Back

More like this

Recommendations from Medial

Saurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

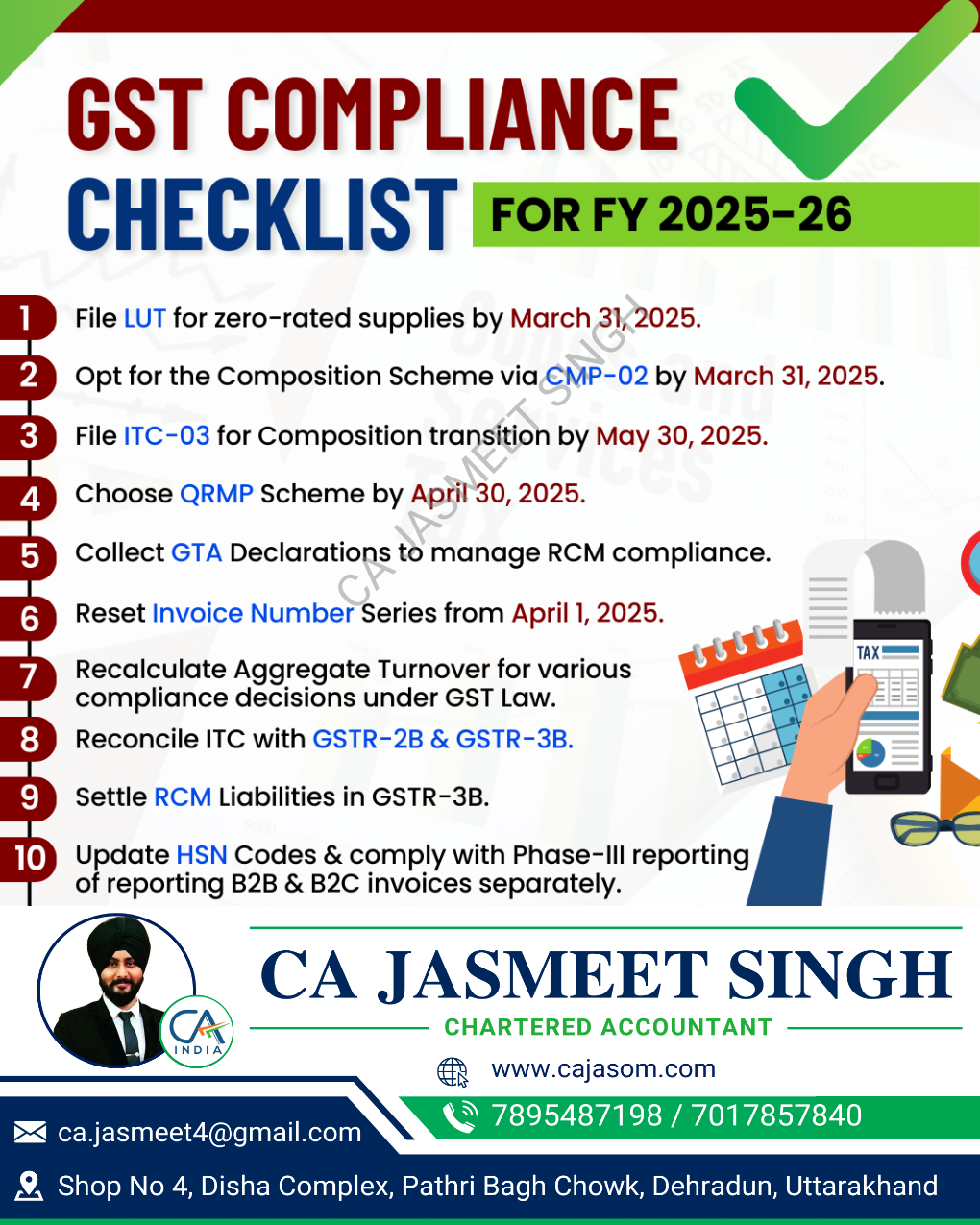

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

Gituparna Sarma

Co-founding Entrepre... • 10m

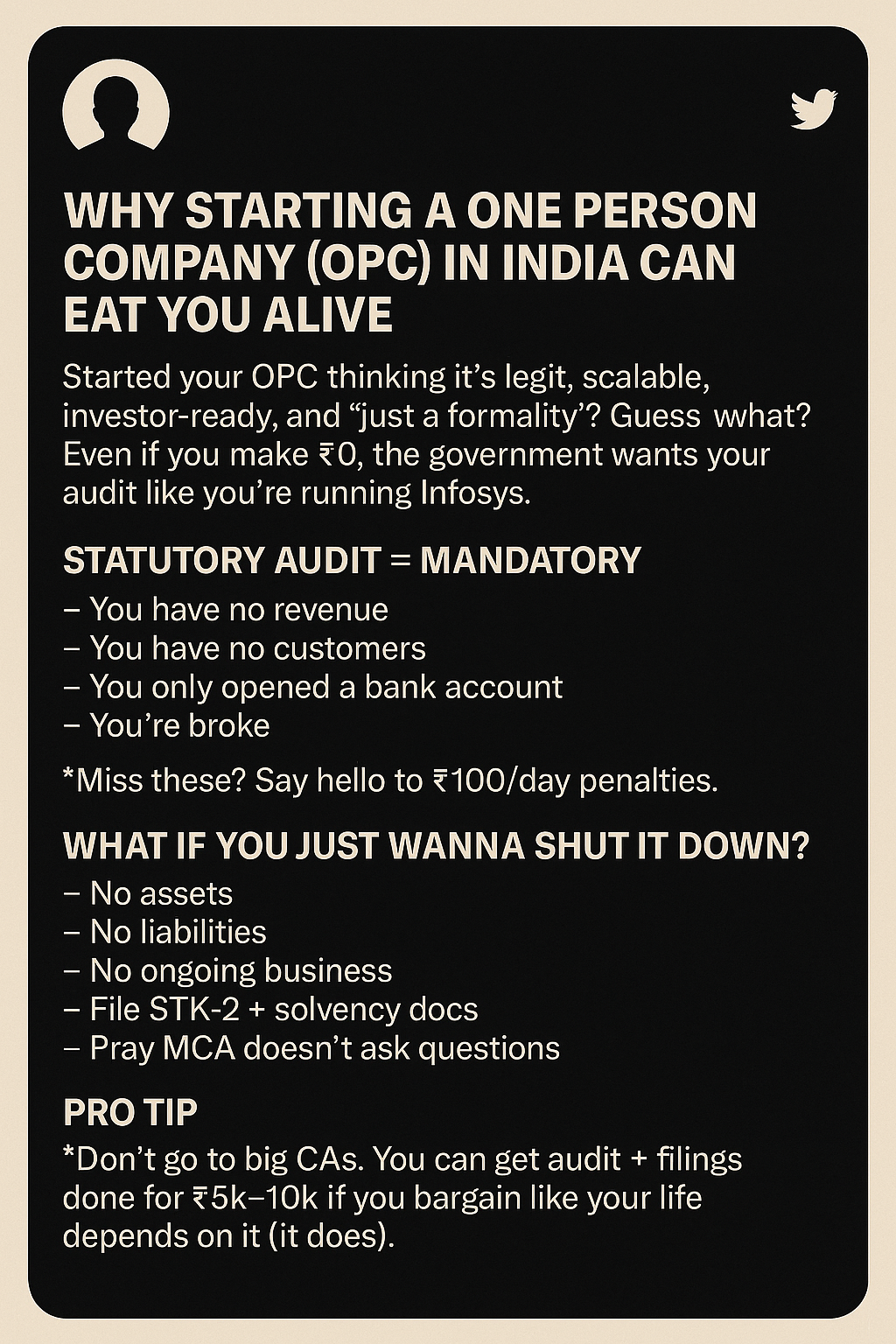

Starting a Company in India Can Eat You Alive — Even if You’re Broke Tag your CA friends, they’ll cry too. Started an OPC thinking it's "just a formality"? Even if you made ₹0, the govt wants an audit like you're Infosys. Statutory Audit = Manda

See More

Mehul Fanawala

•

The Clueless Company • 1y

When the income tax return filing date is near, the income tax department goes into full marketing mode to remind taxpayers to file on time. Guess what? Even they have targets and quotas like our marketing and sales teams! 🎯 Imagine the tax offic

See More

Adithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-16 🎯What is High Watermark in VC? 🎯What are Distributions/Waterfall? Apart from hurdle rate, Some consider also “high watermark” This is more common practice in hedge funds. This market denotes the highest value recorded by the f

See MoreCA Chandan Shahi

Startups | Tax | Acc... • 11m

Here are 10 important accounting tasks to complete before 31-03-2025 to ensure a smooth financial year-end closing and compliance: ✅ 1. Reconcile All Bank Accounts Ensure that bank statements match the books of accounts. Resolve any discrepancies b

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)