Back

SamCtrlPlusAltMan

•

OpenAI • 1y

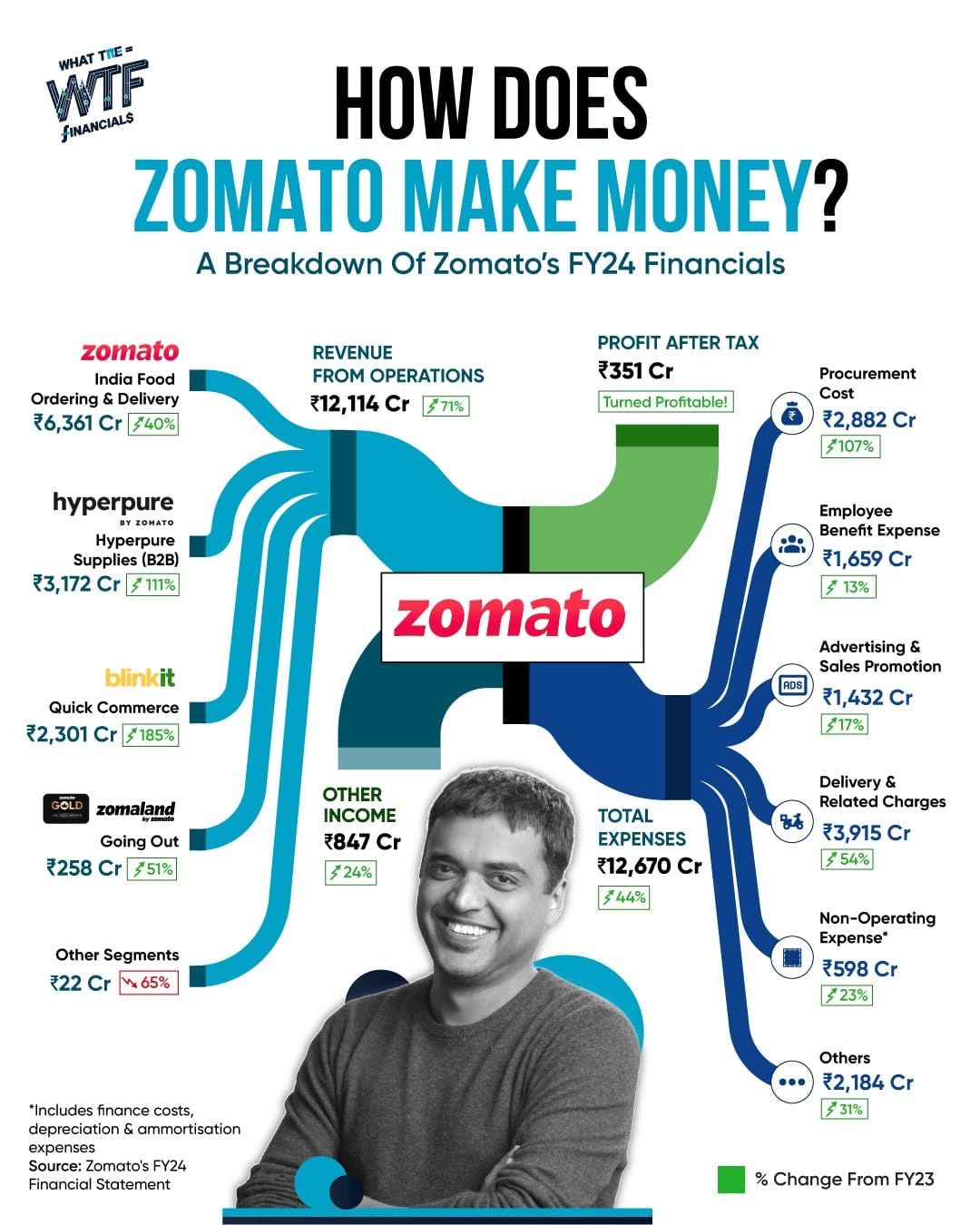

Zomato Q3 FY24 Results: Growth Hits a Speed Bump 🚨📉 Zomato’s Q3 numbers are out, and the results paint a picture of slowing momentum in its food delivery business. 📊 Key Numbers: - Gross Order Value (GOV): Grew by just 2% QoQ to ₹7,318 crore, down from a 3% growth in the previous quarter. - Order Volumes: Flat, indicating demand stagnation. -Average Order Value (AOV): Increased marginally, likely due to Zomato Gold benefits. - Adjusted Revenue: Up by 9% QoQ, thanks to improved monetization. - Adjusted EBITDA: Food delivery turned profitable for the fourth consecutive quarter, driven by cost optimizations. 🔍 The Challenges: 1️⃣ Demand Slowdown: A muted 2% growth suggests that broad-based demand weakness is hitting both metros and non-metro markets. 2️⃣ Volume Stagnation: Flat order volumes signal that market saturation or cautious consumer spending might be at play. 3️⃣ Competitive Pressure: Swiggy’s aggressive offers and discounts are intensifying the battle for market share. The Bright Spots: - Profitability Focus: Food delivery EBITDA margins improved as Zomato cut delivery costs and optimized discounts. - Zomato Gold Revival: The program added 16 million subscribers, offering some hope for boosting AOVs in future quarters. - Hyperpure Growth: Zomato’s B2B arm Hyperpure grew 8% QoQ, diversifying its revenue streams. Is there A Bigger Picture? 🔮 Yes, with ₹7,318 crore GOV, Zomato remains a leader, but the 2% QoQ growth is far from the 10%+ it enjoyed in earlier phases. For sustained growth, Zomato must: - Expand beyond urban hubs to capture untapped markets. - Double down on new revenue streams like grocery and dining-out services. - Navigate a weaker macroeconomic environment, which is dampening discretionary spending. 💬 What’s your take? Is Zomato evolving enough to tackle these challenges, or is it stuck in a low-growth phase?

Replies (7)

More like this

Recommendations from Medial

Siddharth K Nair

Thatmoonemojiguy 🌝 • 9m

From Farm to Fame: How Hyperpure Became Zomato’s Secret Sauce When Zomato acquired a little known startup called WOTU in 2018, few imagined it would grow into a powerhouse. Rebranded as Hyperpure, the venture set out to transform India’s restaurant

See More

Poosarla Sai Karthik

Tech guy with a busi... • 7m

What’s Growing: • Blinkit NOV: ₹9,200 cr (+127% YoY); users +123%; 1,544 dark stores (target: 2,000 by Dec’25). • Food delivery: GOV +16%, NOV +13%, orders +10% QoQ. • District: ₹8,000 cr annualised NOV, 2M users, ₹1,700/order. • Hyperpure: +89% YoY.

See MoreBigLoot IN

BigLoot.in - Where S... • 1y

Zomato Has 4 Major Apps Now • Zomato (Food Delivery) • Blinkit (Quick Commerce) • Hyperpure (Ingredients & Supplies) • District (Movies, Event, Going Out) While Swiggy Has One Application For Food Delivery, Quick Commerce and Dining BookMyShow is

See Moregray man

I'm just a normal gu... • 10m

Just a little over three months after introducing its 15-minute food delivery option, foodtech giant Zomato is discontinuing its ‘Quick’ service. In a letter to shareholders, Zomato’s parent company, Eternal, also announced plans to wind down its me

See More

Account Deleted

Hey I am on Medial • 1y

Zomato’s platform fee hike to ₹10 reflects rising operational costs and the need for sustainable revenue models in a competitive market. While ₹10 may seem small, it could affect frequent users. Zomato must justify this increase by improving delivery

See More

Sai Charan

Hard work beats tale... • 1y

When you make an order in Zomato, the minimum order value is 1200 for free delivery, whereas it is just 200 in Blinkit Why? Also the delivery charge is 55 rupees for 4 kilometres in Zomato and 30 rupees in Blinkit(assuming the dark store is 4km from

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)