Back

Sanjay Srivastav. Footwear Designer

Hey I am on Medial • 1y

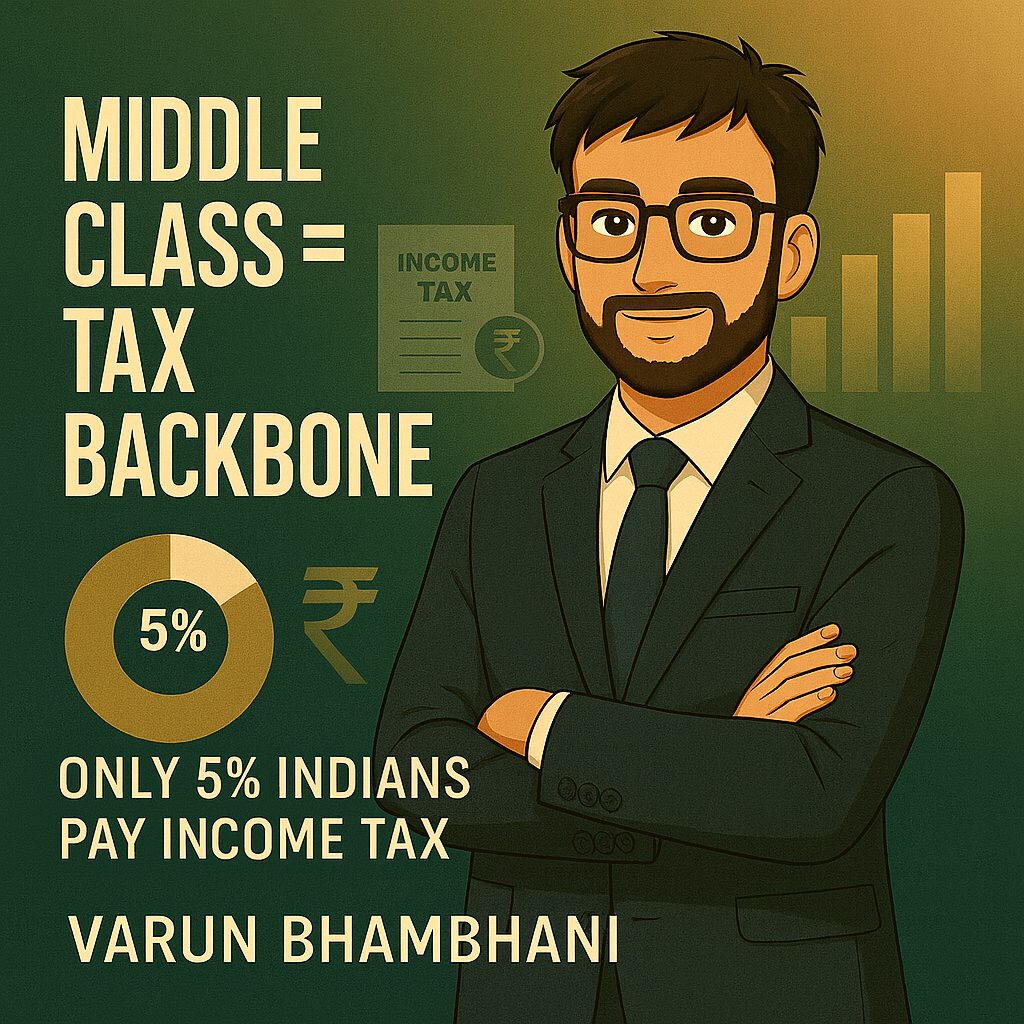

SPECIFICALLY FOR MIDDLE-CLASS- NO INCOME TAX PAYABLE UPTO ₹12 LAKH RUPEES.🔥🔥🔥🔥🔥 #ViksitBharatBudget2025 #Budget2025

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See MoreSameer Patel

Work and keep learni... • 1y

Financial knowledge Indian Tax slabs Income tax slabs categorize taxpayers based on their annual income, determining the applicable tax rates. Here's a breakdown: 1. Nil Tax: Annual income up to ₹2.5 lakh for individuals below 60 years. 2. 5% Tax: I

See MoreAman Verma

BIT'Mesra Undergrad|... • 1y

Who are actually middle class of India ? I am really confused to get the ideal answer of it. Because in village there is only a class that is caste... Most of the rich (as per village standard having acres of land, home, Cars, and non tax incom

See MoreK Shreenathan Nedunghadi

An professional with... • 1y

The Union Budget for 2025-26, presented by Finance Minister Nirmala Sitharaman, introduces significant reforms aimed at stimulating economic growth and providing relief to the middle class. Key highlights include: Income Tax Reforms: Revised Tax Slab

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)