Back

Havish Gupta

Figuring Out • 1y

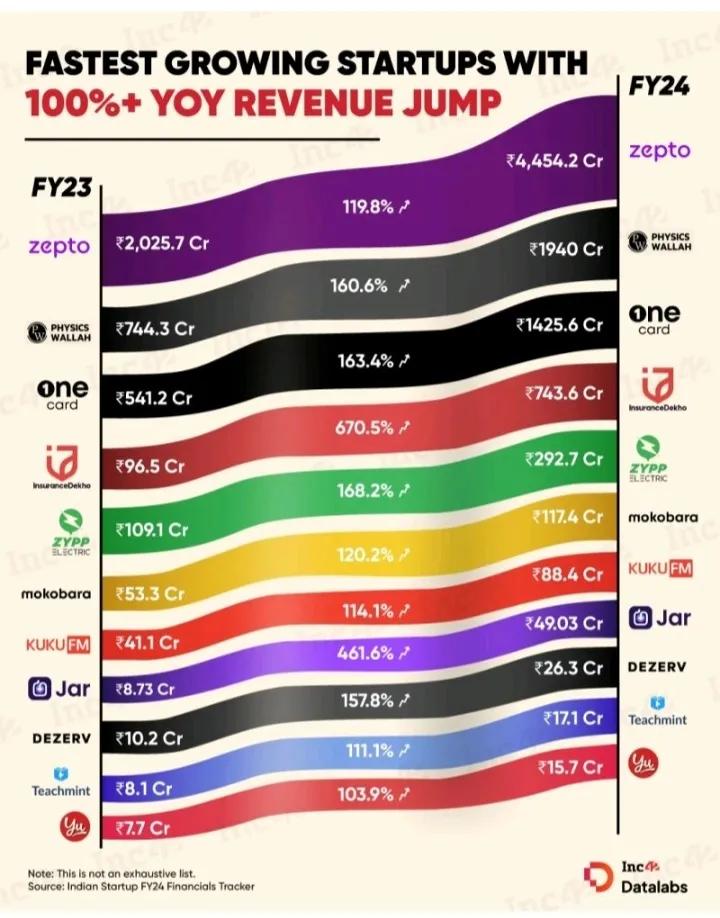

look at their revenue! they disrupted decade old industries and have became market leader in it. Those losses are worth that Growth

Replies (1)

More like this

Recommendations from Medial

Karnivesh

Simplifying finance.... • 28d

A finance leader once said something that changed how I look at businesses. “We were profitable on paper, but cash was always tight.” That’s when the cash conversion cycle started making sense to me. A company may sell today, wait weeks or months

See MoreKarnivesh

Simplifying finance.... • 1m

ROCE is one of those metrics that quietly reveals business quality. I look at it as a simple test: For every ₹100 of capital a company uses, how much value does it actually generate? Revenue growth and profit numbers can look impressive, but ROCE

See More

Mahendra Lochhab

Content creator • 1y

Those Indian brands that look foreign to you. Jaguar Land rover: Tata Group had bought Jaguar and Land Rover in 2008. Royal Enfield: Royal Enfield is owned by Acher Motors of India. Hamlays: Reliance Industries had bought Hamlays in 2019 for ₹620

See MoreAccount Deleted

Hey I am on Medial • 8m

Rapido positioning itself against Zomato and Swiggy with lower restaurant commission fees (a strong move if they can pull it off) Their gross order value is now $1.25B and they’re showing revenue growth while cutting losses. Could be a compelling st

See MoreAccount Deleted

Hey I am on Medial • 10m

Did you know ❓️❓️ In FY'24, more than two dozen startups with revenues of over Rs 500 Cr posted improved financial performance . Startups like Purplle, Porter, Lenskart and PhonePe achieved growth and better margins while others focused on reducing

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)