 3 Startup Mistakes That Kill Businesses 1️⃣ Hiring too fast before making revenue 2️⃣ Raising funding before proving demand 3️⃣ Ignoring marketing & expecting sales to come The best startups focus on: ✔️ Profits before people ✔️ Customers before i

See MoreAanya Vashishtha

Drafting Airtight Ag... • 10m

Should You Raise Fund or Bootstrap? Here’s a Reality Check Every founder faces this question: Should you raise external funding or bootstrap your startup? Both paths have pros and cons, and the right choice depends on your business goals, risk tol

See MoreNimesh Pinnamaneni

•

Helixworks Technologies • 11m

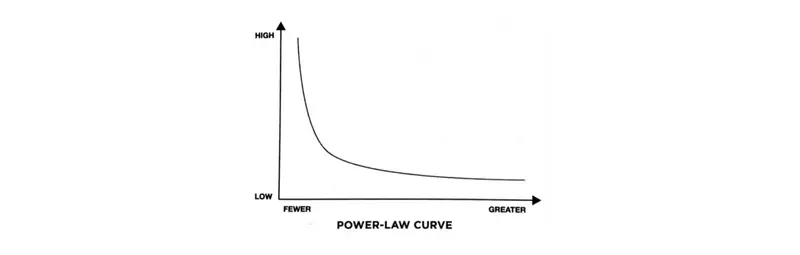

💥 A VC turned $6.4m into $1.3b in 5 yrs — there’s a lesson here for founders💥 Cyberstarts just turned a $6.4M seed investment in Wiz into $1.3 BILLION after Google’s $32B acquisition—a mind-blowing 222x return in just 5 years! 🚀🔥 This is why VC

See More

The Vc Girl

Not a Vc Yet, just O... • 6m

16 VC Terms I’m Learning to Become Sniper . Not a VC (yet), but I’m obsessed with how they think. TAM – Size of the $$ opportunity CAC – Cost to get a user LTV – Money a user brings over time Runway – Months till cash runs out Burn Rate – Monthly

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)