Back

Gautam Das

If I play, i play to... • 1y

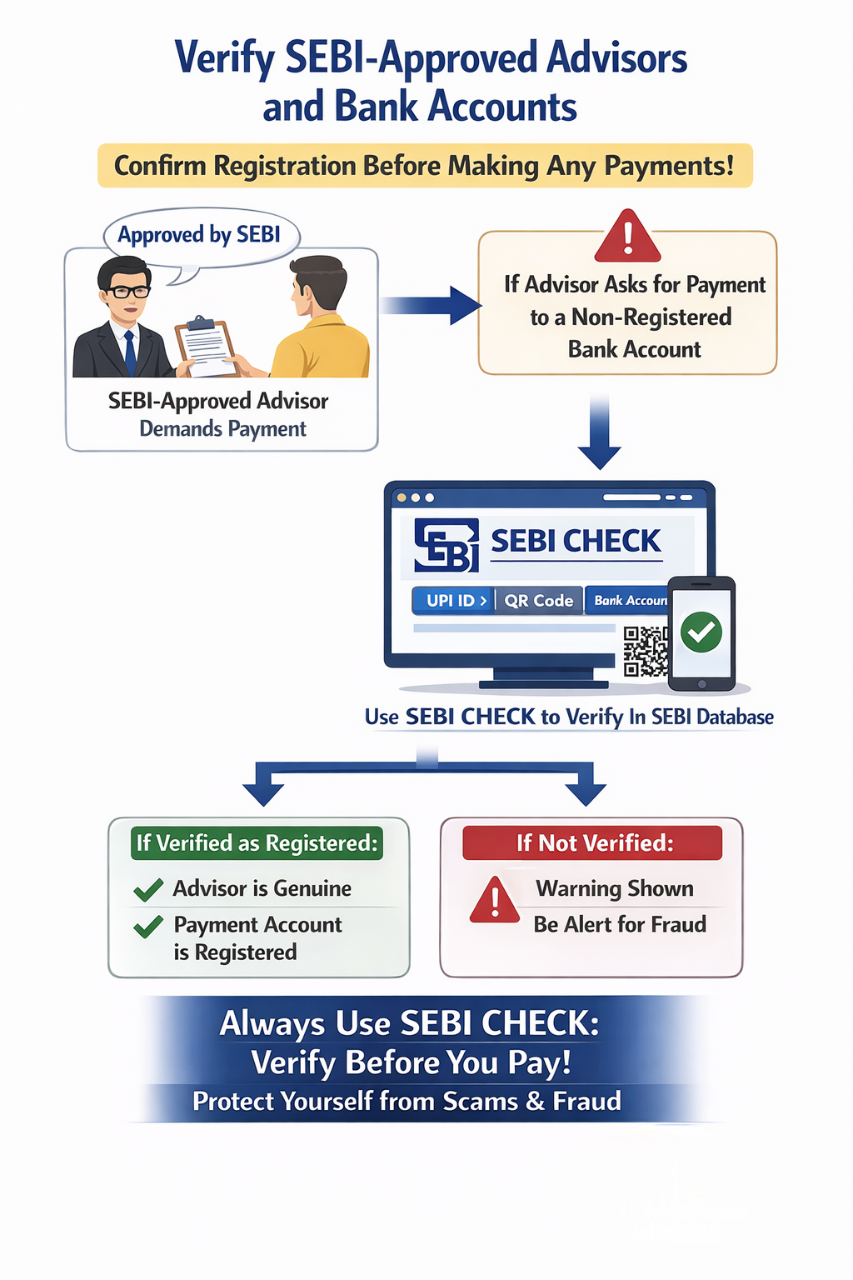

SEBI has proposed a unique alphanumeric UPI ID for every registered market intermediary. This measure will allow investors to verify that their payments are reaching only authorized entities. Unregistered firms, lacking this unique UPI handle, will stand out, making it easier for investors to avoid potential fraud. To further strengthen investor protection, SEBI has proposed a special verification symbol a green triangle with a thumbs-up icon that will appear when payments are made to verified intermediaries. If this symbol is absent, it will act as a red flag, warning investors about the risk of dealing with unauthorized entities.

More like this

Recommendations from Medial

Dr Sarun George Sunny

The Way I See It • 6m

The National Payments Corporation of India (NPCI) is developing UPI 3.0, an upgrade to its UPI that will enable payments through smart devices. The new system will be Internet of Things (loT) -enabled, allowing automated transactions via devices such

See More

gray man

I'm just a normal gu... • 10m

The Reserve Bank of India (RBI) has announced that it will soon revise the transaction limits for Unified Payments Interface (UPI) payments made to merchants, also known as person-to-merchant (P2M) transactions. This move is aimed at enhancing the ef

See More

Swamy Gadila

Founder of Friday AI • 6m

🚀 Should India Start Charging Fees for High-Value UPI Transactions? UPI is a world-class digital payments system — fast, free, and inclusive. But there's a hidden cost: 💸 Infra cost of ₹0.10–₹0.30 per transaction 🏦 Over ₹1,000 crore/month just t

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)