Back

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

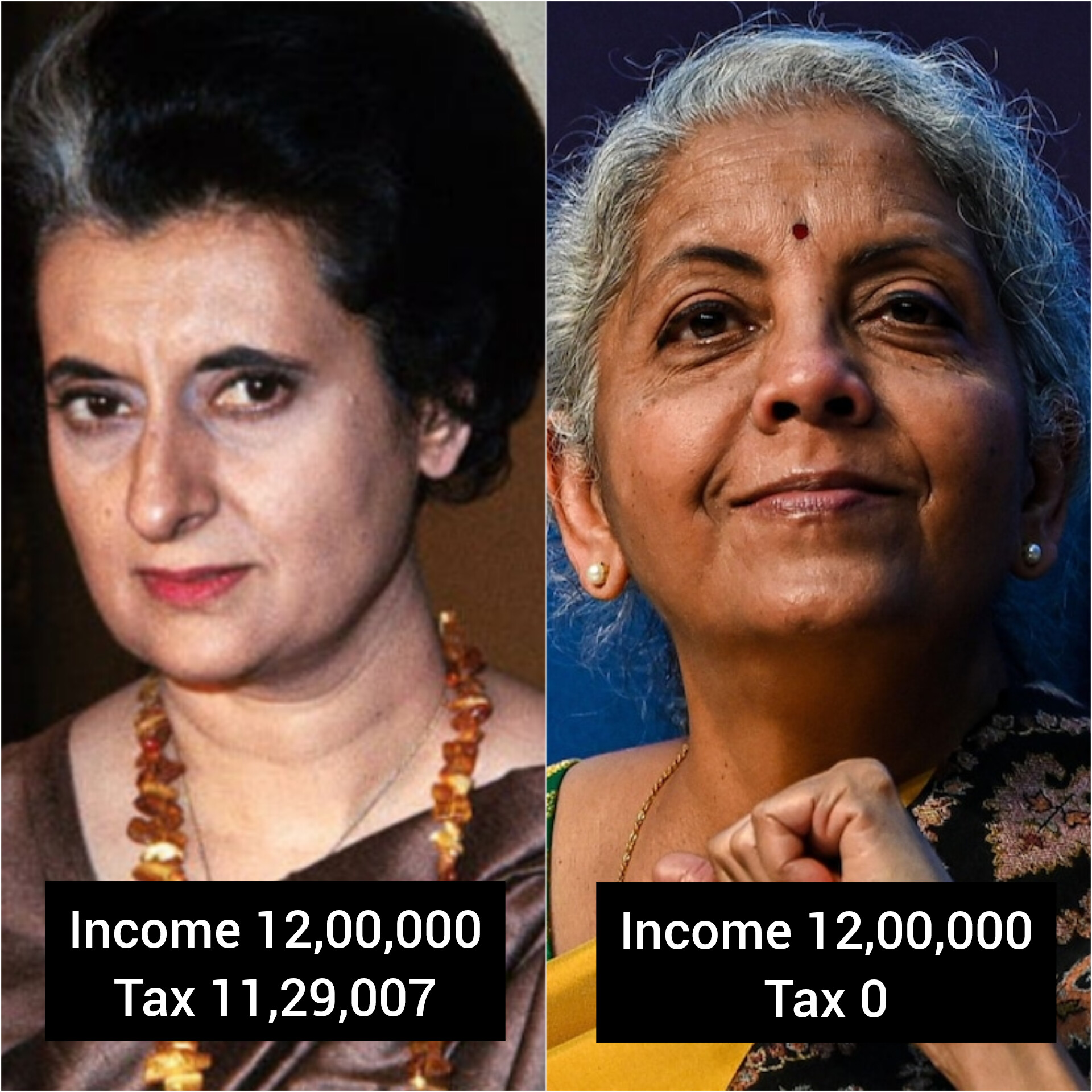

In today's rupee (1972 rupee inflation adjusted), if you earn 1410000 in a year, your tax rate has already hit 57.5% under Indira. Look it up if you don't believe me.

Replies (3)

More like this

Recommendations from Medial

Manish M Tulasi

•

Mitra Robot • 11m

Mutual Funds: A Closer Look at the Real Returns Many people say that mutual funds are a great investment, but have we truly calculated the real returns, considering all factors like inflation and taxes? Let me break it down with a simple example.

See MoreSameer Patel

Work and keep learni... • 1y

Cost Inflation Index The Cost Inflation Index (CII) helps adjust the purchase price of an asset to account for inflation, making it easier to calculate capital gains tax fairly in India. The government updates the CII every year. Example: If you b

See MoreRootDotAi

From the ROOT to the... • 1y

Here's a Summary of the FED decision on March 20, 2024: 1. The Federal Reserve keeps interest rates steady at 5.50% for the fifth consecutive meeting. 2. The Fed maintains its anticipation of three interest rate reductions in 2024. 3. The proje

See MoreAditya Arora

•

Faad Network • 1y

For decades, our parents made a major mistake. They stood in lines outside banks and post offices to invest in the Public Provident Fund (PPF), Kisan Vikas Patra (KVP) and the National Savings Scheme (NSS). PPF's 7.1% interest rate, KVP's 7.5%, and

See MoreAyush gandewar

Just go with the flo... • 9m

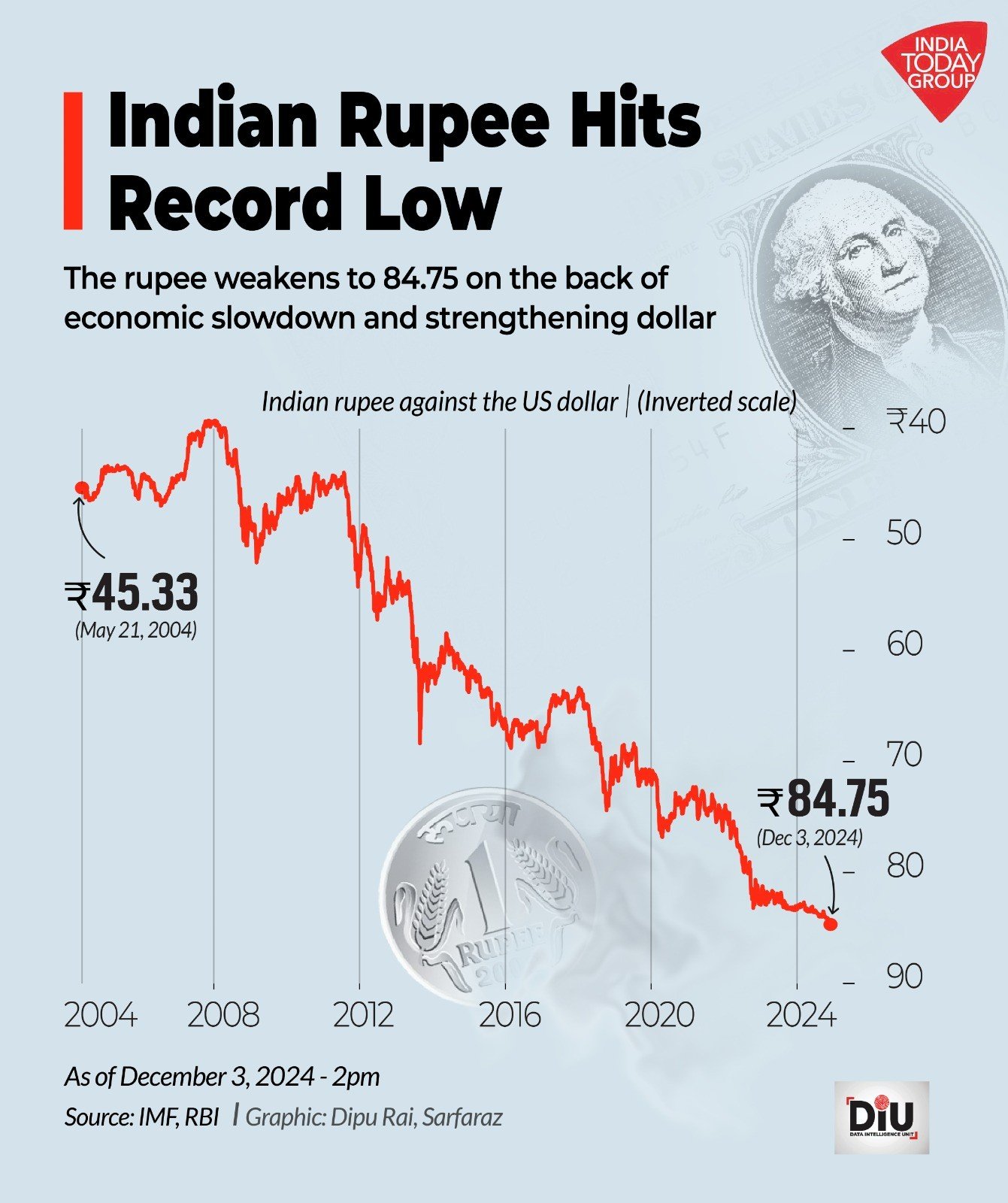

Hey, so the job market's kinda shaky, right? And the gold market's not doing great either. If things keep going like this, we're looking at trouble: no jobs, fewer opportunities, foreign investors bailing, the rupee tanking, and inflation soaring.

See MorePoosarla Sai Karthik

Tech guy with a busi... • 3m

RBI Hints at a Rate Cut: RBI Governor Sanjay Malhotra says there’s room to cut the repo rate as inflation cools and the data lines up. Many expect a 25 bps cut in December. Let’s break down what this actually means on the ground. Lending and Banki

See MoreTREND talks

History always repea... • 1y

🇮🇳 India's Joke of the Day: A calculation error crashed the stock market and the rupee exchange rate! 📉💸 Authorities reported a record trade deficit of $37.8 billion in November, triggering market panic. The rupee plummeted, and a sell-off hit t

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)