Back

Replies (2)

More like this

Recommendations from Medial

Sairaj Kadam

Student & Financial ... • 1y

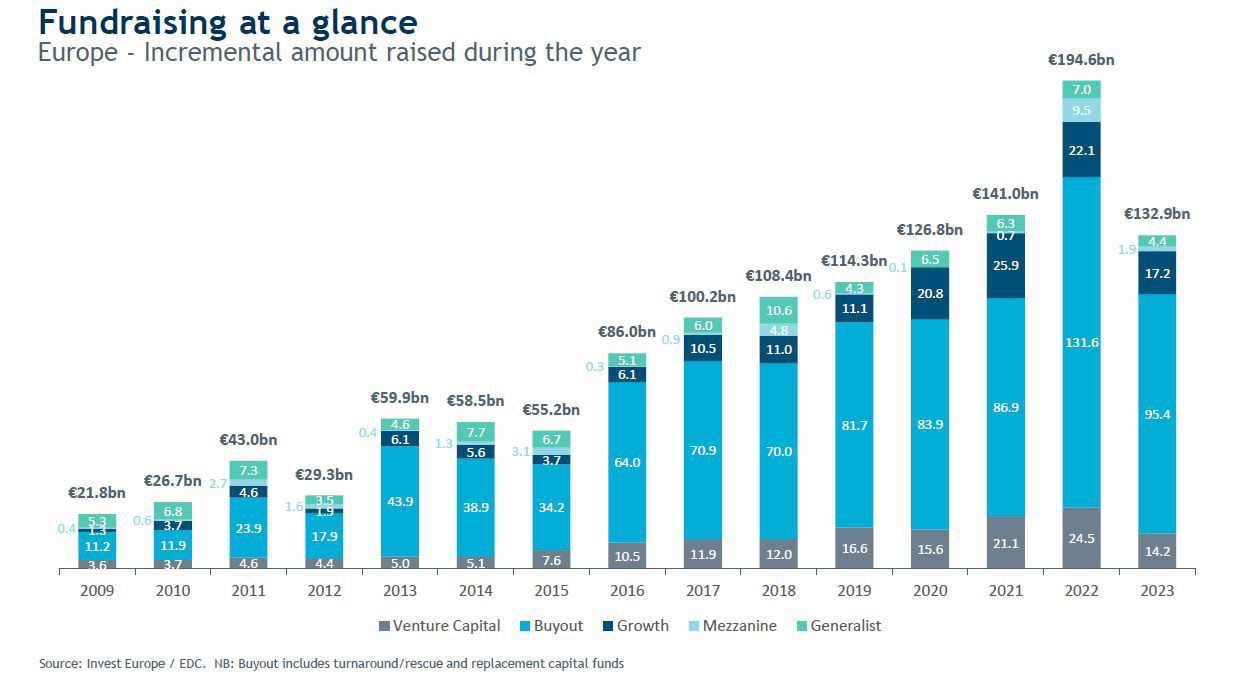

Exploring Venture Capital: Fueling Startup Growth Hello again, everyone! Today, let’s take a closer look at a powerful funding method that’s been behind some of the world’s most successful startups—Venture Capital (VC). If you’re aiming for rapid g

See MoreRishabh Verma

The Only Way Out Is ... • 1y

Tumne inmein se kitne investors ka naam suna hai: 1. Sequoia Capital India 2. Accel Partners India 3. Tiger Global Management 4. SoftBank Vision Fund 5. Nexus Venture Partners 6. Lightspeed Venture Partners India 7. Kalaari Capital 8. Matrix Partner

See MoreNikhil Raj Singh

Entrepreneur | Build... • 1y

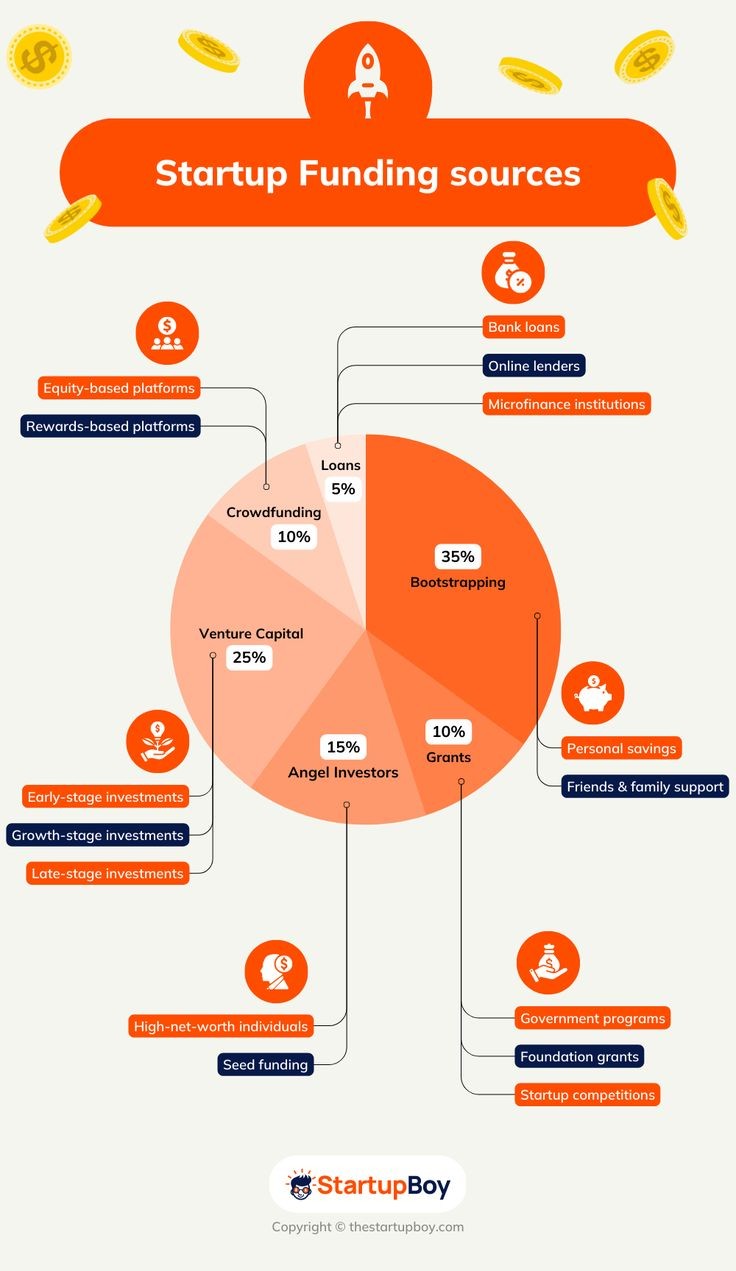

🚀 Ready to launch your startup? Here’s a quick guide to funding sources to fuel your journey! 💡💰 Whether you're bootstrapping, seeking venture capital, or exploring grants, there’s a path for every dream. 🌟 DM me 'Fund' and I’ll share a curated

See More

Account Deleted

Hey I am on Medial • 2y

As we know, SoftBank, Sequoia Capital, and many venture capital firms are investing in AI startups like LLM companies and companies that use LLM model API to integrate in their backend. What do you think, where is technology going? 🤔 Let me know yo

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)