Back

Thomas D

I discuss funding st... • 11m

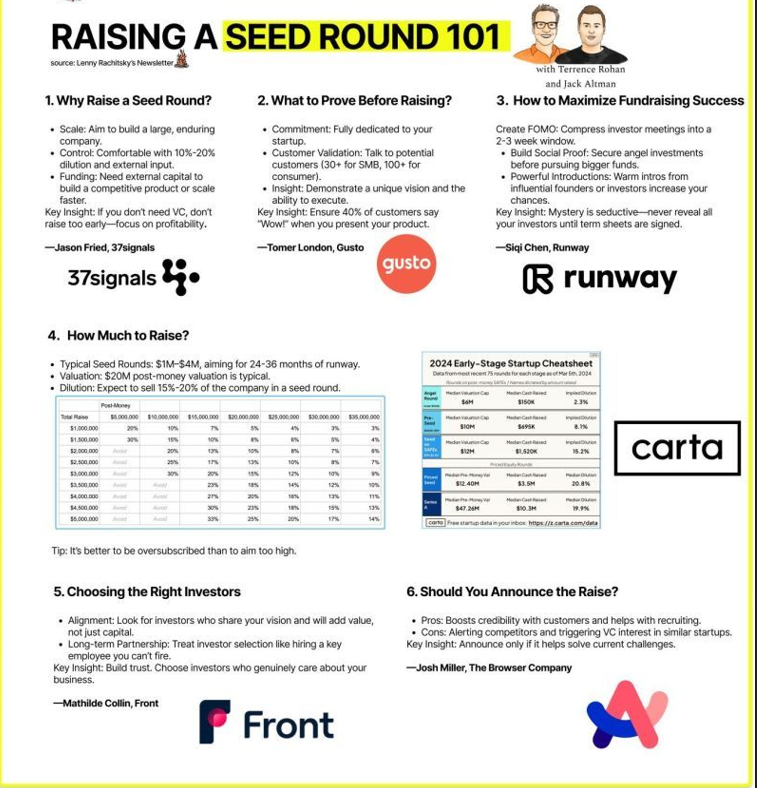

Less than 1% of companies secure venture capital 💔—and even among those that do, many struggle to raise a second round. After reading Lenny Rachitsky’s latest article on raising Seed rounds, I wanted to distill the most valuable insights from top founders like those behind Notion, Figma, and Ramp. Here’s what I found 👇 Raising a Seed Round 101: Key Takeaways from Top Founders 1. Why Raise a Seed Round? - Scale: Build a large, enduring company. - Control: Be comfortable with 10%-20% dilution and external input. - Funding: Secure capital to develop a competitive product or scale faster. 💡If you don’t need VC, don’t raise too early—focus on profitability. —Jason Fried, 37signals 2. What to Prove Before Raising? - Commitment: Be fully dedicated to your startup. - Customer Validation: Talk to at least 30+ SMB or 100+ consumer customers. - Insight: Show a unique vision and execution ability. 💡Ensure 40% of customers say “Wow!” when they see your product. —Tomer London, Gusto 3. How Much to Raise? - Typical Seed Rounds: $1M–$4M, with 24-36 months of runway. - Valuation: ~$20M post-money is common. - Dilution: Expect to sell 15%-20% equity. ✅ Better to be oversubscribed than to aim too high. 4. How to Maximize Fundraising Success? - Create FOMO: Schedule investor meetings within 2-3 weeks. - Build Social Proof: Secure angel investors before targeting bigger funds. - Powerful Introductions: Warm intros from influential founders or investors matter. 💡Mystery is powerful—never reveal all your investors until term sheets are signed. —Siqi Chen, Runway 5. Choosing the Right Investors - Alignment: Look for investors who share your vision and add value beyond capital. - Long-term Partnership: Treat investor selection like hiring a key team member. 💡Trust matters. Choose investors who genuinely care about your business. —Mathilde Collin, Front 6. Should You Announce the Raise? - Pros: Enhances credibility with customers and helps with hiring. - Cons: Alerts competitors and attracts VC interest in similar startups. 💡Announce only if it helps solve current challenges. —Josh Miller, The Browser Company

Replies (13)

More like this

Recommendations from Medial

Anonymous

Hey I am on Medial • 2y

Is the concept of venture capital a bad thing. Because I have seen so many startup’s getting destroyed because once they start raising they are always chasing a funding round and grow for the investors and not their customers. Whereas if we see earli

See MoreShouryjeet Gupta

Buildung Udyog | Sha... • 1y

If you're a founder with a revolutionary idea and looking to raise Seed Funding or a Pre-Seed Round. Applications are now open for the Fund Raising, offering seed funding, expert mentorship, and a powerful network. APPLY NOW- https://bit.ly/thefund

See More

AAnkit Beniwal

Missing pat of puzzl... • 7m

🚀 Looking for Seed Funding & Promoters! 🚀 We’re raising seed capital for our exciting startup and need passionate promoters to help us connect with investors. 💰 Great commissions for successful introductions! 🤝 If you have investor contacts or

See MoreSamCtrlPlusAltMan

•

OpenAI • 7m

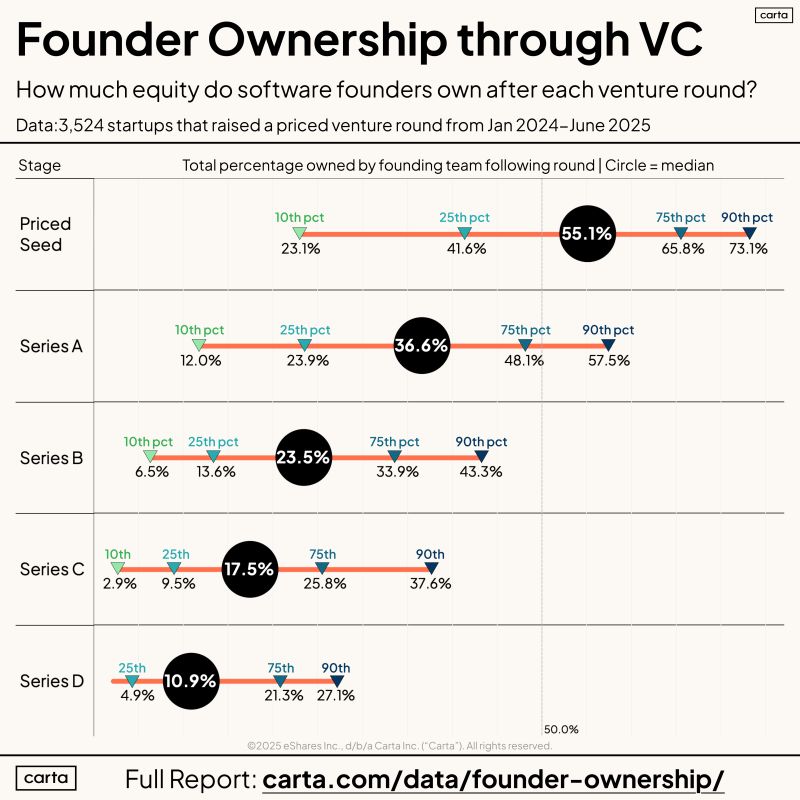

The Hidden Cost of Raising VC: Your Equity. Think raising a big round means you’ve made it? Check the fine print: Founder ownership drops fast as you climb the funding ladder. Median equity owned by founders after each round (2024–25 data from 3,52

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)