Back

Adithya Pappala

Busy in creating typ... • 1y

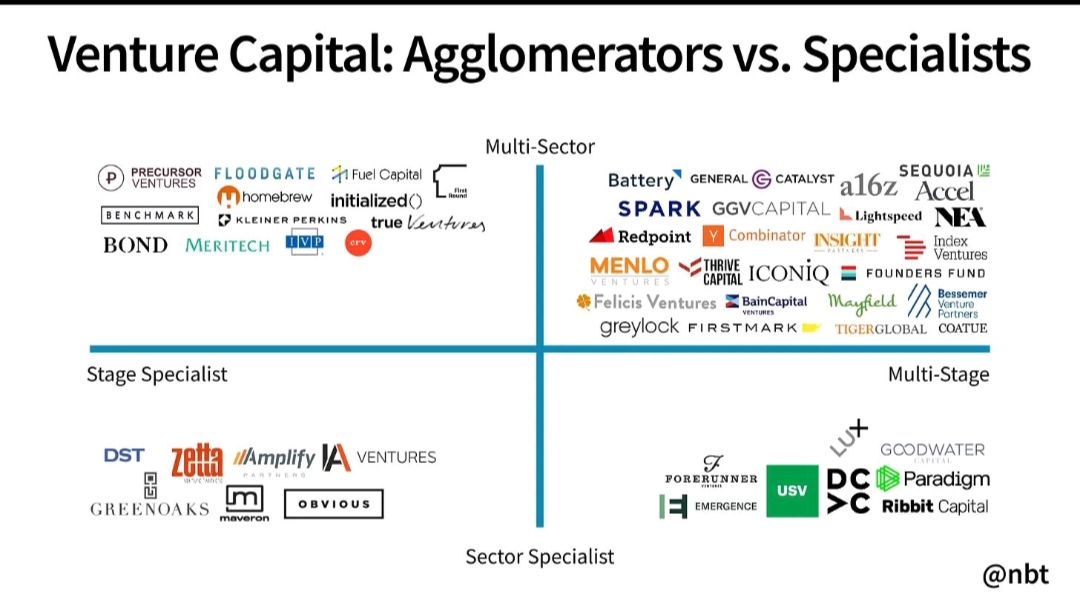

Venture Capital Agglomerators vs Specialists!! Who Wins? Is it Jack of all trades & king of none Or One Shot King? Let me know Founders!!❤️

Replies (1)

More like this

Recommendations from Medial

Mayank Kumar

Strategy & Product @... • 1y

The Impact of Venture Capital on Innovation! Venture capital (VC) plays a crucial role in driving innovation. By providing the necessary funds, VCs enable startups to scale and develop groundbreaking technologies. Think of companies like Uber, Air

See MoreMayank Kumar

Strategy & Product @... • 1y

Startup Funding 101: Bootstrapping vs. VC Funding Deciding between bootstrapping and venture capital (VC) funding is a critical choice for startups. Bootstrapping involves self-funding and can offer more control but may limit growth potential. V

See MoreShivam Chaturvedi

I am ambitious and I... • 4m

🤑 95% 🤤 of early-stage deals hide risk in unstructured data and incomplete documents. Our SaaS engine ingests any doc, confirms every number, and delivers fully validated investment memos at record speed. 👏 For investors: zero blind spots, near-

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)