Back

Anonymous 2

Hey I am on Medial • 1y

Most people don’t realize that family offices (like Tata, Ambani, and Birla) get in before mainstream VCs even hear about a company. These investments never show up on Crunchbase or Pitchbook, but they shape billion-dollar companies.

Replies (1)

More like this

Recommendations from Medial

Adithya Pappala

Busy in creating typ... • 1y

How to build Trillion Dollar Companies?? It's not: Product Problem Solution Marketing Customers or Team neither... There is only one way for it: "Survive longer periods & build long lasting companies" Whatever the giants that you see: TATA

See MoreAccount Deleted

Hey I am on Medial • 1y

Welcome to Dark Pool Venture Capital-where ultra-wealthy individuals, family offices, and private funds invest off the record. Not all VC funding makes headlines. Some of it stays in the shadows. Why stay hidden? 1) No public signals, no inflated

See MoreRadhemohan Pal

Let's connect to wor... • 1y

Aa jao empire build karte hai Idea , suggestion,koi knowledge, experience,koi pehchan, investment, student ho toh friends bhi honge kuch banaye jaye Kuch jab do ,teen dimag saath milte hai toh kuch bada hota hai toh phir intejar kaisa message karo

See MoreVivek Joshi

Director & CEO @ Exc... • 4m

Quick breakdown for VC analysts: Family offices vs. institutional VCs — what each brings, how their mandates, time horizons, decision-making, and involvement shape startup strategy. Learn when patient capital, values-aligned investing, and flexible d

See MoreAccount Deleted

Hey I am on Medial • 1y

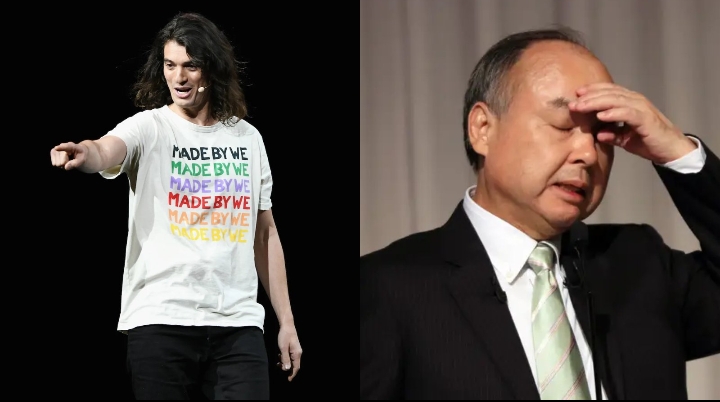

Masayoshi Son, the visionary behind SoftBank, is betting big on AI, predicting that by 2035, AI will be 10,000 times smarter than humans. His company owns 90% of chipmaker Arm and is aggressively investing in AI research, planning to deploy $500 bi

See More

Sairaj Kadam

Student & Financial ... • 1y

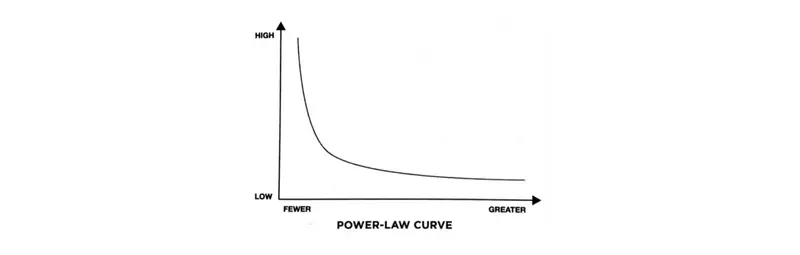

The Harsh Reality of Venture Capital: Recently, I spoke with a founder who had a fantastic business idea, but he was struggling to secure venture capital funding. Got myself thinking: why do some great ideas never get the backing they need? The tr

See MoreNimesh Pinnamaneni

•

Helixworks Technologies • 11m

💥 A VC turned $6.4m into $1.3b in 5 yrs — there’s a lesson here for founders💥 Cyberstarts just turned a $6.4M seed investment in Wiz into $1.3 BILLION after Google’s $32B acquisition—a mind-blowing 222x return in just 5 years! 🚀🔥 This is why VC

See More

Kritarth Mittal • Soshals

Founder, Soshals | C... • 3m

> be Karan Goel > spawn in Delhi, India > see the entire family hustle > decide to build something new > graduate with a dual degree from IIT > rank top 0.1% of India > realize it's not enough > head to Carnegie Mellon to build AI 2017 - 2018 > win

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)