Back

Jayant Mundhra

•

Dexter Capital Advisors • 1y

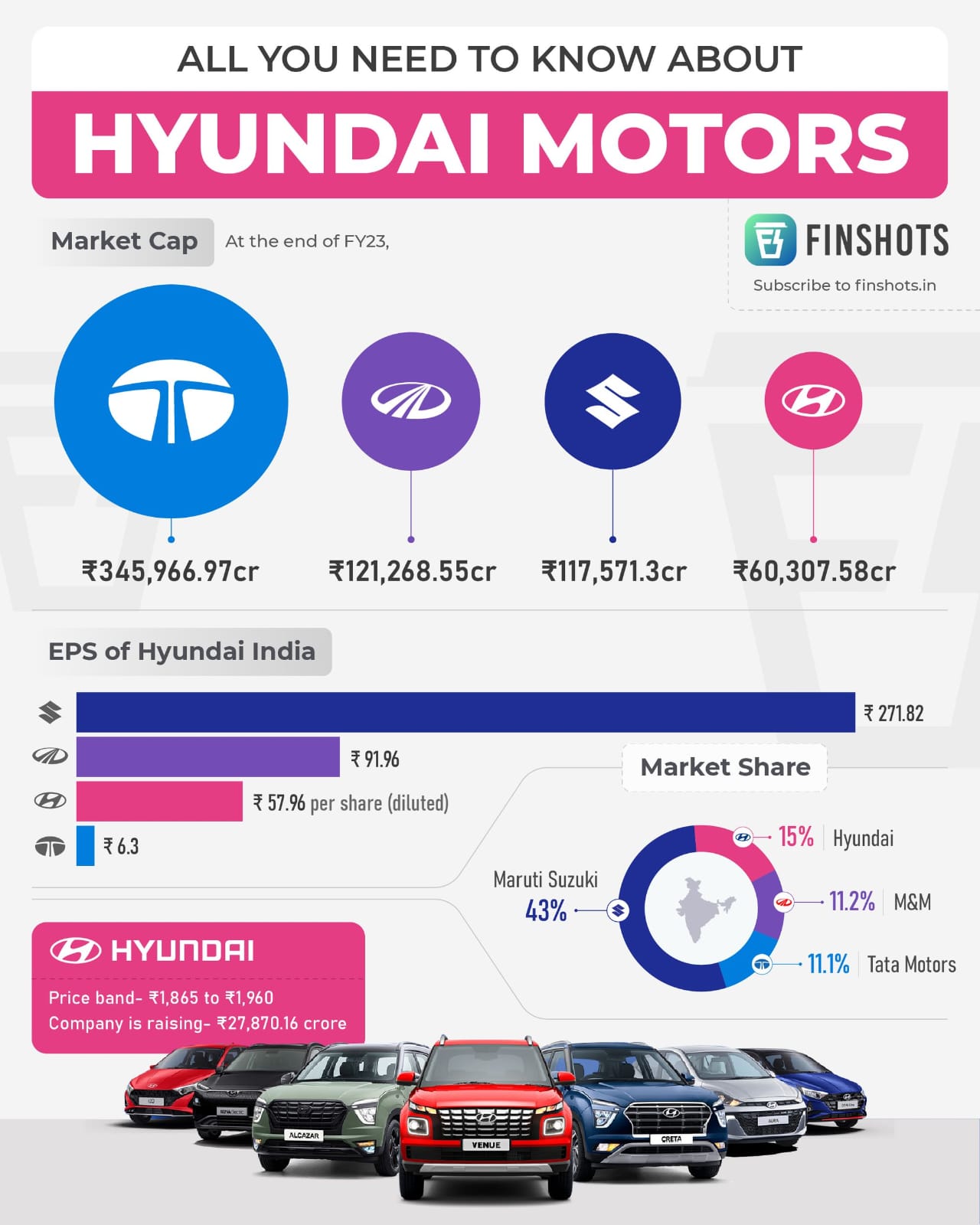

#Deepdive: Hyundai India’s 2/3rds of cash in the bank has been milked up by Korean parent in the last 2yrs 📛📛 In fact, in the last 2yrs, Hyundai India’s dividends to its Korean parent were more than all the profit after tax it earned in the last 5yrs! The narrative has just been controlled so well, that no one’s talking about it. Here’s all you don’t know! .. Total PAT in last 5yrs = Rs 17.8k crore Total dividend to Korean parent in last 2yrs = Rs 17.9k crore And to be precise, in FY24, preparing for the IPO, that was when a Rs 13.3k crore mega dividend was announced. This was a massive 3x jump in dividends from FY23 and a 9x jump versus FY22. .. So, all that Hyundai Motors India actually earned in the last 5yrs after paying all vendors, taxes, interests etc, was milked away by the Korean parent in the run-up to the IPO. And outcome? Indian entity is doing an IPO (all OFS) with its cash and bank balances reduced to just a third of what it was exactly 2yrs ago 📛📛 The data is all out there in the DRHP! .. Mind it, this is serious. This happened right before the time when the Indian unit announced the biggest Indian expansion and investment by Hyundai in decades. With cash on its books having been sucked by Korean parent, a massive chunk of that capex will have a heavy dependency on loans. That will impact the books and profits in the coming years. So, whatever debt you see on the books right now, is only going to go up! 📛📛 .. And trust me, this is not me speculating this. The company has also confirmed this in its DRHP where it talked of the dividends” “Our ability to utilise our internal accruals and cash and bank balances has been reduced. Any resultant insufficiency in our internal accruals and cash and bank balance may require us to borrow money to meet our growth requirements and incur borrowing costs, which may adversely impact our profitability, financial ratios and results of operations.” .. Now tell me, did you know this? Did you see the business media highlight this to investors? Share your thoughts in the comments!

Replies (2)

More like this

Recommendations from Medial

Gangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Dividends When a company makes a profit, it can choose to share a portion of the profit with its shareholders as a reward for their investment. This "reward" given by the company to it's shareholders is called a dividend Di

See MoreJayant Mundhra

•

Dexter Capital Advisors • 1y

You won’t find all of this info in one place anywhere else 🙏🙏 This is about SpiceJet Limited- All in one single deep dive. So, tighten your seatbelts, as we take off on this crazy flight! .. In the last ~5yrs, SpiceJet has earned big in 5 ways

See More

Jayant Mundhra

•

Dexter Capital Advisors • 1y

3k crore of taxpayer money burnt in the last two years 📛📛 And Modi Govt is set to burn another Rs 1.2k crore in FY25 for what is clearly another Air India in the making. For what? And worse, this time, there may be no buyers either. .. FY23: Go

See More

Account Deleted

Hey I am on Medial • 1y

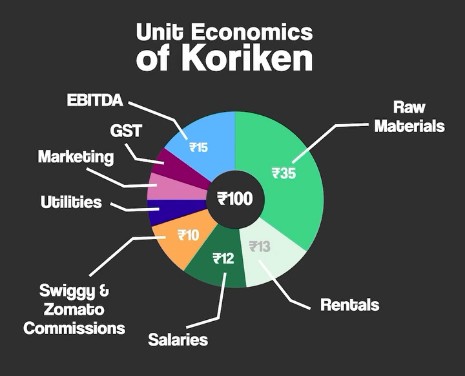

Koriken is a Korean street food startup based in Bengaluru, offering a range of Korean dishes to satisfy the growing demand for Korean cuisine. This image showcases the unit economics of the business, breaking down how each ₹100 is spent. The largest

See More

gray man

I'm just a normal gu... • 11m

Alphabet Inc., Google's parent company, has agreed to acquire cybersecurity startup Wiz for $32 billion in cash. This acquisition, the largest in Alphabet's history, aims to integrate Wiz's security platform into Google Cloud's infrastructure while

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)