Back

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 2m

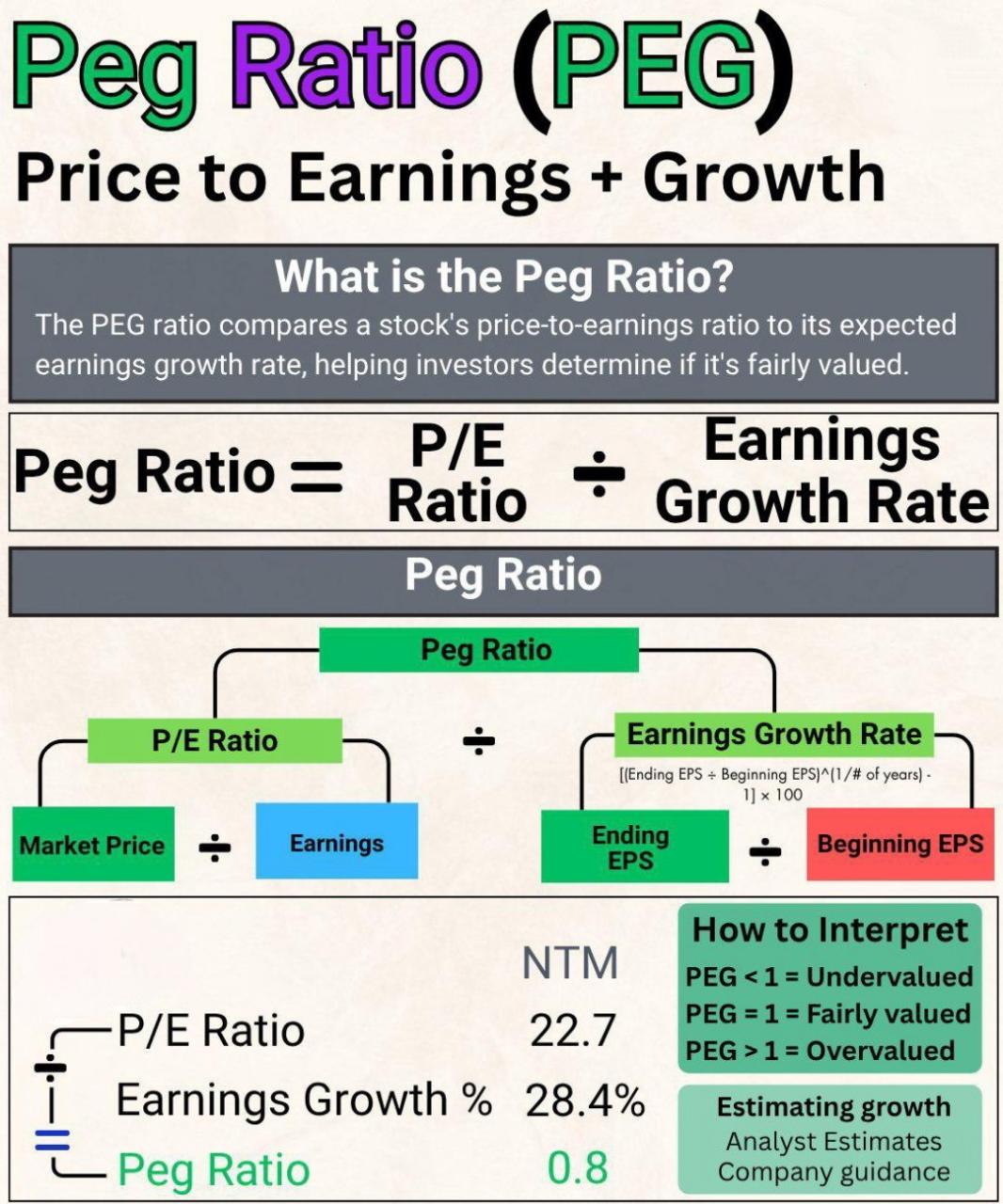

PEG Ratio Explained in 30 Seconds! Want to know if a stock is undervalued or overvalued? Use the PEG Ratio one of the smartest tools used by pro investors! 🧮 Formula: PEG = P/E Ratio ÷ Earnings Growth Rate ✅ PEG < 1 = Undervalued ⚖️ PEG = 1 = Fai

See More

Aryan patil

Intern at YourStory ... • 1y

SEBI warned ⚠️ investors about Stock market bubble is about to burst anytime soon 📉 because The price-to-book (P/B) ratio of the Nifty Midcap 150 index is 4.26, and the Nifty Midcap 50 index has a P/B ratio of 3.64 This Means valuations of the Mid/s

See MoreKarnivesh

Simplifying finance.... • 2m

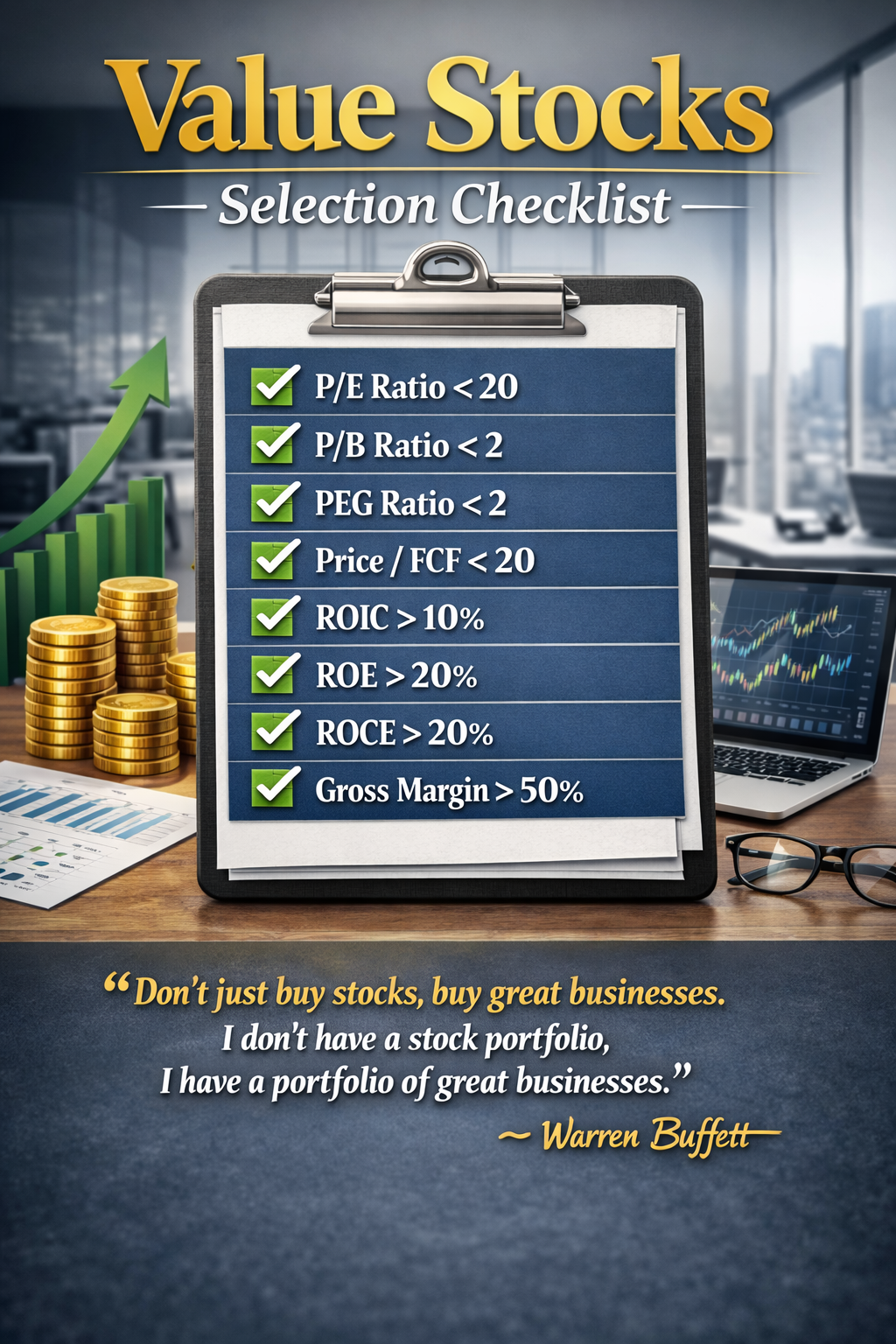

Valuation ratios are often treated like answers, but I see them more as conversations the market is having with us. In Indian markets, the P/E ratio alone rarely tells the full story. A high P/E can reflect confidence in growth and stability, while

See MoreRohan Saha

Founder - Burn Inves... • 7m

Zomato PE ratio has reached around 994 in the Indian market I mean can you even imagine? The company valuation still does not look worth buying yet people are investing in it what I keep thinking is how badly is this one stock affecting the Nifty? A

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)