Back

Anonymous 2

Hey I am on Medial • 12m

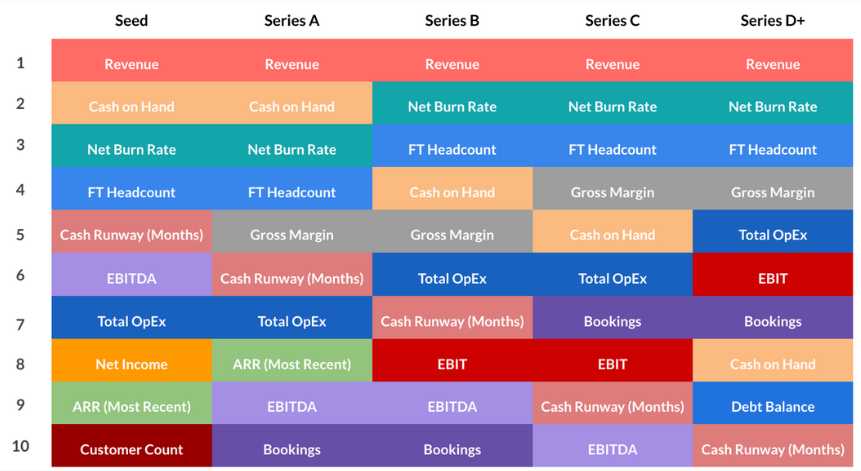

Most funded startups I see are burning cash on vanity metrics. Give a Type-1 founder money, they'll build a fancy office before product-market fit.

More like this

Recommendations from Medial

Ravi Handa

Early Retiree | Fina... • 1y

Startup folks - if you aren’t funded, stop paying money to social media influencers / YouTubers to promote your product or services. It is just vanity. 80% of the time, it does not give you good returns. Stick to Google ads. Not saying they are p

See Morericha joshi

Startup Legal Strate... • 5m

Startups rarely die because of competition. Most die because of avoidable financial mistakes. The worst one I have seen- 👉 Mixing personal & buisness money 👉 Ignoring Taxes 👉 Burning cash on vanity expenses 👉 Bad or missing contracts 👉 Legal c

See MoreRam Pavan

Building TravelTech ... • 5m

🚨 What the heck is Funding-Market Fit? I learned it the hard way. When I started building my travel-tech idea, I got pulled into “startup paperwork mode”: 👉 Should we register as Pvt Ltd or LLP? 👉 What about compliance costs? 👉 Do we need a CA o

See MoreVENTURE NAVIGATOR

INVESTOR | Start up ... • 1y

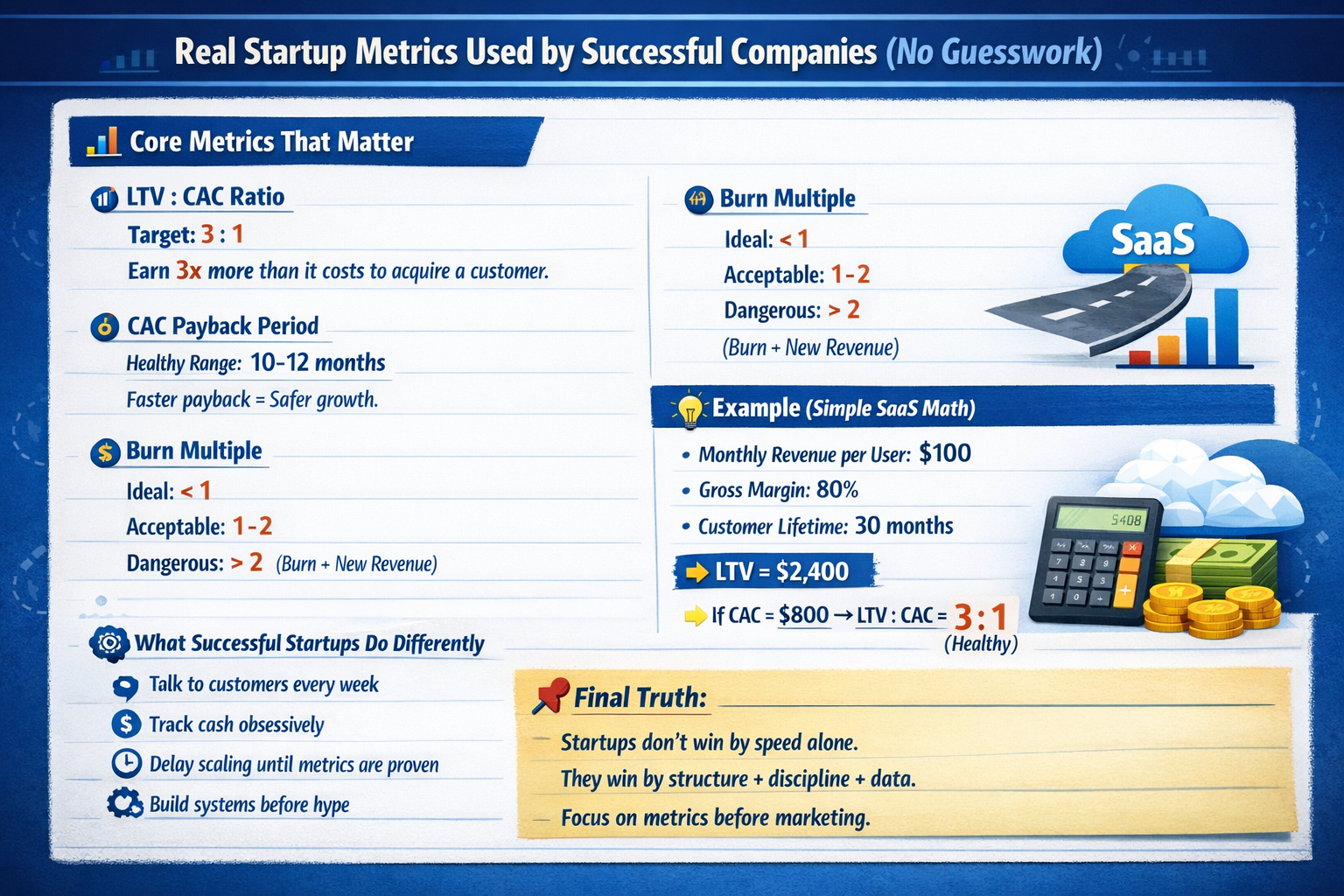

Why One Startup Got Funded & The Other Didn’t? 🚀💰 Recently, I validated two pitch decks. One secured funding, while the other is still seeking investors. The difference? Smart financial planning vs. unnecessary burn. ✅ Funded Startup: 🔹 Allocat

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)