Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

Cashfree’s new $53mn funding cements what is my favourite Indian fintech story of all ❤️❤️ I’ve been following the business for about 4yrs now. Thus, with its new funding in the news, I thought this is a great time to share all I know about this Made in India for the World startup story, which I wish more people knew and tracked. So, as Samay Raina would put it - Let’s Goooo! .. Akash & Reeju started Cashfree Payments in 2015 to solve cash-on delivery for India’s rising e-commerce market. -> The next year, they launched its payments gateway, which helped bring in profitability within 2yrs - a status it maintained -> That disciplined but sky-rocketing growth brought Y-Combinator on its side another 2yrs down And this was when India’s largest bank of all, SBI, spotted the company in 2021 and wrote a big cheque at a $200mn valuation. .. This was very special. The king of India’s financial services industry had not invested in other major fintech. -> Now, with money & SBI on its side, company went all out -> This is why, in Dec 2021, it sponsored the superhit season of Shark Tank India, closing the financial year at ~Rs 230cr topline -> It helped so well with visibility and trust the partnership was renewed, helping drive another 54% growth in FY22 And then it grew by another 75% in FY23 to hit >Rs 600cr! .. But, towards the end of FY23, RBI suddenly fired a bazooka, banning new merchant onboarding. That’s when the company made two big decisions. 1> To use the period till ban was lifted to build a host of more new products and upsell those to the existing clients 2> To go global and diversify market concentration risks .. This is when CashFree launched a big line of new products: -> Instant Refunds (used by Meesho) -> Bulk Payments (used by Swiggy to transfer money to delivery folks) -> UniFi (helps businesses handle finances across banks) -> SoftPOS (Turned Android phones into POS devices) -> And many more such new products like RiskShield, FlowWise and many more. A year later, as RBI lifted the ban, it was a dam-break - opening doors to a crazy lot of growth as it had so many new products to sell to a massive market. And growth followed. .. And the fresh $53mn funding from South Korea’s Krafton and the UK’s Apis Partners, at a $700mn valuation is an outcome of that. It will be used for 3 things. -> Growth in the crowded Indian market -> Deeper play in Middle East, US & Canada -> Enter over 2 dozen more countries over the next 2yrs Thus, I find it to be a beautiful Made in India for the world kind of massive fintech play. And, am super bullish. ..

More like this

Recommendations from Medial

Jayant Mundhra

•

Dexter Capital Advisors • 1y

#Deepdive: Hyundai India’s 2/3rds of cash in the bank has been milked up by Korean parent in the last 2yrs 📛📛 In fact, in the last 2yrs, Hyundai India’s dividends to its Korean parent were more than all the profit after tax it earned in the last 5

See More

Annonimos

Kill them with your ... • 1y

Hey is that you know I what way india grown before and after liberalisation Here's some information about India's growth rate before and after economic liberalization: 1980s India's growth rate was higher than the previous decades, but it was als

See MoreSohail Akhter

Hey I am on Medial • 9m

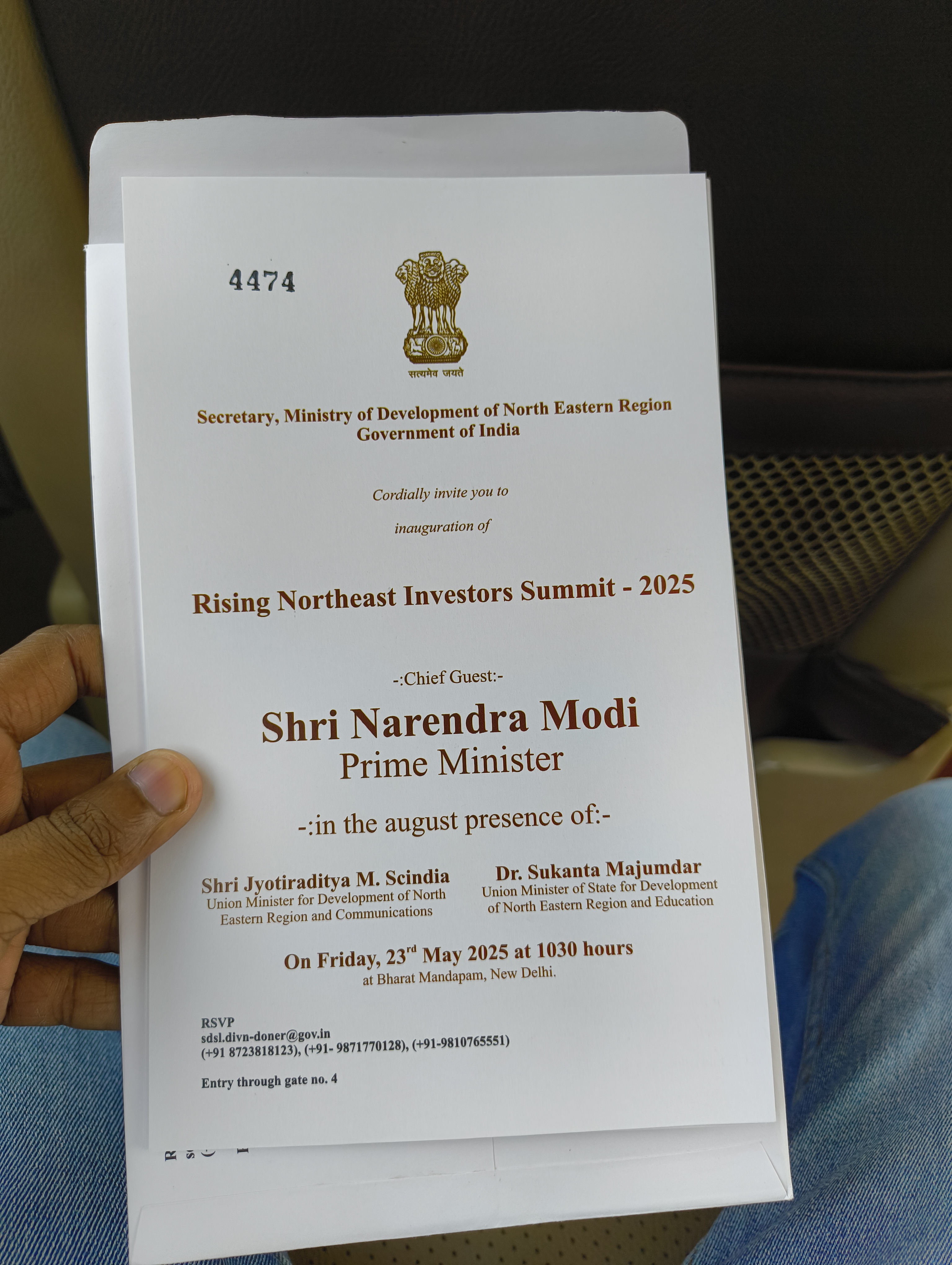

Recently I had the privilege of attending the #RisingNortheastInvestorsSummit2025 at Bharat Mandapam, New Delhi, where the event was inaugurated by Hon'ble PM Shri Narendra Modi. The summit brought together some of the biggest names in Indian indust

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)